So stocks continued to rally into options expiration, and now that it is over with we should see the pace of the market slow. The rally, although strong, I believe was mostly related to OPEX, and by pounding, I am taking on Twitter. It would seem the bulls have their guts back, and are again feeling like they are in charge.

Unfortunately, most of the evidence I see continues to suggest we will not see an all-time high anytime soon, and more than likely trading sideways, similar to what we saw in the 2015 and 2016 time frame, at least until we start to get more details on the balance sheet run-off which should come in about 3 weeks times, although Powell does speak prior to the Fed minutes.

Additionally, I expect that Fed governors will begin to indicate the balance sheet running off at a pace of about $100 billion a month, the Dovish Fed governor Kashkari already indicated as much.

The chart below shows why I think we may be in for a period of sideways consolidation in the equity market, essentially because it went nowhere in 2015 and 2016 as the balance sheet was stagnate, and in the process of actually falling to some degree.

Then in 2017, as the balance sheet stabilized and even increased some, the S&P 500 was able to rise. But clearly, once the balance sheet started its decline in 2018, the equity market endured a lot of choppiness and big price swings.

This time around, we will go from 2016 straight to 2018, which means between now and May, the market may be in a consolidation phase, and then in May that dynamic changes again.

1. S&P 500

Anyway, so the S&P 500 did break the downtrend that started at the peak in January. But if you remember my Fibonnaci grid, from around that time, which seems to be working fairly well, it shows that the recent rally took the index back right to the 1.68% extension trend line, which for now is serving as resistance.

Additionally, there is a gap that needs to be filled around 4,480 which will tell us a lot about what happens next in this market. If that level of resistance breaks, I would look for a retest of resistance around 4,590, and then 4,650.

However, we have seen this pattern of sharp rallies in the SPX and the Qs before. As I pointed out in my video over the weekend, the rally in the market nearly perfectly mimics the move at the end of December and January. If it ends the same, we should see a period of sideways consolidation start this week, once the gap at 4,480 is filled.

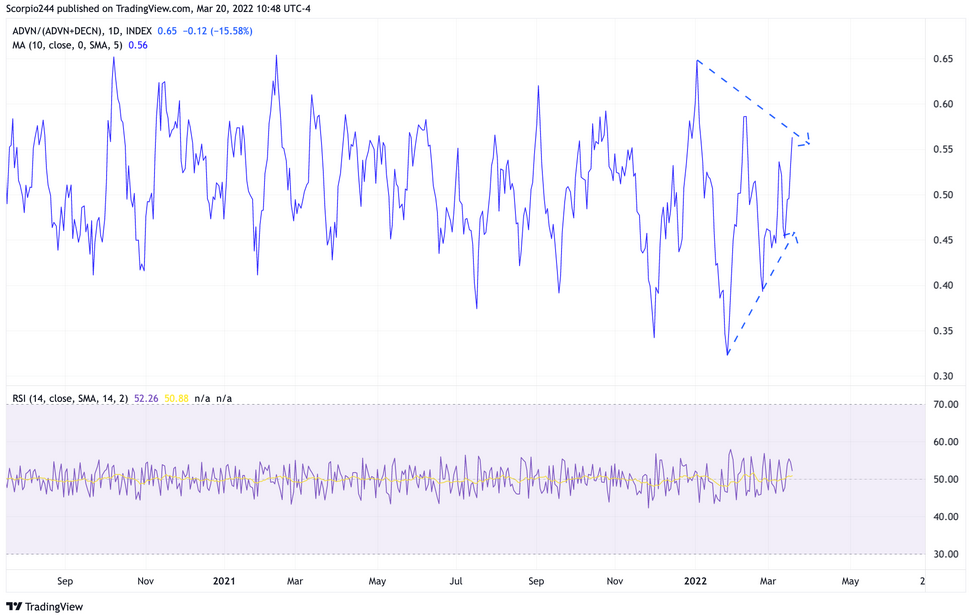

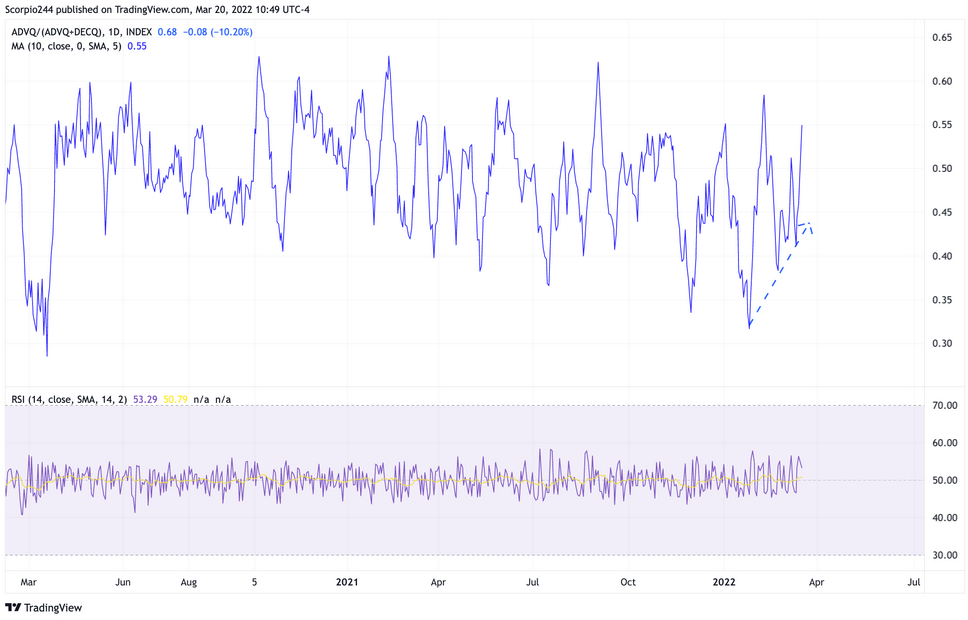

The term breadth thrust is being thrown around a lot on Twitter, and this breadth thrust is actually thus far weaker than all the previous thrust during these same 4 day rallies, on the NYSE. ADVN

and the NASDAQ

2. NASDAQ

Additionally, the options cycle appeared to have a very material impact on the market this week as well, as the chart of the QQQ shows below. The only time the cycle didn’t work was in October. The March cycle seemed to shift, quite possible because of the FOMC meeting, which was two days prior to the OPEX.

Much of the evidence continues to support the idea that this market rally from the last few days, was likely a giant squeeze, with copycat patterns galore, and if these patterns persist, there is a lot of evidence to suggest a consolidation this week or very sharp pullback.

3. Semis

For all its might the VanEck Semiconductor (NASDAQ:SMH) ETF, which rose by 13%, was unable to push above resistance at $270, and unable to recapture its up trend. Not bullish from a sector that was very much the leader of the market for the past 2 years.

4. DocuSign

DocuSign (NASDAQ:DOCU) had a huge rally this past week, but at this point it looks like nothing more than a gap fill. DocuSign is a good stock to watch the coming week, because it has been battered, and if it can continue to rally, then maybe sentiment has really shifted.

5. Amazon

Amazon.com (NASDAQ:AMZN) did break its downtrend this week, and the RSI looks strong. However, it needs to clear the uptrend that started in July 2020, and resistance around $3,250 for the rally to see a more pronounced rise to $3,450. If it is unable to clear that $3,250 to $3,300 region, I think it will just head back to the recent lows. So a lot can be proven here.

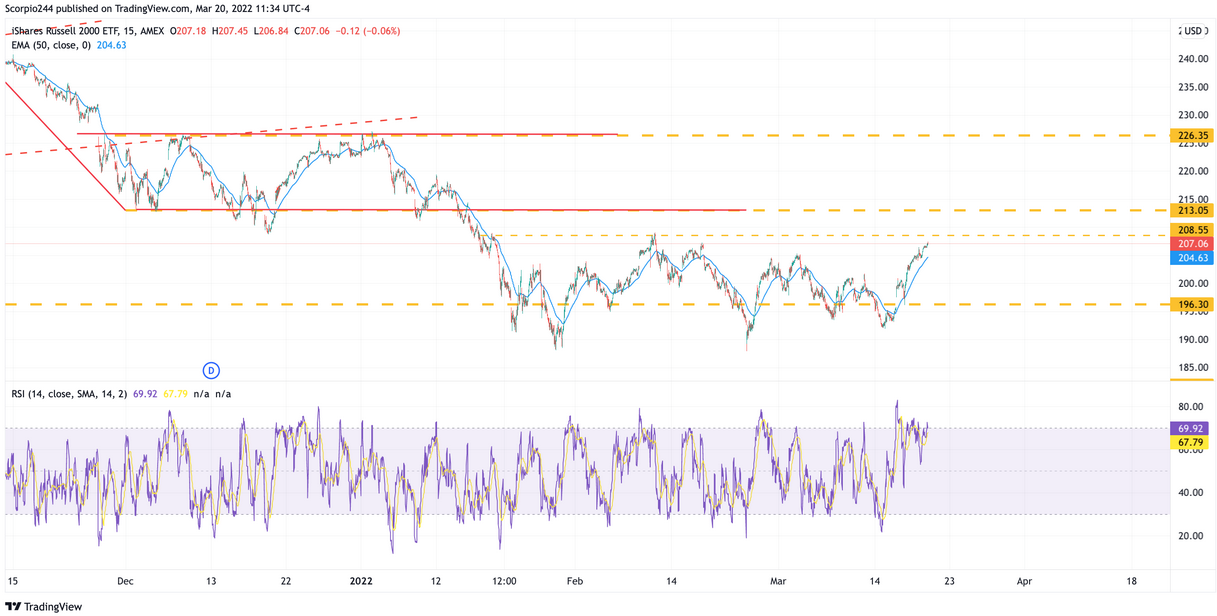

6. Russell ETF

The iShares Russell 2000 ETF (NYSE:IWM) had a big week too, but notice where it stopped, right below resistance at $208. It could still have to climb (sure it hasn’t reached resistance yet), but there is a lot of resistance to come for the IWM.

7. Adobe

Adobe (NASDAQ:ADBE) may be the stock to watch this week, with earnings expected Mar. 22. This could set the tone for the technology sector, especially following weak commentary from players like DocuSign. Adobe sits just a above a huge level of technical support at $415. I’m not going to try to guess what happens here.