Does Volume Complement Or Contradict Bullish Analysis?

An August 19 analysis outlined a long-term bullish signal for stocks that has occurred only ten other times in the last thirty-five years. Have we seen any other long-term signals in recent weeks? The answer is yes.

A Trend Change In Up/Down Volume?

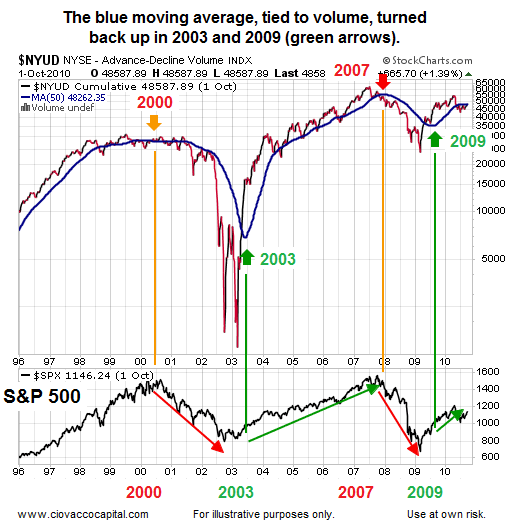

The chart below shows up/down volume (1996-2010) for the NYSE Composite Stock Index, along with its 50-week moving average (thick blue line).

Notice how all-things-being equal, the probability of bad things happening increases when the 50-week moving average is flat or negative (see orange and red arrows below). Conversely, the probability of good things happening increases when the 50-week moving average turns back up in a bullish manner (see green arrows below). The S&P 500 is shown at the bottom of the image below for reference purposes.

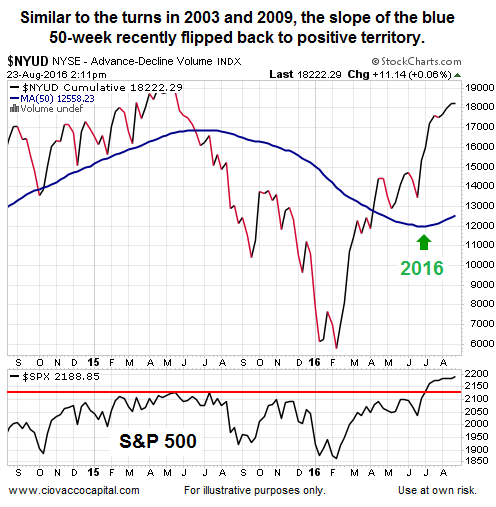

Has The Line Turned Back Up In A Bullish Manner?

The answer to the question above is 'yes'. In simplified terms, it appears as if volume patterns have shifted from favoring declining issues earlier in 2016 to favoring rising issues currently.

A Foolproof Signal?

Since there is no such thing as a foolproof indicator or signal in the financial markets, the recent bullish shift in up/down volume assists us with probabilities. As long as the slope of the 50-week remains positive, the odds of good things happening will be higher. With Yellen’s Jackson Hole speech coming Friday, the market will be processing some important new information in the coming days.

Long-Term Means Long-Term

Both the moving-average analysis covered in a recent video and the analysis above relate to longer-term outcomes, and that means weeks, months and years. Therefore, even if the bullish signals prove to be helpful, stocks could experience a fairly significant pullback before resuming the current bullish trend. Said another way, for these signals to be used effectively we must have realistic expectations about normal volatility within the context of a rising trend.