By Lucy Raitano

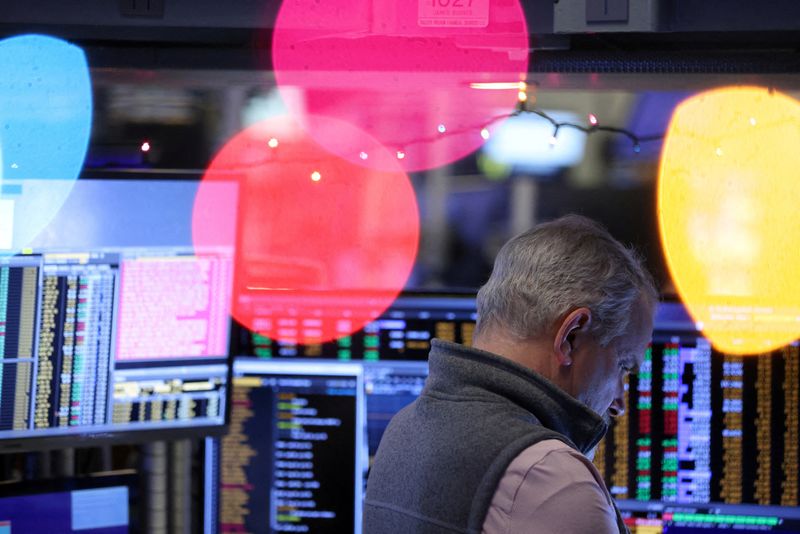

LONDON (Reuters) -Investors ploughed cash into stocks and bonds and sold cash and gold in the week to Wednesday, BofA Global Research said on Friday, hailing the end of "extreme bear sentiment".

Equity inflows totalled $18 billion and bond funds saw $2.3 billion of inflows while investors sold $0.2 billion of gold and shed cash at the highest rate in three months, selling $31.1 billion.

U.S. equity value funds recorded their largest inflows ever, of $14.3 billion, and investors bought passive equities and sold active equities.

BofA's "Bull & Bear" indicator jumped to its highest level since March 15 in the week to Wednesday.

The shift in sentiment was reflected in markets. Europe's STOXX 600 hit at a more than six-month high on Tuesday while the Nasdaq and S&P 500 traded around three-month tops earlier this week.

Since then central banks including the Federal Reserve, and European Central Bank (ECB) have warned that more rate hikes are needed to curtail inflation, with the ECB in particular giving a very hawkish message.

The STOXX 600 is now on track for its biggest two-day drop since late September, while the S&P 500 closed on Thursday at its lowest level since Nov. 10.

BofA's report also showed that emerging market debt funds recorded inflows of $0.9 billion, their largest since April 2022, while emerging market equity funds saw their second week of outflows, totalling $1.6 billion.

Investors sold $1.3 billion of bank loan funds, the largest outflow in three months.