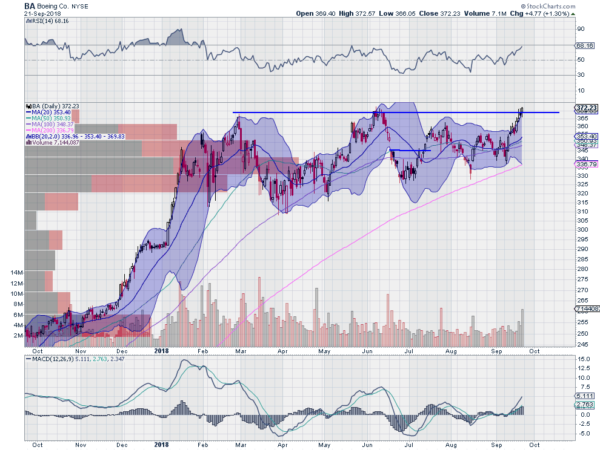

Boeing, Ticker: $BA

Boeing, $BA, ended a long, strong run higher in February. Since then it has consolidated under resistance with a series of higher lows since the April low. Coming into the week it is at resistance and has a RSI rising and bullish with the MACD positive and moving up. Look for a push over resistance to participate…..

BlackRock, Ticker: $BLK

BlackRock, $BLK, made a top in January and started a long descent. It broke below its 200 day SMA in June and has found support recently and been consolidating since the beginning of August. Last week it ended back over the 50 day SMA for the first time since June with a RSI rising to the bullish zone and a MACD about to go positive. Look for continuation to participate…..

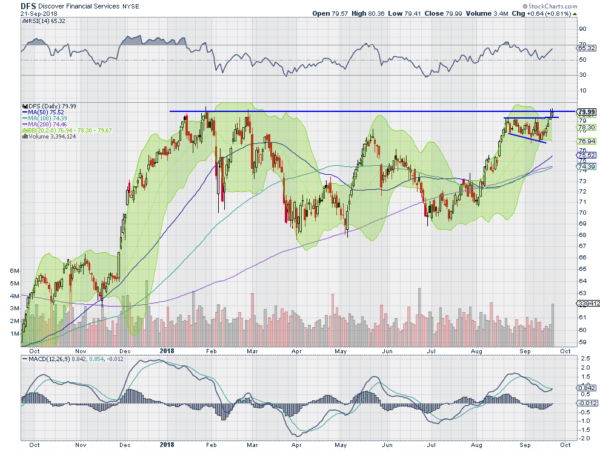

Discover Financial, Ticker: $DFS

Discover Financial, $DFS, started a move higher in November, reaching an all-time high in January. It pulled back from there to the 200 day SMA into May and bounced along at that level as support. In August it started higher again and is now near a retest of the January high. The RSI is rising and bullish with the MACD crossed up and positive. Look for continuation to participate…..

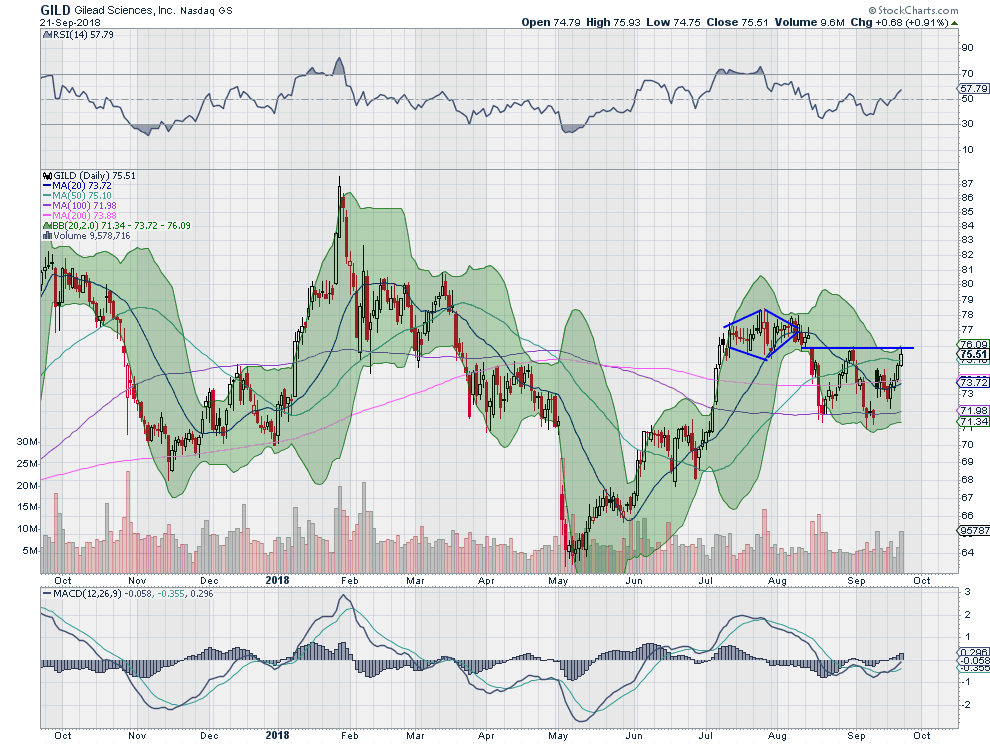

Gilead, Ticker: $GILD

Gilead, $GILD, fell from a top at the end of January and continued lower into a gap down in May. It rose from there but stalled as it retraced over the 200 day SMA in a Diamond. It broke the Diamond to the downside in August and found support at the 100 day SMA. It has consolidated there since. The RSI is rising now and the MACD crossed up and headed to positive as the price approaches resistance. Look for a push over to participate…..

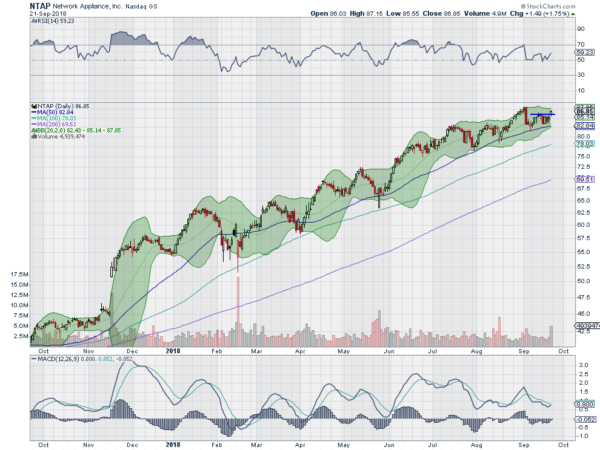

NetApp, Ticker: $NTAP

NetApp, $NTAP, seems to just keep going up. But at the end of August it dropped back to its 20 day SMA and then on to the 50 day SMA. This has been a buy point along the way. The RSI is bullish and rising with the MACD about to cross up. Look for continuation to participate higher…..

Up Next: Bonus Idea

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which heading into the last week of the 3rd quarter, sees equity strength has rotated from the small cap and tech names into the large caps of the Dow Jones Industrials and the S&P 500. The leaders are making new all-time highs as the laggards hold steady, a strong market.

Elsewhere look for Gold to consolidate in its downtrend while Crude Oil slowly moves higher. The US Dollar Index looks to continue to the downside slowly while US Treasuries are at the bottom of consolidation and look better lower. The Shanghai Composite is bouncing off a retest of the lows but not safe yet and Emerging Markets are bouncing in their downtrend as well.

Volatility looks to remain very low keeping the bias higher for the equity index ETF’s SPY, IWM and QQQ. The SPY is now leading the way on the shorter timeframe with the QQQ and IWM consolidating, while all look fantastic on the longer timeframe. Use this information as you prepare for the coming week and trad’em well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.