A look at the day ahead in markets from Julien Ponthus.

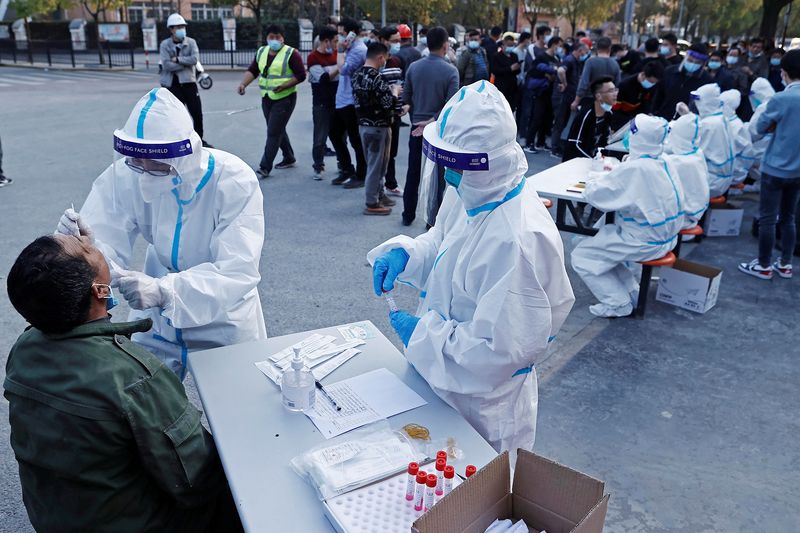

There's arguably never a good time for the COVID-19 pandemic to make a comeback but the surging cases in China over the weekend come at a moment when the global economy could do without another layer of stress to its already stretched supply chains.

Ukraine's two leading providers of neon, which produce about half the world's supply of the key ingredient for making chips, have halted operations, threatening to raise prices and to aggravate the semiconductor shortage.

This morning, Chinese stocks fell as domestic COVID-19 cases jumped to a two-year high, prompting Beijing's technology and financial hubs to impose restrictions.

How severe the outbreak will prove and how much pain it will bring to the global economy is anyone's guess, but the economic fallout of Russia's invasion of Ukraine is already taking a heavy toll.

Analysts have started trimming corporate earnings' estimates and on Thursday, the European Central Bank cut its 2022 growth target to 3.7% from 4.2% while raising its inflation forecast to 5.1%.

This week all eyes will be on the Federal Reserve and U.S. producer price index (PPI) data expected to show an annual 10% jump on Tuesday, will set the stage nicely for a rate hike.

A quick look at the fast-ascending popularity of search queries for 'stagflation' on Google (NASDAQ:GOOGL) Trends confirms that central banks hawks and doves are not the only ones worrying about sky-rocketing oil prices and higher rates slowing the economy.

In the meantime, both the pan-European STOXX 600 and Wall Street's S&P 500 are down over 11% year-to-date but this morning futures are pointing to a positive start of the week.

With low visibility on the macro front, trading these past weeks has focused on news from the war in Ukraine and on diplomatic efforts to put an end to it.

On Friday, stocks jumped when Russian President Vladimir Putin noted "certain positive shifts" in the negotiations and investors and trading algorithms will be on the lookout for any sign that the crisis could somehow de-escalate as talks continue today.

Key developments that should provide more direction to markets on Monday:

- India's February WPI inflation accelerates to 13.11% y/y

- German February wholesale prices +1.7% m/m, +16.6% y/y

- Euro zone finance ministers meet on fiscal stance for 2023, banking union

- ECB speakers: President Christine Lagarde as well as board members Fabio Panetta and Frank Elderson

- UK house prices Rightmove (OTC:RTMVY)

Inflation: the road back to the 1970s? https://fingfx.thomsonreuters.com/gfx/mkt/lgvdwaezkpo/theme1003.PNG