By Peter Nurse

Investing.com - European stock markets are seen opening largely unchanged Tuesday, as investors consolidate after the strong gains of the previous session, weighing the potential for more stimulus against the damage done by the ongoing coronavirus pandemic.

At 2:05 AM ET (0605 GMT), the DAX futures contract in Germany traded 0.1% lower, CAC 40 futures in France climbed 0.1% and the FTSE 100 futures contract in the U.K. was flat. These benchmark cash indices all posted strong gains Monday, with the DAX starring, closing 3.2% higher.

Democratic lawmakers unveiled late Monday a new $2.2 trillion coronavirus relief bill, which U.S. House of Representatives Speaker Nancy Pelosi described as a compromise measure.

This looks like a last-ditch effort to revive stalled talks with the White House, with the total cost of the package now closer to the level the Republicans could stomach.

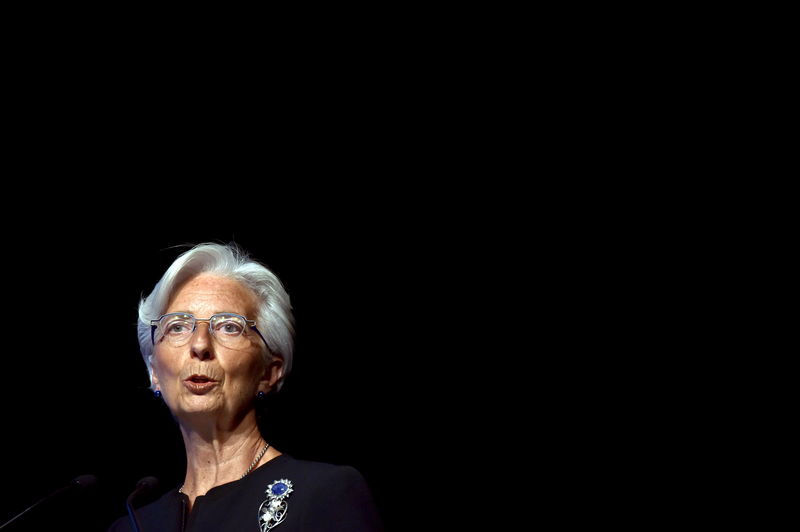

Back in Europe, European Central Bank President Christine Lagarde said, while addressing European lawmakers on Monday, that the region’s central bank is ready to deploy more monetary stimulus to aid the recovery if needed as the pandemic hampers prospects for the economy.

This comes as the global death toll from Covid-19 rose past 1 million on Tuesday, according to data from the Johns Hopkins University, with the death rate increasing in recent weeks as infections surged in several countries.

Europe accounts for nearly 25% of the deaths, and the World Health Organization has warned of a worrying spread in western Europe just weeks away from the winter flu season.

Investors will also be keeping a wary eye on the latest Brexit talks, while the first debate between U.S. President Donald Trump and rival Joe Biden takes place later Tuesday and will be closely watched in the run up to November’s presidential election.

In corporate news, the German car sector may be in focus after Bloomberg reported that Uber (NYSE:UBER) is weighing up a purchase of Free Now, a ride-hailing joint venture between Daimler (OTC:DDAIF) and BMW (DE:BMWG).

Oil prices edged lower Tuesday as concerns about the impact on demand from rising coronavirus cases took precedence over hopes that a new stimulus package may be in the offing.

The market will be looking for signs of U.S. demand growth in inventory data due on Tuesday from the American Petroleum Institute and the Energy Information Administration on Wednesday.

U.S. crude futures traded 0.6% lower at $40.34 a barrel, while the international benchmark Brent contract fell 0.6% to $42.63.

Elsewhere, gold futures rose 0.1% to $1,884.55/oz, while EUR/USD traded 0.1% higher at 1.1668.