Following fresh tensions over North Korea’s fanatic militant activities, this time targeting Japan, majority of the U.S. defense stocks moved north on Aug 30. Notably, North Korea fired a ballistic missile which flew over Japan's Hokkaido island before crashing in to the sea.

This sudden move made investors skeptical owing to which major world market indices, at the onset of Aug 29 trading session, dipped. However, by the end of the day, the U.S. stocks regained their footing.

The S&P 500 ended the session by inching up 0.1%, while both the Nasdaq Composite and Dow Jones Industrial Average rose 0.3%. Though investors were initially unnerved by the mounting tension due to the missile launch and Hurricane Harvey’s devastation, the day eventually closed on a promising note. U.S. administration’s aggressive defense strategy probably saved the day for the stocks.

How Did North Korea Justify?

North Korea’s President Kim Jong-Un justified the move as an action to counter the United States and South Korean military drills. Per major media sources, Kim maintained that the missile launch was his first step of conducting military operations in the Pacific and more such actions can be expected, going forward.

Moreover, North Korea's official news agency KCNA claimed that the move marks the anniversary of the disputed Japan-Korea treaty of 1910, which saw Japanese forces annex the Korean peninsula.

South Korea and U.S. Retaliates

A high alert has been issued in Japan following North Korea’s missile launch. Japanese Prime Minister Shinzo Abe strongly condemned the action as a “reckless act” and a grave threat to the country’s security. He also reminded North Korea of the U.S.’ cordial relationship with Japan.

In response, a few hours after the attack on Japan, South Korea dropped bombs at the Taebaek Pilsung Firing Range in North Korea’s Gangwon province. Through this South Korea exhibited its military strength to dent the opposition’s confidence when needed.

Further, North Korea’s missile attack on Japan, was severely criticized by the U.S. President Trump. He sent a strong message to his Korean counterpart, saying “all options are on the table" indicating a possible counter missile launch in the near term.

Stocks in Focus

Cross-border tensions between the United States and North Korea have escalated manifold in the last few months. The last month, in particular, has seen the highest tension between the two countries. It reached its peak at this month’s onset, providing an impetus to a number of defense majors to scale new all-time highs.

The fresh altercation yesterday boded well for the U.S. defense bellwethers as rising geopolitical tensions always prompt the government to strengthen it arsenals.

Here we have sorted five defense primes that witnessed more than 1% gain in their share price in the last trading session following North Korea’s missile attack on Japan. Banking on the below mentioned bullish trends boasted by these stocks, investing in them seem to be a prudent choice.

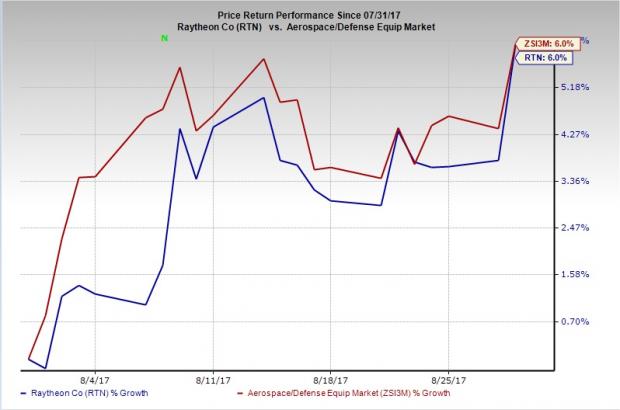

Raytheon Company (NYSE:RTN) is one of the largest aerospace and defense companies in the U.S. with a diversified line of military products, including missiles, radars, sensors, surveillance and reconnaissance equipment, communication and information systems, naval systems, air traffic control systems and technical services.

In the last trading session, this defense prime’s share price gained 2.2%, maximum among other defense majors. Raytheon currently has a Zacks Rank #3 (Hold).

The Zacks Consensus Estimate for its current-year earnings increased 0.7% over the last 30 days. The company’s shares returned 6% in the last one month, in line with the broader industry’s gain, thus making it a viable investment choice.

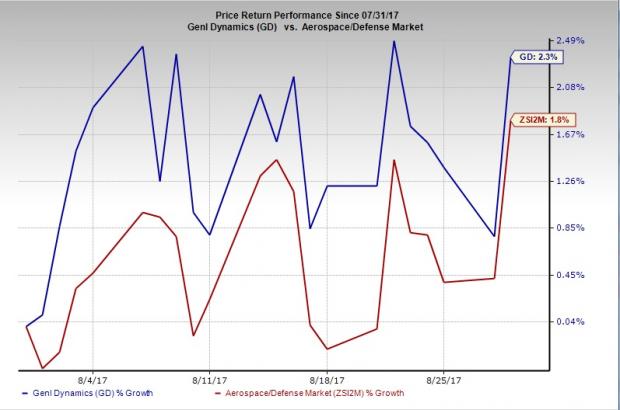

General Dynamics Corp. (NYSE:GD) is one of the only two contractors in the world equipped to build nuclear-powered submarines. It engages in mission-critical information systems and technologies; land and expeditionary combat vehicles, armaments and munitions; shipbuilding and marine systems; and business aviation.

In the last trading session, the company’s share price gained 1.6%. General Dynamics currently carries a Zacks Rank #3.

The Zacks Consensus Estimate for its current-year earnings inched up 0.1% over the last 30 days. The company’s shares gained 2.3% in last on month, compared to the broader industry’s return of 1.8%.

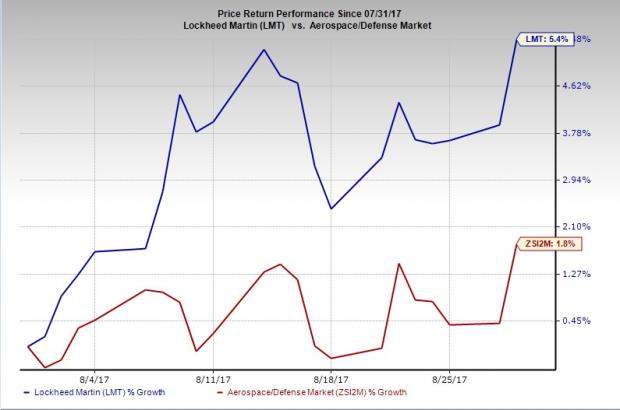

Lockheed Martin Corp. (NYSE:LMT) is the largest defense contractor in the world, which manufactures military aircraft, Joint Light Tactical vehicle, Littoral combat ships and many more defense equipment alike.

In the last trading session, the company’s share price gained 1.5%. Lockheed Martin currently carries a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for its current-year earnings remained stable over the last 30 days. The company’s shares moved up 5.4% in the last month, compared to the broader industry’s return of 1.8%.

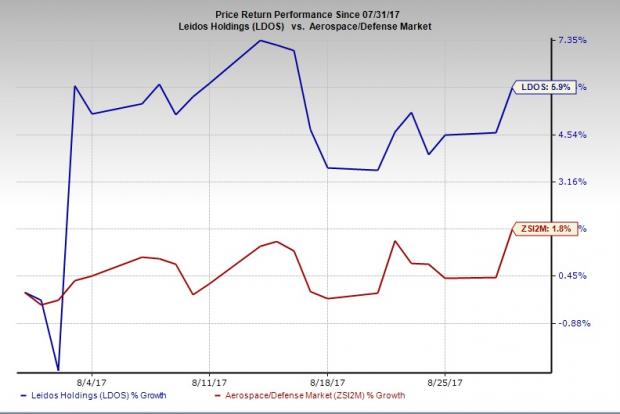

Leidos Holdings, Inc. (NYSE:LDOS) offers technology and engineering services and solutions in the defense and intelligence markets to the U.S. Department of Defense, the U.S. Intelligence Community, the U.S. Department of Homeland Security, the Federal Aviation Administration and a few more authorities.

In the last trading session, the company’s share price gained 1.3%. Leidos Holdings currently carries a Zacks Rank #1 (Strong Buy).

The Zacks Consensus Estimate for its current-year earnings improved 6.7% over the last 30 days. The company’s shares rallied 5.9% in last on month, compared to the broader industry’s return of 1.8%.

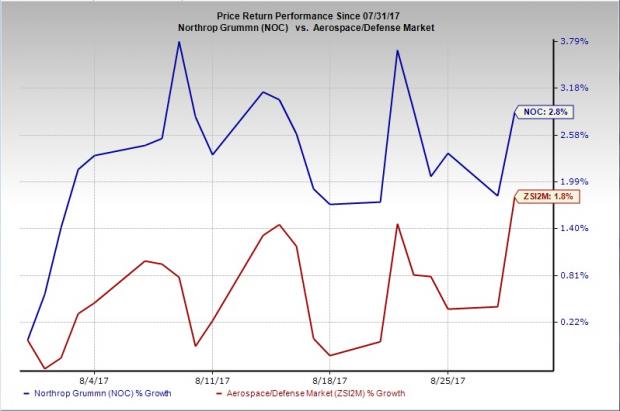

Northrop Grumman Corp. (NYSE:NOC) provides systems, products and solutions to government and commercial customers in the areas of aerospace, mission systems and technology services worldwide.

In the last trading session, the company’s share price gained 1.1%. Northrop Grumman presently has a Zacks Rank #3.

The Zacks Consensus Estimate for its current-year earnings increased 0.6% over the last 30 days. The company’s shares rallied 2.8% in last on month, compared to the broader industry’s return of 1.8%.

4 Surprising Tech Stocks to Keep an Eye On

Tech stocks have been a major force behind the market’s record highs, but picking the best ones to buy can be tough. There’s a simple way to invest in the success of the entire sector. Zacks has just released a Special Report revealing one thing tech companies literally cannot function without. More importantly, it reveals 4 top stocks set to skyrocket on increasing demand for these devices. I encourage you to get the report now – before the next wave of innovations really take off.

Northrop Grumman Corporation (NOC): Free Stock Analysis Report

General Dynamics Corporation (GD): Free Stock Analysis Report

Lockheed Martin Corporation (LMT): Free Stock Analysis Report

Leidos Holdings, Inc. (LDOS): Free Stock Analysis Report

Raytheon Company (RTN): Free Stock Analysis Report

Original post

Zacks Investment Research