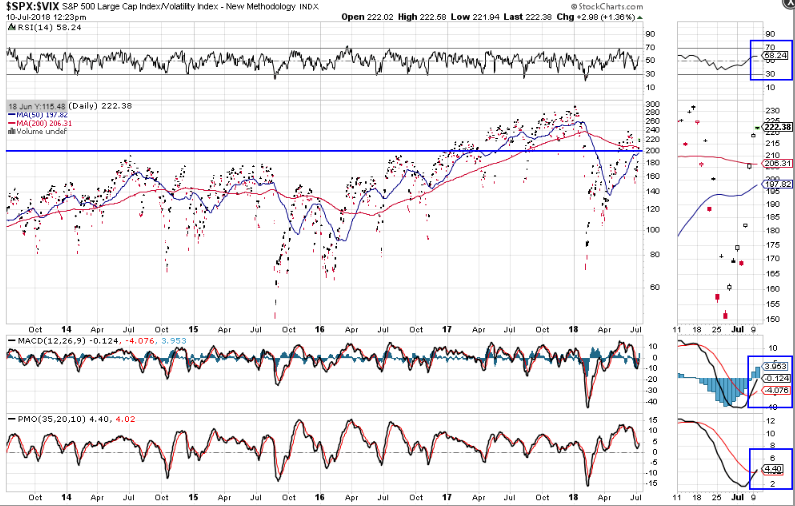

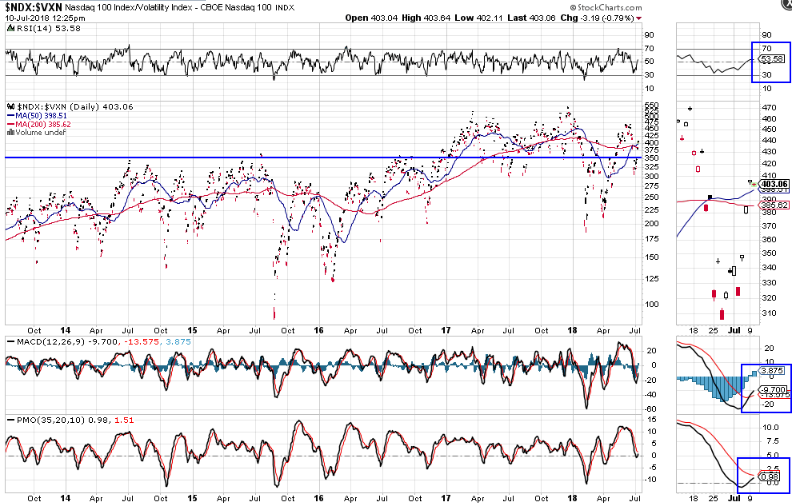

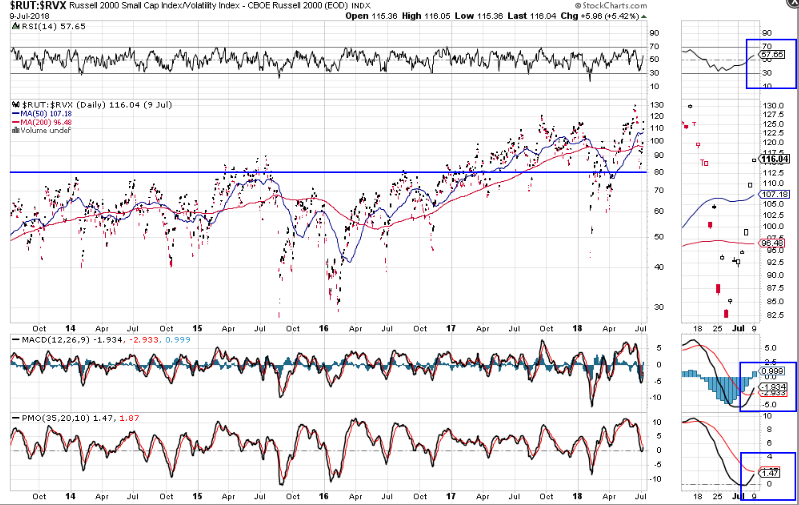

Further to my post of March 10, we may be seeing the beginnings of a 10th year bull run, inasmuch as volatility on the SPX, NDX and RUT has been attempting to stabilize recently.

However, this attempt is not yet a slam dunk. As noted on the following daily ratio charts, I'm still waiting for:

- SPX:VIX ratio: a bullish crossover of the 50 MA above the 200 MA to form a Golden Cross

- NDX:VXN ratio: a bullish crossover of the PMO technical indicator

- RUT:RVX ratio: a bullish crossover of the PMO technical indicator

All other technical indicators must continue to hold their present bullish formations and price needs to hold above their respective major support. levels, namely:

- SPX:VIX: 200

- NDX:VXN: 350

- RUT:RVX: 80

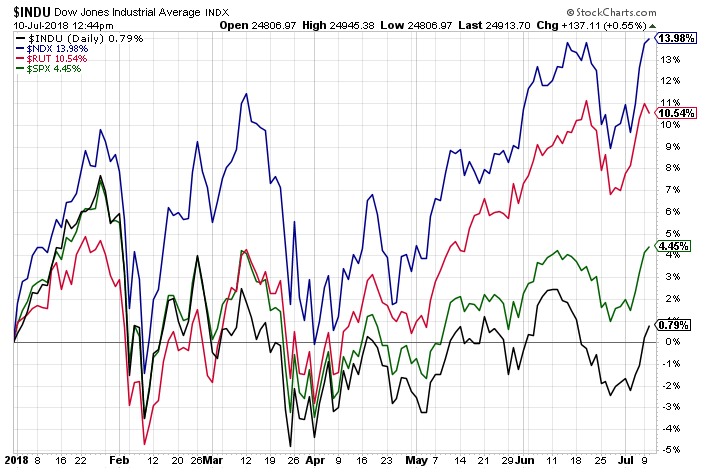

From the next chart, which compares price action and percentages gained year-to-date of the four major indices, we see that the Dow 30 and S&P 500 indices will need to pick up the pace in order to provide some kind of assurance to traders/investors that there is broad support for a 10th year bull run.

Otherwise, we just may see a 'summer swoon,' as I described in my post on June 30. In this regard, I'm continuing to monitor the World Market Index (last chart). If we see a break and hold above its next resistance level of 2000, a reversal of the bearish moving average Death Cross to form a bullish Golden Cross, and maintenance of bullish formations on all three technical indicators, such a swoon may be averted.

Keep an eye on the above three ratio charts, as well as the World Market Index for cross-confirmation of either scenario.