Investing.com’s stocks of the week

May has been a tricky month over the years, a well-deserved reputation following the May 6, 2010 “flash crash”. It used to be part of what we called the “May/June disaster area”. From 1965 to 1984 the S&P 500 was down during May fifteen out of twenty times. Then from 1985 through 1997, May was the best month, gaining ground every single year (13 straight gains) on the S&P, up 3.3% on average with the DJIA falling once and two NASDAQ losses.

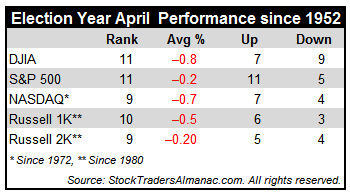

In the years since 1997, May’s performance has been erratic; DJIA up eight times in the past eighteen years (three of the years had gains in excess of 4%). NASDAQ suffered five May losses in a row from 1998-2001, down – 11.9% in 2000, followed by eight sizable gains in excess of 3% and four losses -- the worst of which was 8.3% in 2010. Election-year Mays rank at or near the bottom, registering net losses on DJIA and S&P 500 (since 1952), NASDAQ (since 1972) and Russell 2000 (since 1980).

May begins the 'Worst 6 Months' for the DJIA and S&P. To wit: “Sell in May and go away.” Our “Best Six Months Switching Strategy,” created in 1986, proves that there is merit to this old trader’s tale. A hypothetical $10,000 investment in the DJIA compounded to $838,486 for November-April in 65 years compared to $221 loss for May-October.