It will be a short trading week with Monday closed for Martin Luther King Jr. day. It will also be a relatively light week for economic data in the U.S. with the Markit Manufacturing and Services PMI’s on Thursday.

S&P 500

The S&P 500 is approaching a significant level of technical resistance and downtrend at 2,690. If the index can manage to rise above that level, it likely triggers a much bigger rally, perhaps to 2,800.

NASDAQ

The NASDAQ has already risen above its downtrend and is likely a positive sign that index can continue to increase. Additionally, it is likely to serve as a positive sign for the S&P 500.

Tech Sector

TheTechnology Select Sector SPDR (NYSE:XLK) is also nearing a potentially big break out at $65.50.

Consumer and Industrials

Consumer Discretionary Select Sector SPDR (NYSE:XLY) is also breaking out, as is the Industrial Select Sector SPDR (NYSE:XLI).

Microsoft

Microsoft Corporation (NASDAQ:MSFT) has been steadily rising and may be on its way to around $112. The RSI is also nearing a potential break out, which could be a positive sign for the long-term uptrend in the stock.

Apple

Apple Inc (NASDAQ:AAPL) has risen above a critical level of resistance at $155, and should it manage to rise above $163; it has room to move up to $182.

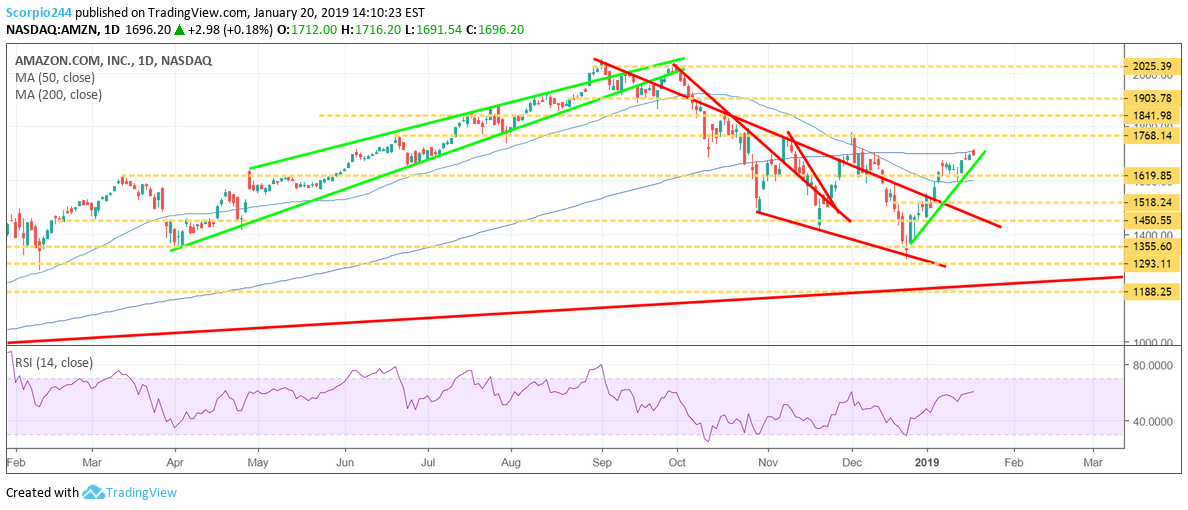

Amazon

Amazon.com Inc (NASDAQ:AMZN) is the largest stock in the consumer discretionary sector, and the big hurdle for Amazon doesn’t come until $1,770.

Netflix

Netflix Inc (NASDAQ:NFLX) successfully refilled a gap at $335, and it held firm on Friday. If the stock falls below $335, it could drop to around $329. But it seems more likely the stock retest resistance at $355 and moves on to $380.

Tesla

Tesla Inc (NASDAQ:TSLA) fell hard on Friday following some less than clear news about its fourth-quarter profit. But then again, it doesn’t take much for the short-sellers to get into motion. $300 has been a significant level in the past; I don’t see any reason the stock can’t continue to hold support at $300.

Square

Square (NYSE:SQ) broke out in a big way last week, and should it rise above $75, it could be on its way to $83.

Roku

Roku Inc (NASDAQ:ROKU) still can’t get over $43, and I continue to believe the stock is heading lower to $34.

Micron

Micron Technology Inc (NASDAQ:MU) is once again trying to break out, and jump above $37, pushes the stock up to $40.25.

Regeneron

Regeneron Pharmaceuticals Inc (NASDAQ:REGN) could be on its way towards $440.

Disclaimer: Michael Kramer and the clients of Mott Capital own Apple, Netflix, and Tesla.