Earnings season has taken the stage for the next couple of weeks as the market steadies itself for another move higher. Of course, another push higher means that companies will need to outperform or show signs of continued growth into the fourth quarter.

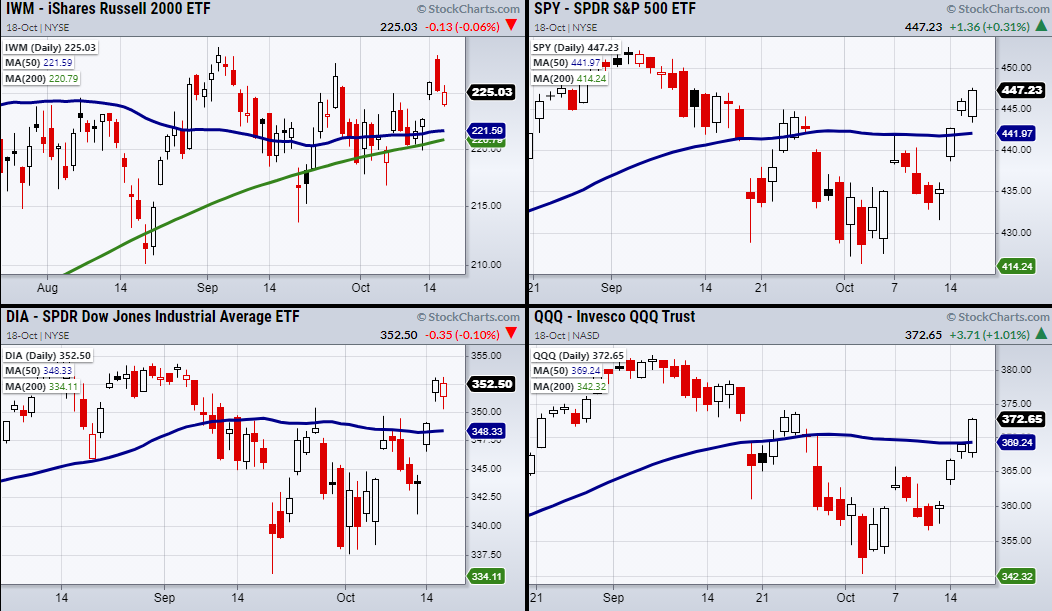

So far, the financial sector has started with a bang of better than anticipated earnings leaving a pleasant taste in investors' mouths as they load up on their favorite picks. This can also be seen as the market has switched from a cautionary mode to a bullish mode with all the major indices recently clearing their 50-Day moving averages.

As seen in the above chart compilation, the last to cross its 50-DMA was the tech-heavy NASDAQ 100 Invesco QQQ Trust (NASDAQ:QQQ). Now that every major index is trading over its 50-DMA, we can use this price level as a new support area.

With that said, let us look at a couple of interesting companies that are due to report this week.

1. International Business Machines

First, we have International Business Machines (NYSE:IBM) which has been consolidating in a range from $145 to $140 for roughly two weeks. With its recent upward trend, IBM would be interesting on a close over $145. However, IBM will need to get through earnings on Oct. 20 first.

2. Las Vegas Sands

Another company with a great setup is Las Vegas Sands (NYSE:LVS). Also reporting on Oct. 20, LVS is sitting in tight consolidation over its 50-DMA. If it continues to hold over $39.84 LVS has a nice setup once it clears $41.02.

While both companies are showing consolidation and a potential trade setup, we must wait for them to report as earnings can easily lead to some nasty surprises. Even if a trade is missed from a gap higher, from a technical standpoint waiting for earnings to pass is the best way to protect a trader's capital.

ETF Summary

- S&P 500 (SPY) 442 new support.

- Russell 2000 (IWM Needs to stay over 225.

- Dow (DIA) 349 support area.

- NASDAQ (QQQ) 369.50 support the 50-DMA.

- KRE (Regional Banks) 71.75 resistance area.

- SMH (Semiconductors) Needs a second close over the 50-DMA at 264.17.

- IYT (Transportation) 255 support area.

- IBB (Biotechnology) 160 resistance. 153.38 support.

- XRT (Retail) 93.77 resistance from the 50-DMA.

- Junk Bonds (JNK) Minor support from the 10-DMA at 108.62.

- SLV (Silver) Still Flirting with the 50-DMA at 21.52.

- USO (US Oil Fund) 56 support the 10-DMA.

- TLT (iShares 20+ Year Treasuries) 144.33 needs to hold.

- DBA (Agriculture) Support 19.00.