By Jamie McGeever

(Reuters) - A look at the day ahead in Asian markets.

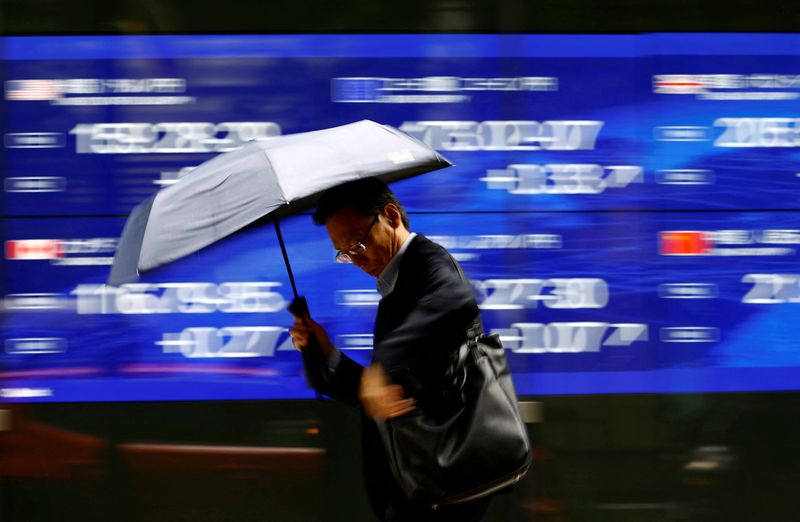

Asian markets are set to open in the red on Thursday following Wednesday's global selloff, as the prospect of more severe U.S. trade curbs puts the frighteners on investors and squeezes the tech sector in particular.

Chipmaker and tech stocks in Asia face a double whammy as investors weigh a report that the United States may restrict imports of technology to China, and comments from Republican presidential candidate Donald Trump that production hub Taiwan should pay the U.S. for its defense.

The S&P 500 on Wednesday registered its biggest fall since April, the tech-heavy Nasdaq had its biggest falls since December 2022, while the Philadelphia semiconductor index lost nearly 7%, its worst day since March 2020.

The Hang Seng tech index and Taiwan's semiconductor bellwether TSMC will be under fire on Thursday.

Thursday's regional calendar sees the release of trade figures from Japan and Malaysia, and labor market data from Australia and Hong Kong. Investors in China await policy news from a key leadership gathering in Beijing that is expected to end on Thursday.

But global sentiment is likely to drive local markets and the rotation out of tech stocks into other sectors - the Dow hit another record high - is unlikely to prevent further losses.

In currencies, the yen is on the rise after suspected intervention from Japan pushed it to a one-month high 156.00 per dollar on Wednesday. It looks like Tokyo's third bout of intervention in a week, in which time the dollar has tumbled six 'big figures' from 162.00 yen.

Japan's top currency diplomat Masato Kanda said on Wednesday he would have to respond if speculators cause "excessive" moves in the currency market and that there was no limit to how often authorities could intervene, Kyodo News reported.

Daily money market indicators from the Bank of Japan can indicate the scale of any potential action, but official confirmation on intervention and amounts spent only come at the end of every month.

The dollar is on the defensive more broadly, hitting a four-month low against a basket of major currencies with traders pointing to Trump's comments in a Bloomberg interview on the currency's recent strength as a factor behind its slide.

Bond yields are lower too after top Fed officials said they are they 'closer' to cutting interest rates, and the 10-year Treasury yield hit at a four-month low on Wednesday.

Another upbeat development for investors on Wednesday saw the Atlanta Fed's GDPNow tracking estimate for second quarter growth rise again, to 2.7%. It was 2.0% last week.

None of that will matter much in the near term, however, if the tech-fueled selloff across U.S. and global equity markets persists. Investors in Asia should buckle up for a rocky ride on Thursday.

Here are key developments that could provide more direction to markets on Thursday:

- Japan trade (June)

- Australia unemployment (June)

- ECB policy meeting