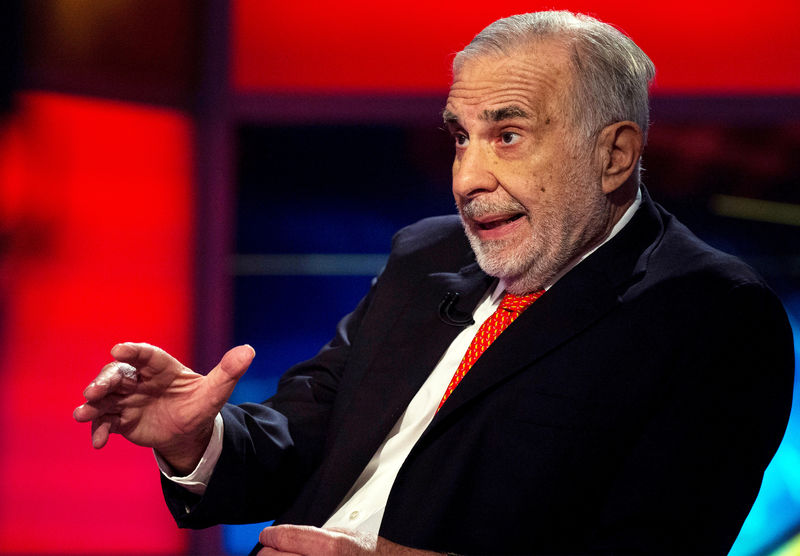

NEW YORK (Reuters) - Billionaire activist investor Carl Icahn warned on Tuesday that investors have exposure to "way too many derivatives" and called the stock market's nosedive just "rumblings of an earthquake."

"The market is really not a place for the average person to be playing around with derivatives," Icahn said on CNBC. "Today, you have these triple-leveraged ETFs (exchange-trade funds) that are crazy."

U.S. stocks swung wildly between positive and negative territory on Tuesday, a day after the Dow and S&P 500 indexes saw their biggest one-day declines in more than six years, while a world stock index dropped more than 1 percent. The pullback followed a rapid run-up in the start of the year and strong 2017 gains.

Icahn, who has been raising red flags on the stock-market's meteoric rise, said the S&P 500 and Dow Jones industrials indexes should recover, given the "great fundamentals" in U.S. companies and the recent tax cuts.

"I think this market will bounce back probably. Eventually, you get through this little panic thing," Icahn said. "Ironically, even though I am bearish and we have a lot of hedges on, I am not that bearish."

Icahn said investors should not use the markets like a casino. "... that's a huge mistake. This casino is on steroids."

He suggested that the Federal Reserve's loose quantitative easing policies had helped prop up stocks. "I don't think this is the explosive time (for stocks)...I think here, we will get out of this."

All told, Icahn said the major risks are in ETFs and exchange-traded notes (ETNs).

Credit Suisse (SIX:CSGN) said on Tuesday it would terminate the second-largest publicly traded product tracking swings in the S&P 500 after its value plunged during the global markets selloff.

VelocityShares Daily Inverse VIX Short-Term Exchange-Traded Note (ETN), which tracks financial instruments that bet against a fall in markets, will stop trading by Feb. 20, the Swiss bank said in a statement.

The notes were worth a combined $1.6 billion on Friday, according to Thomson Reuters' Lipper unit, but the redemption after Monday's selloff will likely leave investors with a fraction of their initial investment, just one casualty of the global selloff.

"It completely evaporated in one day," Icahn said of XIV.

"One day, this thing is just going to implode because you have too much leverage with too many people buying these (ETF) things and Wall Street sells them these products. And I’ve been saying for a long time, it is extremely dangerous," he added.