By Alun John

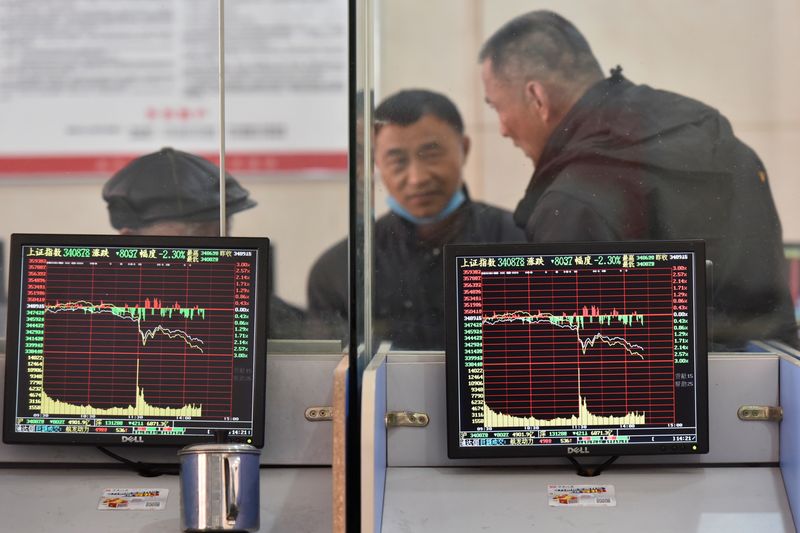

LONDON (Reuters) - Investors poured almost $12 billion into Chinese equity funds in the week to Wednesday in the largest inflow since 2015 and the second largest ever, a BofA Global Research report showed on Friday - a positive sign for battered Chinese stocks.

Hong Kong's Hang Seng Index is up nearly 5% this week, its best performance since last July, and onshore blue chips have risen 1.5% as Beijing steps up efforts to restore confidence in the world's second economy. [.SS]

China's central bank said earlier this week it would cut the amount of cash that banks must hold as reserves. In addition Beijing has announced steps to ease a liquidity crunch facing troubled property developers, while media have reported a 2 trillion yuan ($278.53 billion) rescue package to buy stocks.

Those come as onshore Chinese blue chips trade around their lowest in around five years and the Hong Kong benchmark at its lowest in over a year due to investor fears about the Chinese economy, particularly its beleaguered property sector.

That collapse in shares merits a wager on an eventual rebound and perhaps a new approach to investing in the market, some investors say.

A sharp fall in Chinese property stocks made China "the world’s most enticing contrarian long 'trade'", BofA analysts said, noting: "No one believes it's an 'investment'".

Elsewhere, equity funds recorded investments of $17.6 billion, and bond flows of $14.2 billion in the week to Wednesday, BofA said, citing data from fund flows and asset allocation data provider EPFR.

U.S. stocks meanwhile were surging to new highs driven by tech shares as an AI "baby bubble" grows, the BofA note said.

According to its note, tech stocks saw a third straight weekly inflow of $2.8 billion, the largest since last August.

Tech and technology-related sectors drove the S&P 500's 24% gain in 2023, and many of those stocks are off to a strong start again this year.

Emerging market (EM) equities registered a record weekly inflow of $12.1 billion, and EM debt markets a third week of outflows, BofA added.

It said that bond markets have recorded inflows for the past five weeks, with inflows worth almost $5 billion in the past two weeks into government bonds.