Investing.com - Here are the top five things you need to know this morning, Monday, November 2:

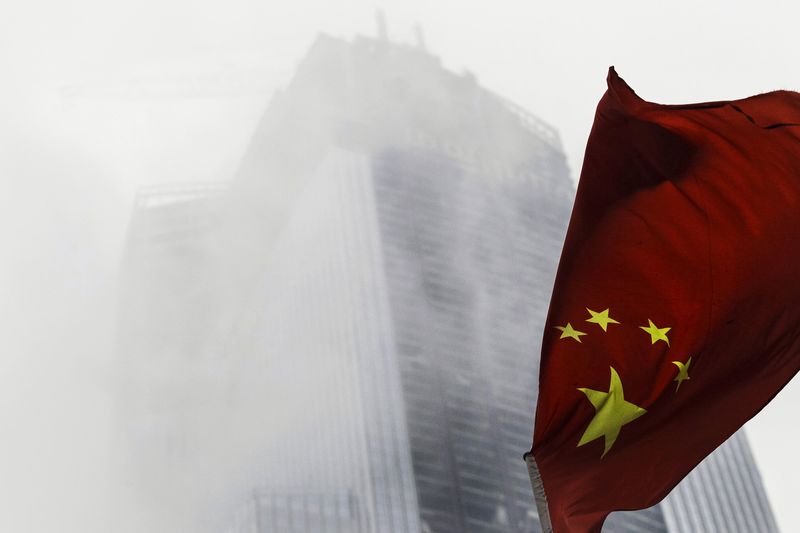

1. China's manufacturing sector contracts again in October

The final Caixin manufacturing purchasing managers’ index for October released earlier rose to 48.3 from September's six-and-a-half year low of 47.2.

Despite the modest uptick, activity still contracted for the eighth straight month, fueling fears the economy may still be losing momentum despite a raft of stimulus measures in recent months.

Meanwhile, the official manufacturing purchasing managers' index published Sunday held steady at 49.8 in October, the weakest level since August 2012. Analysts had expected the index to inch up to 50.0 last month.

A reading below 50.0 indicates industry contraction.

Asian shares dropped on Monday, with the Shanghai Composite falling 1.6% as appetite for riskier assets weakened amid indications that China's economy is losing momentum.

2. Eurozone factory growth improves modestly in October

Data on Monday showed that growth in the euro zone's manufacturing sector ticked higher in October. The final reading of the euro zone manufacturing purchasing managers' index rose to 52.3, up from the flash estimate of 52.0 and up from September’s 52.0 print.

The French factory sector posted modest growth, with the manufacturing PMI coming in at 50.6 while growth in Germany’s factory sector improved to 52.1 from a flash reading of 51.6.

Meanwhile, the U.K. manufacturing PMI jumped to a 16-month high of 55.5 last month from 51.8 in September. Economists had expected the index to tick down to 51.3.

The better than expected data helped European stock markets turn higher in mid-morning trade, after opening lower amid concerns over China.

3. U.S. ISM data due after the opening bell

U.S. economic data will be in the spotlight this week, as markets continue guessing whether the Federal Reserve will raise interest rates at its next meeting in December.

The U.S. Institute of Supply Management is to release data on October manufacturing activity at 10:00AM ET on Monday, amid expectations for a modest decline.

Market players have been trying to gauge when the Federal Reserve will raise interest rates for the first time in nearly a decade after recent economic reports offered a mixed picture of the U.S. economy.

The U.S. central bank has one more scheduled policy meeting before the end of the year in mid-December.

4. Oil prices decline on China demand concerns

Oil prices pushed lower on Monday, as persistent worries about future demand from China weighed.

U.S. crude dropped 78 cents, or 1.67%, to $45.81 a barrel while Brent shed 74 cents, or 1.49%, to $48.82 a barrel.

The Asian nation is the world’s second largest oil consumer after the U.S. and has been the engine of strengthening demand.

5. Gold falls to 4-week low

Gold prices slumped to a four-week low on Monday, as investors continued to cut holdings of the precious metal on expectations of tighter U.S. monetary policy.

Prices of the precious metal lost $23.60, or 1.87%, last week, the largest drop in nine, amid speculation the Federal Reserve may still raise interest rates this year.

Gold had rallied in October as concerns over a global economic slowdown led by China and its impact on U.S. growth prospects had prompted market participants to push back expectations for a rate increase to March 2016.

But the Fed's hawkish statement last week forced market players to readjust expectations for higher interest rates to as early as December, triggering a sell-off in the bullion market.

Expectations of higher borrowing rates going forward is considered bearish for gold, as the precious metal struggles to compete with yield-bearing assets when rates are on the rise.