(Bloomberg) -- Lacking in commendations, European stocks are close to gaining a keener fan.

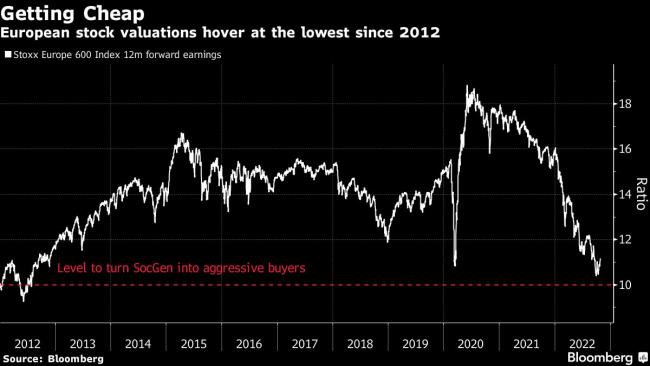

Societe Generale strategists said on Wednesday that they “would turn more aggressive buyers” of the region’s stocks if the benchmark Stoxx Europe 600 falls below 10 times forward earnings. And with the multiple currently just below 11 times -- hovering at the lowest valuations in a decade -- that’s not far off.

“History shows that at this level, markets deliver a positive one-year performance 82% of the time,” the strategists led by Roland Kaloyan wrote in a note.

The Stoxx 600 Index has fallen about 26% year-to-date in dollar terms, trailing a drop of 19% in the S&P 500. A recent Bloomberg survey showed strategists are mostly gloomy on the outlook for Europe amid worries over higher yields and slower economic growth.

The SocGen strategists regard a level of 400 index points as being a bottom for the Stoxx 600, which slumped to a closing low of 382.89 in late September amid a selloff fueled by concerns about stubbornly high inflation, hawkish central banks and an energy crisis. It’s since rebounded to around 408 points, helped by a third-quarter earnings season that Kaloyan said “is far from the debacle promised by bears.”

“Cyclical risks are no longer a focus, as we are already into recession,” the strategists said, adding that the key short-term uncertainty is the energy crunch.

Meanwhile, Barclays Plc strategists led by Emmanuel Cau said positioning in Europe can hardly get any more bearish. They noted an “ever-widening equity flows divergence,” with the US having seen equity inflows of $157 billion in the year to date while Europe has witnessed outflows of $88 billion.

“It looks overdone to us compared to activity and earnings fundamentals, although we believe it’s unlikely to reverse without some kind of resolution to the Ukraine conflict,” the strategists wrote.

©2022 Bloomberg L.P.