By Lewis Krauskopf

(Reuters) - A look at the day ahead in Asian markets from Lewis Krauskopf.

Asian markets will turn their attention to a series of central bank meetings after ending last week on a buoyant note.

MSCI's gauge of world stock markets on Friday hit its highest point in 13 months. Wall Street was upbeat as the S&P 500 notched its fourth straight weekly gain and a 20% rise from its October low, meaning the benchmark index had confirmed a bull market, according to the definition of many investors.

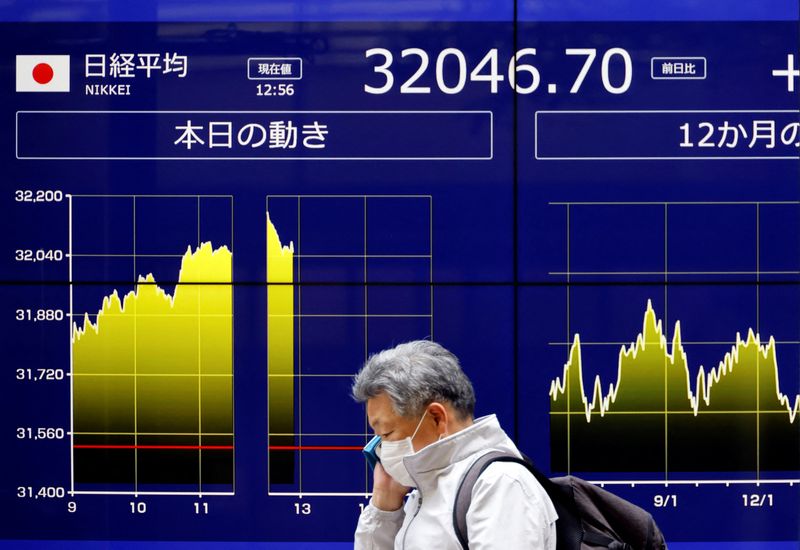

Meanwhile, Japan's Nikkei has posted nine straight weekly gains. Even beaten-up China stocks managed to end higher on Friday, buoyed the automobile and technology sectors, even as disappointing inflation data weighed on investor sentiment.

Of course, a busy week could quickly change the mood. Producer price data in Japan is expected. In India, inflation and industrial production reports are also due out on Monday.

But investors will largely be girding for the run of major central bank meetings later in the week. The Federal Reserve is expected to pause its rate-hiking cycle when it issues its policy decision on Wednesday -- although a U.S. consumer price inflation report out on Tuesday could complicate those plans if it comes in hot.

A day after its U.S. counterparts, the European Central Bank is expected to raise rates by another 25 basis points, with traders seeking clues about next steps. On Friday, the Bank of Japan meets as recently-appointed BOJ Governor Kazuo Ueda has signaled ultra-easy policy will remain until wage gains and inflation are stable and sustainable.

Ahead of the central bank bonanza, the U.S. dollar had slid back after strengthening in May. In other asset price action, oil prices fell on Friday to record a second straight weekly decline, as disappointing Chinese data added to doubts about demand growth.

Here are key developments that could provide more direction to markets on Monday:

- Japan producer prices (May)

- India CPI data (May)

- India industrial production (April)

(By Lewis Krauskopf; Editing by Diane Craft)