The technology sector is on fire given a deluge of upbeat earnings results and high hopes of the tax reform getting clearance. In particular, five technology stocks, touted as FAAMG – Facebook (NASDAQ:FB) , Amazon (NASDAQ:AMZN) , Apple (NASDAQ:AAPL) , Microsoft (NASDAQ:MSFT) , and Alphabet (NASDAQ:GOOGL) – led to skyrocketing prices.

Additionally, a string of reports from other tech players like International Business Machines (NYSE:IBM) , and Intel (NASDAQ:INTC) INTC added to the strength (read: Play IBM's Turnaround Story With These ETFs).

Total earnings from 85% of the sector’s total market capitalization reported so far are up 22.4% on 9.3% higher revenues with 81.8% of the companies beating on earnings and 86.4% exceeding top-line estimates. While the beat ratios are in line with the last reported quarter, the growth rates are encouraging and higher than the recent quarters.

Trump’s proposed tax reform policy, which could allow companies to bring back cash held overseas at lower rates, are fueling exceptional growth in the sector. Per Moody’s, the top five U.S. hoarders are from the technology sector, namely Apple, Microsoft, Alphabet, Cisco (NASDAQ:CSCO) and Oracle (NYSE:ORCL) (ORCL, which hold 88% of their money overseas.

Further, the buzz that communications’ chipmaker Broadcom (NASDAQ:AVGO) is looking to make a bid of more than $100 billion for the smartphone chip supplier Qualcomm (NASDAQ:QCOM) . The combination would mark the biggest technology acquisition in history. This has triggered further rally in the semiconductor stocks.

If these aren’t enough, the sector has a solid Zacks Rank in the top 25%, suggesting robust growth prospects in the coming months (see: all the Technology ETFs here).

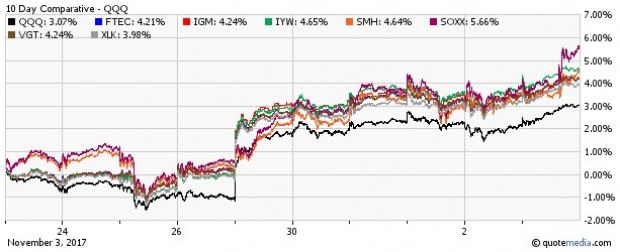

Given this, tech ETFs have been hitting all-time highs in recent trading sessions, easily crushing PowerShares QQQ QQQ by a wide margin in the past 10 days. Below, we have presented a bunch of those that will continue to outperform in the coming months given that these have potentially superior weighting methodologies and a solid Zacks ETF Rank #1 (Strong Buy) or 2 (Buy).

iShares PHLX Semiconductor ETF SOXX – Up 5.7%

This ETF targets the semiconductor corner of the broad tech space and follows the PHLX SOX Semiconductor Sector Index. It is a home to 30 securities charging investors 48 bps in annual fees. The fund has amassed $1.2 billion in its asset base and trades in a solid average volume of around 478,000 shares a day. It has a Zacks ETF Rank #1.

VanEck Vectors Semiconductor ETF SMH – Up 4.6%

This fund provides exposure to 26 securities by tracking the MVIS US Listed Semiconductor 25 Index. The product has managed assets worth $989.6 million and charges 36 bps in annual fees and expenses. It is heavily traded with a volume of around 3.2 million shares per day and has a Zacks ETF Rank #1.

iShares Dow Jones US Technology ETF IYW – Up 4.6%

This ETF also offers broad exposure to technology stocks by tracking the Dow Jones U.S. Technology Index and holds 142 stocks in its basket. The fund has AUM of more than $4 billion and charges 44 bps in fees and expenses. It has a Zacks ETF Rank #1 (read: 5 Red Hot Tech Stocks That Sent S&P 500 ETF Higher).

Vanguard Information Technology ETF (HN:VGT) – Up 4.2%

This fund targets the broad technology sector and follows the MSCI US Investable Market Information Technology 25/50 Index. It holds 361 stocks in its basket with AUM of $16.2 billion. VGT is the low choice in the space, charging just 10 bps in annual fees while volume is good at nearly 465,000 shares a day. The product has a Zacks ETF Rank #2.

iShares North American Tech ETF IGM – Up 4.2%

This ETF tracks the S&P North American Technology Sector Index, giving investors exposure to 283 electronics, computer software and hardware, and informational technology companies. The fund has AUM of $1.3 billion and charges 48 bps in annual fees. It trades in a light volume of nearly 28,000 shares in hand a day and has a Zacks ETF Rank #2 (read: Tech ETFs to Soar on Microsoft's Blockbuster Earnings Beat).

MSCI Information Technology Index ETF (V:FTEC) – Up 4.2%

This fund is home to 358 technology stocks with AUM of $1.3 billion. It follows the MSCI USA IMI (LON:IMI) Information Technology Index. The ETF has 0.08% in expense ratio while volume is good at 191,000 shares a day. It has a Zacks ETF Rank #2.

Select Sector SPDR Technology ETF XLK – Up 4%

XLK is the ultra-popular technology ETF with AUM of $19.1 billion and average daily volume of 10.2 million shares. It follows the Technology Select Sector Index and holds a basket of 72 stocks. The fund charges 14 bps in annual fees from investors and has a Zacks ETF Rank #2 (read: Top ETF Stories of October 2017).

Want key ETF info delivered straight to your inbox?

Zacks’ free Fund Newsletter will brief you on top news and analysis, as well as top-performing ETFs, each week. Get it free >>

Cisco Systems, Inc. (CSCO): Free Stock Analysis Report

International Business Machines Corporation (IBM): Free Stock Analysis Report

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Facebook, Inc. (FB): Free Stock Analysis Report

Alphabet Inc. (GOOGL): Free Stock Analysis Report

QUALCOMM Incorporated (QCOM): Free Stock Analysis Report

Apple Inc. (AAPL): Free Stock Analysis Report

Microsoft Corporation (MSFT): Free Stock Analysis Report

SPDR-TECH SELS (XLK): ETF Research Reports

NASDAQ-100 SHRS (QQQ): ETF Research Reports

ISHARS-PHLX SEM (SOXX): ETF Research Reports

VANECK-SEMICON (SMH): ETF Research Reports

FID-INFOTEC (FTEC): ETF Research Reports

VIPERS-INFO TEC (VGT): ETF Research Reports

Original post

Zacks Investment Research

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

7 Top-Ranked Tech ETFs On Unstoppable Rally

Published 11/05/2017, 11:10 PM

7 Top-Ranked Tech ETFs On Unstoppable Rally

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.