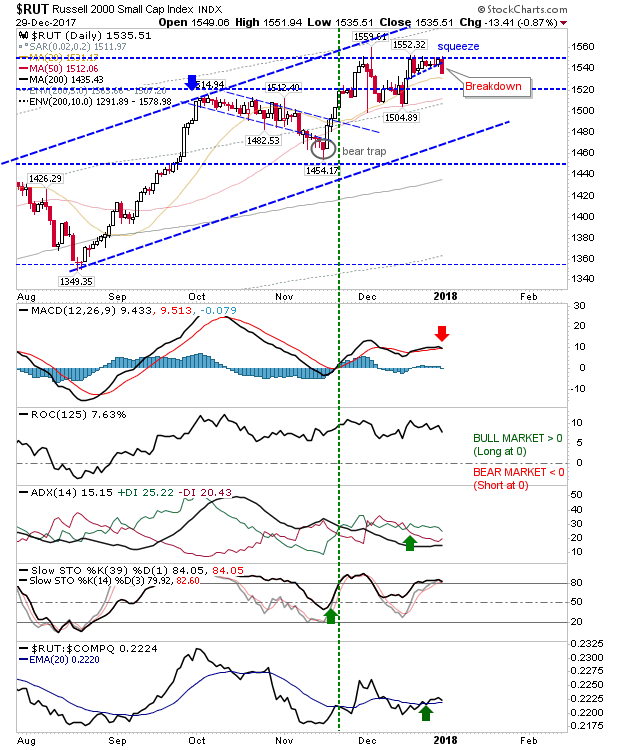

It wasn't a big sell-off on Friday, but there was a downward break of the bullish squeeze in the Russell 2000. It was associated with a MACD trigger 'sell' although this had effectively flatlined from the middle of December.

It will be important for support to hold at 1,500 but aggressive shorts could look to enter here with a stop above 1,550 (or longs could decide now is the time to take profit). When traders come back from their break this weakness could accelerate and you don't want to be on the wrong side of the trade.

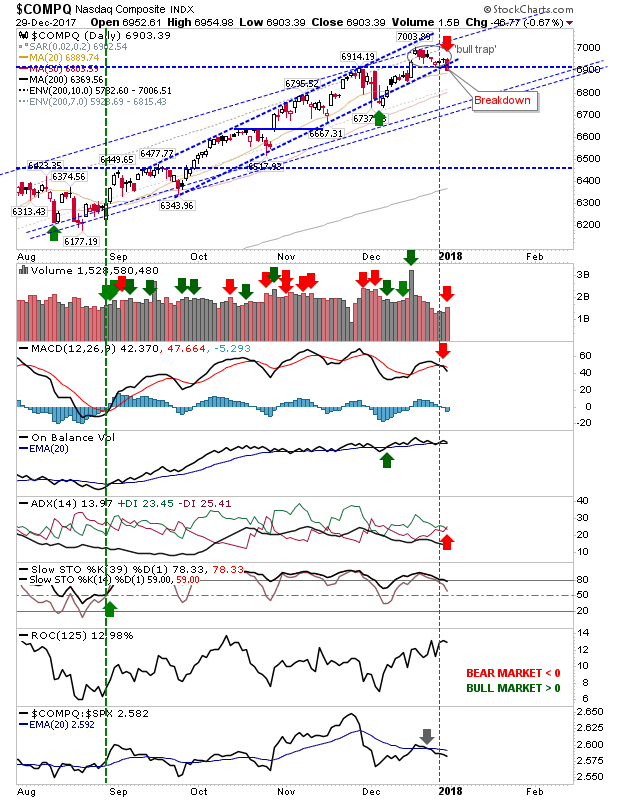

The NASDAQ is another index on the edge of a selling phase. Unlike the Russell 2000, the observed channel break and potential 'bull trap' occurred within a larger bullish channel. Existing longs can afford to wait-and-see what happens when larger channel support is tested. Aggressive shorts can assess risk based on a stop of 7,000; in essence, a risk:reward play which would need a test of the 200-day MA to be worth it.

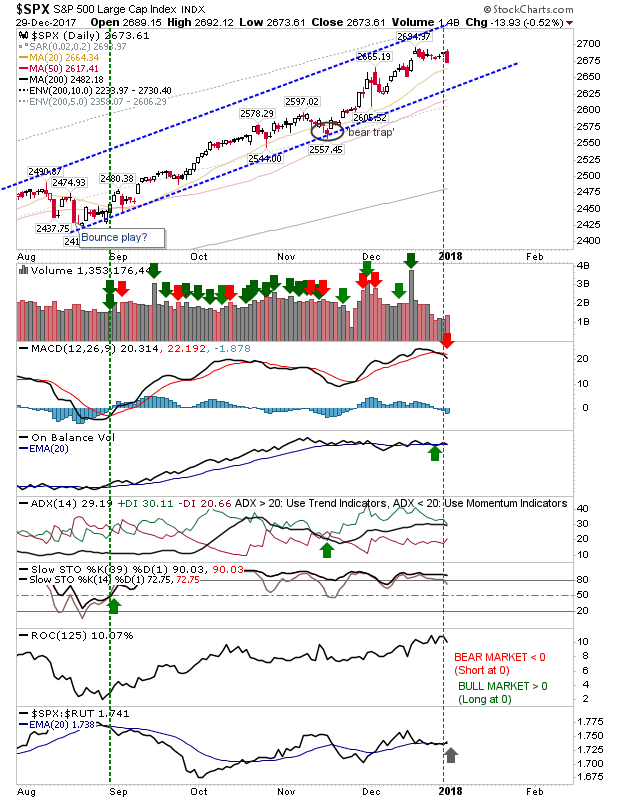

The S&P undid the last 9-days of sideways trading but it hasn't yet challenged - or near - support or resistance. Aside from the MACD trigger 'sell' there was little of note from the index.

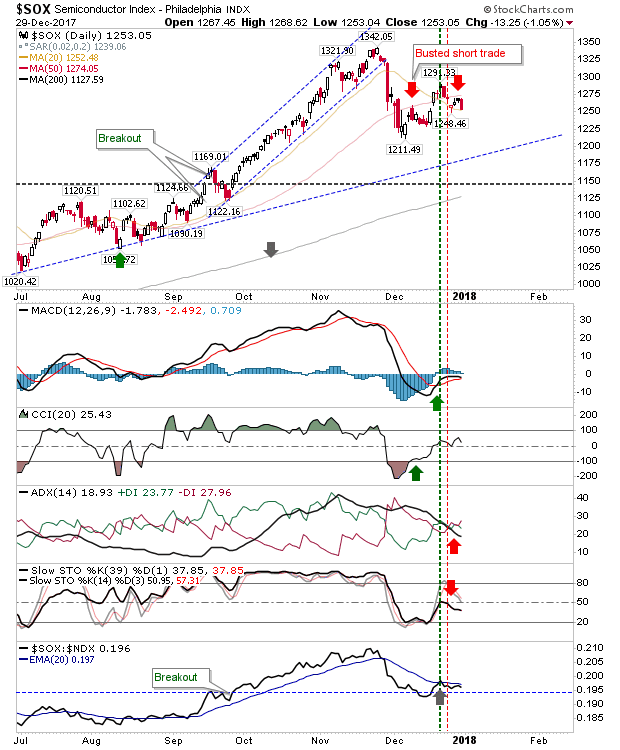

The Semiconductor Index reversed off its 50-day MA in another 'sell-off' phase for the index. This looks like the index best positioned to reward shorts as it struggles to make back November losses. A break above 1,300 would attract a wave of buying from both short covering and new longs (and is where short-stops should go) but this index is looking the most vulnerable to a new wave of selling.

I don't have any predictions for 2018. Mid-term elections offer a chance for some sanity to be restored to the US and if the indices haven't sold off by November then I would expect Democractic gains to trigger a wave of profit taking as Trump's agenda becomes deadlocked. If the status-quo remains unchanged in November then it's hard to see what will stop the rally (or kickstart a new one if a significant sell off has already occurred).

Indices are in need of a sustained period of selling to reset the bull count (buyer complacency). The cryptocurrency bubble has to burst but it's unclear what impact (if any) this will have on other assets. However, it's hard to see such crypto-inflation not diverting money flow out of stocks/bonds/commodities; Gold Bugs must be crying at action in the cryptos.