Stocks rose on Monday as volume dried up, and the VIX continued to drift lower. Somehow the VIX magically popped at around 4 AM over 19, only to drift lower the entire day. I’m not sure why the VIX would jump over 19 in the middle of the night; markets weren’t doing much. But there, in the chart, you can see the jump.

There is nothing to explain why stocks are rising right now; volume has started to dry up, with S&P 500 futures trading less yesterday than they did on Thursday. You have to go back to late August to find lower trading volumes. It seems like a combination of volatility selling and lower market participants causing buyers to just trip over themselves.

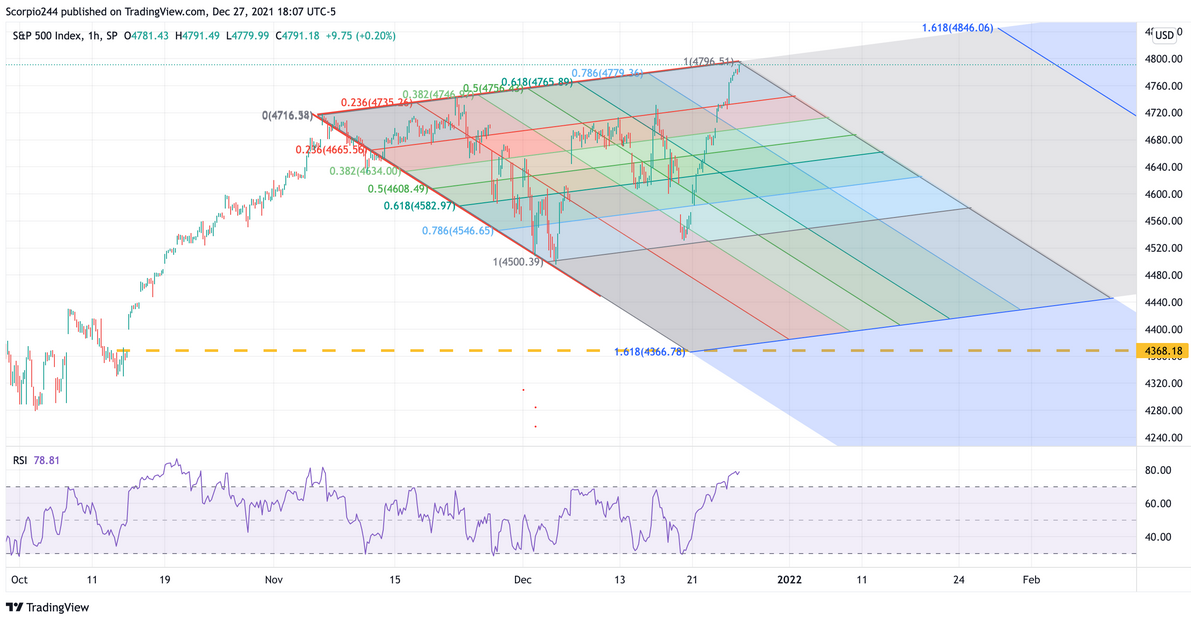

A broadening megaphone pattern is still in play for the S&P 500. It shows the whipsaw nature of a market in transition and is outlined by the two red lines. More importantly, I think this creates an overall diamond pattern. I have been trying to figure this out since the end of November, but it was not apparent until yesterday. That would make Moday’s rally the apex of the pattern.

Everything is running off this more prominent parallel diamond pattern that goes back to the September sell-off.

That’s going to be all for today. I’m going to keep these for the rest of this week.