By Gabriel Burin and Ana Isabel Martinez

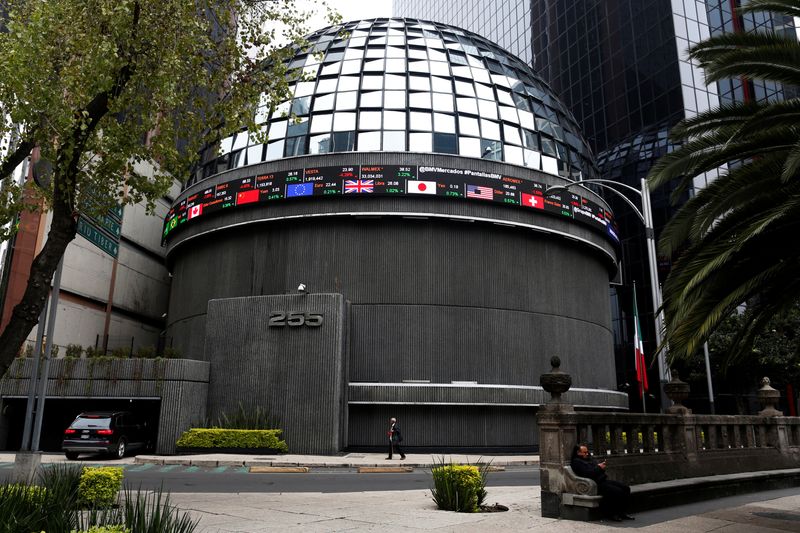

BUENOS AIRES/MEXICO CITY (Reuters) - Mexican stocks will likely gain further in 2024, propelled by faster economic growth, but local markets may go through some volatility in the months before a presidential election in June, a Reuters poll found.

Overall, Mexico's equities should continue getting support from the spillover of "nearshoring" activity, or the relocation of manufacturing plants in Mexico to benefit from the proximity to the United States.

The S&P/BMV IPC index of Mexican stocks is expected to advance 11% to 58,500 points at the end of 2024 compared to 52,685 on Friday, according to the median estimate of 13 strategists polled Nov. 13-20.

Adrian Ramirez, head of equity strategy at Masari Casa de Bolsa, said stocks may experience volatility in line with political developments around the elections in Mexico and the United States, as well as from policy adjustments in both countries.

"However, it could be a positive year for stocks, with a continuation of the current upswing favored by discretionary consumption and the construction industry, reflected in the recent improvement of economic growth expectations," he added.

Local businesses, particularly those linked to real estate and construction, are counting on investment by companies moving from other countries to Mexico, whose economy could grow 3.5% or more this year.

Meanwhile, the campaign for the presidential vote on June 2 is starting to take shape. Ruling party candidate Claudia Sheinbaum, a former Mexico City Mayor, holds a solid lead over her nearest rival.

Sheinbaum has pledged to consolidate the legacy of current President Andres Manuel Lopez Obrador, who has built his popularity with increased welfare spending and cannot seek reelection.

On the other hand, the central bank has kept an orthodox approach consisting of rate hikes that brought the cost of credit to record levels. Any adjustments would be slight in the near term, a top policymaker said last week.

In Brazil, the Bovespa stocks index is set to add 10.6% to 138,000 points at the end of next year versus 124,773 last week. So far in 2023 local equities tracked by the Bovespa index are up 13.7%, compared to 8.7% in Mexico per the S&P/BMV IPC index.

"However, foreign investors will have less reason to buy Brazilian stocks as interest rates abroad remain high," said Gustavo Cruz, RB Investimentos strategist, following a spike in U.S. Treasury yields that initially hurt the Bovespa last month.

This was followed by a recovery in November thanks to more stable trends in debt markets due to lower-than-expected inflation readings both in the U.S. and in Brazil, where the central bank is slowly cutting its benchmark interest rate.

(Other stories from the Reuters Q4 global stock markets poll package:)

(Reporting and polling by Gabriel Burin in Buenos Aires and Ana Isabel Martinez in Mexico City; Editing by Christina Fincher)