By Martinne Geller and Kate Holton

LONDON (Reuters) - British companies are preparing for the possibility that the country will vote to leave the European Union with extra funds, pre-written statements and plans for late-night vigils by teams of consultants.

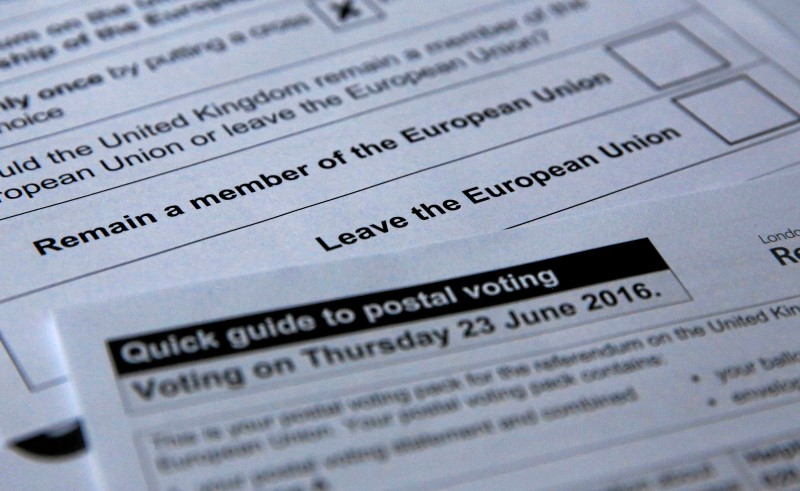

In the final week before Britain's June 23 referendum on EU membership, the prospect of a "Leave" vote has come into sharp focus, prompting a last-minute flurry of preparations in the corridors of "UK PLC".

Much of the focus is on communication -- how to assure customers, employees and investors that there will be near-term business continuity in the event of an "Out" vote. Britain would have two years to negotiate its exit, or "Brexit", from the 28-country bloc.

Treasury departments will also be working overtime because a vote for a Brexit would be expected to roil currency markets and have major consequences for trade, the economy and migration in Britain and elsewhere.

Many companies have yet to work out detailed plans, as any post-Brexit picture is unclear and opinion polls had until recently suggested the "Remain" camp was comfortably ahead.

But some have sprung into action since the momentum in the polls swung toward the "Leave" camp in the latter stages of campaigning, which was suspended on Thursday after a British lawmaker was killed.

"The nearness of the vote and sudden increased likelihood of Brexit has definitely sharpened client appetite for draft statements," said a senior executive at a public relations firm, one of three who said this week there had been an increase in client requests for communications advice.

As of February, more than three-quarters of Britain's FTSE 250 companies had not made any contingency plans for a possible exit, according to a survey published in April by the Chartered Institute of Internal Auditors.

More than 60 percent said they planned to do so, but the uncertainty at that time made it impossible.

STERLING SWINGS

For many export-orientated multinationals in the FTSE 100 index, violent currency swings on the morning of June 24 are the top concern.

"The biggest short-term impact and the biggest headache for us is going to be sterling," said the head of strategy at one top-10 FTSE company.

While chief executives generally back "Remain" on the grounds that unfettered access to Europe's market of about 500 million consumers is good for business, a short-term fall in sterling on a "Leave" vote would make exports cheaper and could boost sales, while a "Remain" vote could see the currency jump.

Either way, it spells volatility for sterling-denominated earnings at businesses including engineering firms Rolls-Royce (LON:RR) and BAE Systems (LON:BAES), pharmaceuticals giant GlaxoSmithKline, drinks group Diageo (LON:DGE), and British American Tobacco (LON:BATS).

Richard De Meo, managing director of Foenix Partners, a foreign exchange specialist for British companies, said many corporate treasury departments were now escalating currency decisions up the chain of command.

"There can be serious business risks to them sticking to long-term policies in a situation like this. They are in communication with the chairman, the MDs (managing directors), the board," he said. Some companies have also been keeping open lines of credit in case Brexit-related volatility increases their need for cash.

Vodafone (LON:VOD), which boosted its short-term borrowing capabilities this year during merger talks with U.S. cable company Liberty Global (NASDAQ:LBTYA), has said it is grateful it has that funding in place for now.

"Once we're through uncertainty, you would expect the (commercial paper) to drop down," Vodafone CFO Nick Read told analysts in May. "There's no other uses of cash. It's just more, I would argue, timing and tactical."

NOT "A HOSTILE ACT"

Several executives said they were concerned about managing relations with international employees, customers, suppliers and shareholders immediately after the results are announced on June 24. While there were no plans to issue public statements to the stock market, several executives said they would be likely to communicate with stakeholders in the event of a Leave vote.

"I would want to reassure our European partners that this is not something they should regard as a hostile act," said Miles Young, chairman of advertising agency Ogilvy & Mather, part of British group WPP (LON:WPP).

Another senior FTSE 100 executive told Reuters the company would bring in external lawyers and consultants on June 24 for backup, if this was necessary.

"One thing we need to do immediately is to engage in a very serious dialogue after the 24th with customers to identify both opportunities and challenges in the ongoing relationship," said the executive. "They may say 'come back in two years to talk to us' or they may want to talk then."

One senior executive at a public relations firm said he planned to stay in a central London hotel the night of June 23 to be close to the office.

He also expected most of the firm's public affairs team to work late on June 23 and come to work early on June 24 to watch and analyze the results on behalf of multinational clients.

"As their public affairs eyes and ears, they're expecting us to do ... most of the watching and analysis for them," he said. "I'm not telling people they have to stay on the floor or anything, but if they can get in earlier than usual, that would be helpful."

After issuing weekly bulletins to clients in the last few months, he said he would update them shortly after the polls close at 2100 GMT on June 23 and then again around 0600 GMT the next day.

In the financial services sector, where a Brexit vote will echo the loudest, large banks including Citi and Goldman Sachs (NYSE:GS) will have senior traders working through the night, which is set to be among the most volatile 24 hours for markets in a quarter of a century.

A FTSE 100 finance director said there would also be concern about what a Brexit would mean for the rest of the EU.

"We will have to reassure clients," the director said. "The EU is worried. We are an important part of it and you risk a domino effect. We're in the hands of the gods."