By Sujata Rao

LONDON (Reuters) - European shares fell on Wednesday from four-year highs after U.S. President Donald Trump threatened to "substantially" increase tariffs if China failed to agree a trade deal and also took a swipe at European Union trade policies.

Concern is also growing that the intensifying unrest in Hong Kong could prompt a Chinese crackdown, pushing Hong Kong shares 2% lower and weighing on markets across Asia.

MSCI's index of world shares slipped 0.2%, following a 1% fall in Asian shares outside Japan. Japan's Nikkei slipped almost 1%, moving further off last week's 13-month highs.

"The market was anticipating something more positive from Trump, but he didn't deliver," said Justin Onuekwusi, a portfolio manager at Legal & General Investment Management.

"In recent weeks, we saw the balance of probabilities shift to the positive side, risks being taken off the table, but people have realized that risk is still there," Onuekwusi said. He's been reducing his equity allocations, he said.

Trump's speech threatened to raise tariffs on China, but he also said a trade deal was "close", without offering details on when or where it would be signed. He also criticized EU trade policies before a Nov. 14 deadline to decide whether to raise tariffs on European and Japanese carmakers.

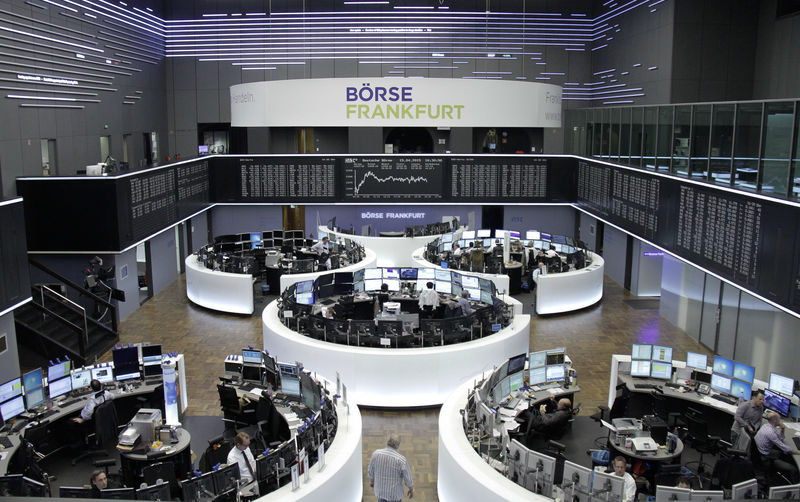

That deadline will probably be extended, but investors remain jittery. A pan-European equity index opened half a percent lower, coming off Tuesday's four-year highs, when optimism before Trump's speech and better-than-expected economic indicators from Germany boosted stock.

An index of European auto companies slipped 1.3%.

Brent crude oil futures were down 0.5% Expectations for phase one of a trade deal this month have supported stocks and riskier assets recently. Investors were led to cut the share of cash in their portfolios to six-and-a-half-year lows, according to Bank of America (NYSE:BAC) Merrill Lynch's monthly survey of global managers. The poll also showed growth optimism at 18-month highs. However, lack of progress on an agreement has started to increase doubts about whether a trade truce will happen at all. "I'm absolutely concerned. The clock is ticking," said Michael McCarthy, chief market strategist at CMC Markets in Sydney. "Markets are now expecting substantial progress in the next week or so, and if not, then confidence could crumble." Equity futures suggested U.S. stocks would open lower, with the S&P500 indicated down 0.2%. The S&P closed up on Tuesday, backing off record highs after Trump's speech. The S&P 500 has risen 2% this month and 23% so far in 2019 thanks to interest rate cuts, trade hopes and robust corporate earnings -- profits at three-quarters of S&P 500 companies have topped expectations this quarter, according to Refinitiv. European shares have gained 2.3% this month. But a more prolonged standoff will revive fears for the world economy. Oxford Economics estimates the trade war has trimmed eight-tenths of a percentage point off U.S. growth. Having started 2019 with 3.1% growth, the economy eased to 1.9% in the third quarter, they noted Asian markets were also rattled, by Trump's speech and Hong Kong's turmoil. Onshore spot yuan fell to a low of 7.0270 per dollar at one point, the weakest since Nov. 5. Hong Kong protesters planned to paralyze parts of the city for a third day, with transport, schools and many businesses closing after violence escalated across the city. Hong Kong interbank rates rose, with one-month HIBOR at its highest since Aug. 6. London-listed shares in HSBC fell almost 2%. But the New Zealand dollar rose more than 1% to $0.6402 after the central bank unexpectedly left interest rates on hold at 1%. The U.S. dollar gained 0.10% against a basket of currencies, just off three-week highs. Yields on 10-year Treasury notes held off recent three-month highs. Bond yields dipped across the euro zone as well. U.S. markets were waiting for data later on Wednesday that was expected to show inflation rose in October. Federal Reserve Chairman Jerome Powell will also provide testimony to a Congressional committee.