Stocks finished flattish on the day, but we are moving into the busiest part of the week. Now that Meta’s results are out of the way, we will have GDP and PCE to finish the week off, along with earnings from Microsoft (NASDAQ:MSFT) and Alphabet (NASDAQ:GOOGL). On top of that, next week will be even busier with an “alphabet soup” of economic data points and more big earnings reports.

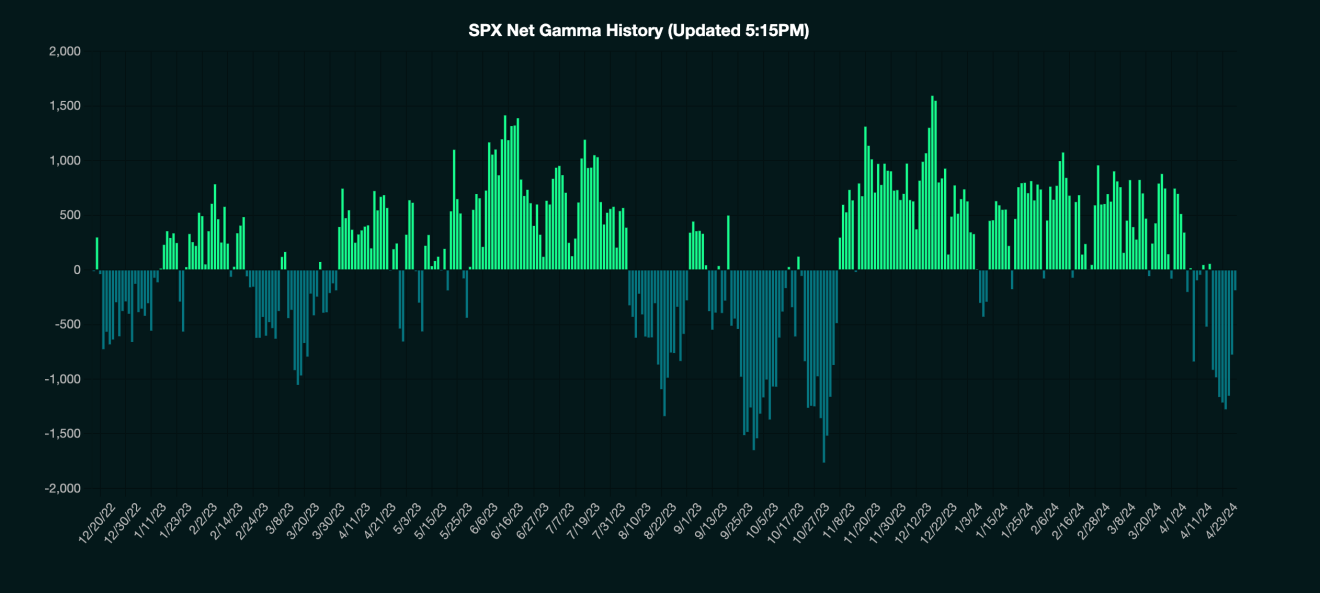

I have repeatedly cautioned the last two days not to get complacent. The equity market had all the signs of a negative gamma regime driving trade. That stalled out yesterday because gamma levels in the S&P 500, while still negative, have risen a lot over the past few days, which has helped stabilize markets.

(GAMMALABS)

As one would expect, the S&P 500 did nothing yesterday. It tried a few times to keep the rally going, but it only managed to gain 0.02%.

10-Yr Yield Eyeing Breakout

But again, it is not about the S&P 500 right, or the NASDAQ for that matter. It is about bond yields and the dollar, and the data over the next couple of days is going to have a lot of say as to where rates and the dollar go.

The 10-year has been consolidating and patiently waiting at the 4.65% level for some time, and break out would get the 10-year moving to 5%. There is a bullish ascending triangle that is present in the 10-year Treasury, and the RSI shows that momentum is pointing higher.

Anyway…

Meta Sinks Post Earnings

Meta (NASDAQ:META) reported better-than-expected earnings and just barely beat on ad revenue, which came in at $35.635 billion versus estimates of $35.573 billion. Total revenue was $36.5 billion, less than 1% better than estimates for $36.1.

The company noted that second-quarter revenue would be $37.75 billion at the mid-point, a miss versus estimates for $38.2 billion. Meanwhile, the company said capex would rise to $37.50 billion versus estimates for $34.5 billion. They are making less than expected and spending more, which has the stock sinking 12.6%.

The market was very nervous heading into the result. This was obvious from the elevated put skew and a large amount of put gamma down at the $470 level, which suggested hedging activity. It looks like, at this point, the stock will try to fill the gap from its earnings report in February at $394, which seems like the obvious place.