By Noreen Burke

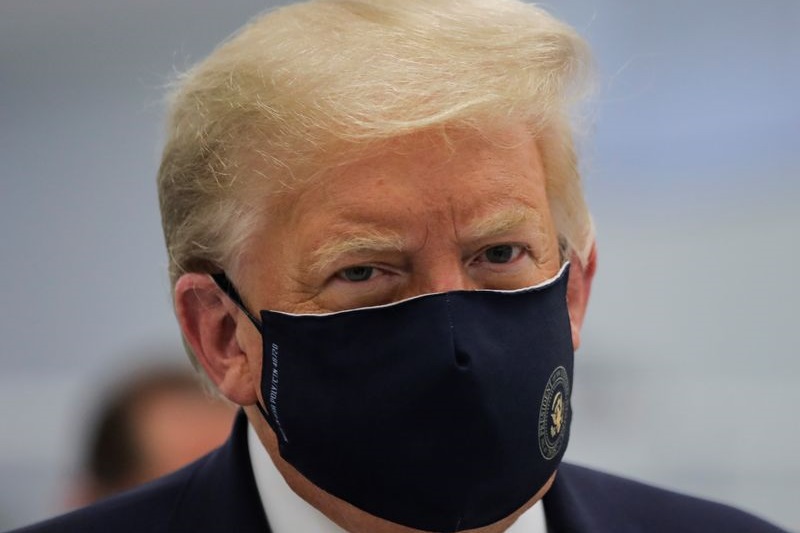

Investing.com -- U.S. President Donald Trump remains hospitalized after being diagnosed with Covid-19 and his health will be a major factor for markets in the week ahead. Investors will also be closely following the progress of fiscal stimulus talks in Washington, amid hopes for an agreement on another aid package. A fresh round of stimulus would bolster markets which have been roiled by uncertainty ahead of the upcoming presidential election and fears that the economic recovery is running out of steam. A speech by Federal Reserve Chairman Jerome Powell on Tuesday is expected to reiterate the need for additional fiscal stimulus and the Fed will publish its latest meeting minutes a day later. Here is what you need to know to start your week.

- Trump’s Covid diagnosis fuels election uncertainty

Trump said Saturday that the next few days will be the "real test" of his treatment for Covid-19, after a series of contradictory messages from the White House left it unclear how ill he had become since he tested positive for the coronavirus.

Trump’s doctors said Saturday he had received the first two doses of a five-day course of Remdesivir, an intravenous antiviral drug sold by Gilead Sciences (NASDAQ:GILD). He is also taking an experimental treatment, Regeneron's (NASDAQ:REGN) REGN-COV2.

With barely a month to go until the presidential election on Nov. 3 Trump’s illness has thrown his campaign into turmoil and cast a spotlight on his handling of the pandemic. He is trailing Democratic rival Joe Biden in opinion polls.

The president has repeatedly played down the threat of the coronavirus pandemic, even as it has killed more than 208,000 Americans and ravaged the U.S. economy.

- Spotlight on stimulus talks intensifies

Trump’s illness has intensified the spotlight on talks in Washington aimed at reaching a new fiscal relief package.

U.S. House Speaker Nancy Pelosi said on Friday that negotiations were continuing and asked airlines to halt furloughs and firings, indicating that the House could pass a standalone bill to send aid money to airlines.

But it remains to be seen whether Trump’s diagnosis or Friday’s weaker-than-expected September jobs report will make Congress any more likely to approve a new round of stimulus amid ongoing partisan wrangling.

The slowdown in the labor market recovery is the clearest indication yet that the economy is losing momentum heading into the fourth quarter. Growth had been boosted over the summer by fiscal stimulus.

"The virus is in the driver's seat in controlling the speed of the recovery and right now the economy is in the slow lane unless Congress and the White House can settle their differences and provide additional stimulus," said Chris Rupkey, chief economist at MUFG in New York.

- Market volatility to remain elevated

Many investors are concerned that any deterioration in the president’s health this close to the election could roil U.S. stock markets, which recently recorded the worst monthly performance since a selloff in March.

"This injects further uncertainty into the outcome of the election," said Roberto Perli, head of global policy research at Cornerstone Macro in Washington. "My read is that markets have demonstrated an aversion of late especially to uncertainty, not so much to one or the other candidate winning."

"Markets are also paying attention to the likelihood that another stimulus package will pass soon," Perli added. "If that happens it could offset at least in part the uncertainty generated by the Covid news."

Should uncertainty persist, technology and momentum stocks that have led this year's rally may be particularly vulnerable to a selloff, some investors said. The tech-heavy Nasdaq fell more than 2% on Friday, double the S&P 500's decline.

- Powell speech

Fed Chairman Jerome Powell is to make a speech to the National Association of Business Economists on Tuesday where he is expected to reiterate the need for additional fiscal stimulus to underpin the slowing economic recovery.

Besides Powell, several other Fed speakers are due to deliver remarks during the week, including Chicago Fed President Charles Evans, Atlanta Fed President Raphael Bostic, New York Fed President John Williams, Minneapolis Fed President Neel Kashkari and Boston Fed President Eric Rosengren.

The Fed is also due to publish the minutes to the September FOMC meeting on Wednesday, which are expected to underline the message that there is little prospect of an interest rate hike in the next couple of years.

- Euro zone rescue fund squabbles

Euro zone finance ministers are to meet in Brussels on Monday to discuss implementation of a 750 billion-euro coronavirus recovery fund, widely hailed as game-changing when it was announced earlier this year. But disagreements over how the funds are to be distributed are threatening to sour the mood.

Germany is proposing that only countries who respect the rule of law could benefit from the funds amid growing alarm in the European Union about backsliding on the rule of law in Poland and Hungary. The proposal has prompted an outcry from those two countries.

Italy, Spain and Greece, whose economies are among the worst hit by the pandemic, stand to lose out from any delay in unlocking recovery funds.

--Reuters contributed to this report