Investing.com – China stocks were higher after the close on Thursday, as gains in the Life Insurance, Banking and Financials sectors led shares higher.

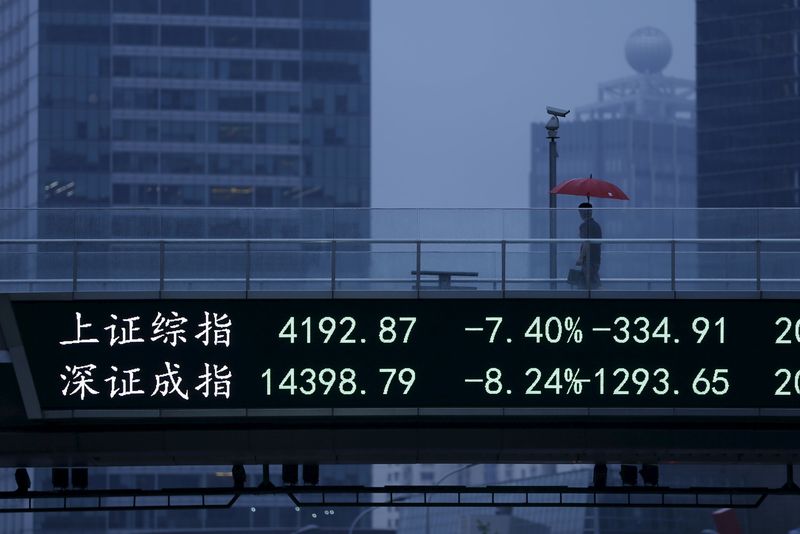

At the close in Shanghai, the Shanghai Composite added 5.40%, while the SZSE Component index climbed 3.58%.

The best performers of the session on the Shanghai Composite were Cn Citic Bank (SS:601998), which rose 10.09% or 0.570 points to trade at 6.220 at the close. Meanwhile, Shenma Indu (SS:600810) added 10.08% or 0.670 points to end at 7.320 and Rebecca (SS:600439) was up 10.08% or 0.520 points to 5.680 in late trade.

The worst performers of the session were Jingyuntong Te (SS:601908), which fell 10.01% or 1.590 points to trade at 14.290 at the close. Sc Langsha (SS:600137) declined 10.00% or 3.550 points to end at 31.960 and Changjiang Ele (SS:600584) was down 10.00% or 1.900 points to 17.100.

The top performers on the SZSE Component were Sichuan Meifeng Chemical Industry Co Ltd (SZ:000731) which rose 10.06% to 7.55, Cangzhou Mingzhu Plastic Co Ltd (SZ:002108) which was up 10.04% to settle at 12.39 and Sichuan Kelun Pharmaceutical Co Ltd (SZ:002422) which gained 10.03% to close at 16.24.

The worst performers were Shanghai Luxin Packing Materials Science&Technology Co Ltd (SZ:002565) which was down 10.02% to 7.81 in late trade, Hebei Iron and Steel Co Ltd (SZ:000709) which lost 10.00% to settle at 4.59 and Zhejiang JIULI Hi-tech Metals Co Ltd (SZ:002318) which was down 10.00% to 34.74 at the close.

Rising stocks outnumbered declining ones on the Shanghai Stock Exchange by 872 to 69.

The CBOE China Etf Volatility, which measures the implied volatility of Shanghai Composite options, was down 11.13% to 47.13.

Gold for December delivery was up 0.08% or 0.90 to $1125.50 a troy ounce. Elsewhere in commodities trading, Crude oil for delivery in October rose 3.10% or 1.20 to hit $39.80 a barrel, while the October Brent oil contract rose 2.99% or 1.29 to trade at $44.43 a barrel.

USD/CNY was down 0.07% to 6.4063, while EUR/CNY rose 0.03% to 7.2545.

The US Dollar Index was down 0.05% at 95.25.