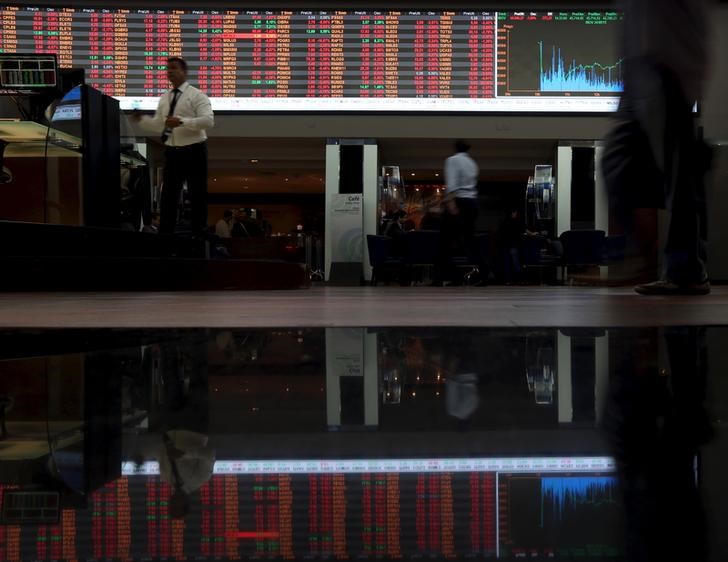

Investing.com – Brazil stocks were lower after the close on Tuesday, as losses in the Basic Materials, Public Utilities and Financials sectors led shares lower.

At the close in Sao Paulo, the Bovespa declined 1.59% to hit a new 1-month low.

The best performers of the session on the Bovespa were Viavarejo Unt (SA:VVAR11), which rose 5.10% or 1.48 points to trade at 30.50 at the close. Meanwhile, Companhia Brasileira deDistribuicao (SA:PCAR4) added 3.18% or 2.04 points to end at 66.14 and EcoRodovias SA (SA:ECOR3) was up 1.72% or 0.15 points to 8.87 in late trade.

The worst performers of the session were Cia de Saneamento Basico do Estado (SA:SBSP3), which fell 8.62% or 3.34 points to trade at 35.39 at the close. Marfrig Alimentos SA (SA:MRFG3) declined 4.58% or 0.27 points to end at 5.63 and Centrais Eletricas Brasileiras SA (SA:ELET6) was down 3.92% or 1.04 points to 25.46.

Falling stocks outnumbered advancing ones on the BM&FBovespa Stock Exchange by 270 to 167 and 32 ended unchanged.

Shares in Viavarejo Unt (SA:VVAR11) rose to all time highs; gaining 5.10% or 1.48 to 30.50.

The CBOE Brazil Etf Volatility, which measures the implied volatility of Bovespa options, was up 2.78% to 32.50 a new 1-month high.

Gold Futures for April delivery was down 0.77% or 10.50 to $1344.50 a troy ounce. Elsewhere in commodities trading, Crude oil for delivery in May fell 1.02% or 0.67 to hit $64.88 a barrel, while the May US coffee C contract rose 0.58% or 0.68 to trade at $118.85 .

USD/BRL was up 0.42% to 3.3279, while EUR/BRL rose 0.02% to 4.1267.

The US Dollar Index Futures was up 0.37% at 88.97.