By Ambar Warrick

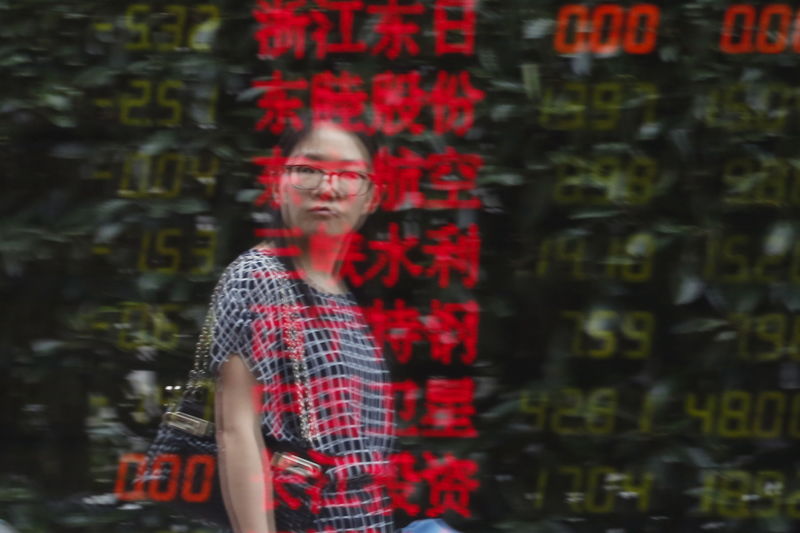

Investing.com-- Chinese stock markets resumed trade after a week-long holiday on softer footing following a surprise contraction in service sector activity, while the yuan inched higher in anticipation of more supportive measures by the Chinese government.

The bluechip Shanghai Shenzhen CSI 300 index fell 0.5%, while the Shanghai Composite index shed about 0.1%. The onshore yuan rose 0.1% to 7.1097 to the dollar, while the offshore yuan rose 0.2% to 7.1178 a dollar.

Local chipmaking stocks were pressured by new U.S. measures to curb their access to new technology. The U.S. government on Friday published new rules cutting off China from semiconductor chips made using U.S. equipment.

Caixin data over the weekend showed that China’s massive services sector unexpectedly contracted in September following continued disruptions from COVID-related restrictions. The reading mirrors a contraction in Chinese manufacturing activity, and shows that economic activity in the country likely slowed in the previous month.

Local markets were also pressured by bearish global trends, after stronger-than-expected U.S. jobs data pointed to a robust labor market, giving the Fed enough space to keep raising rates at a sharp pace. Most Asian markets tumbled last week in anticipation of the reading, and extended losses on Monday.

Chinese markets have a slew of data points to contend with this week. Readings on inflation and trade for September will be released on Friday, and are expected to signal some signs of recovery in the world’s second-largest economy. But they may also undercut expectations, like the recent service sector data.

The People’s Bank of China is also expected to decide on adjusting interest rates this week, which will factor into the yuan’s performance. The central bank is reluctant to allow any more losses in the currency, and has also reportedly intervened in currency markets.

Earlier in September, the yuan touched its weakest level since the 2008 financial crisis, while the offshore yuan slumped to a record low.

Focus this week is also on the 20th National Congress of the Chinese Communist Party, which is expected to set the tone for Beijing’s political climate for the next five years. An update to the country’s zero-COVID policy, which has decimated economic growth this year, will be in focus.