The Hoot

Actionable ideas for the busy trader delivered daily right up front

- Wednesday uncertain.

- ES pivot 2013.25. Holding above is bullish.

- Rest of week bias uncertain technically.

- Monthly outlook: bias higher.

- YM futures trader: no trade.

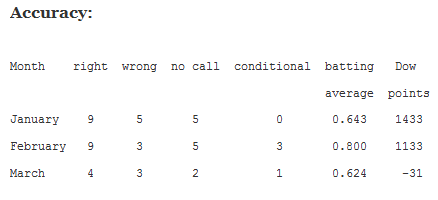

It was a risky call as I acknowledged last night and while both the SPX and the Nasdaq did indeed finish lower, the Dow somehow managed to eke out a 22 point gain despite an early dump out the gate, and so there went my call for a lower close on Tuesday. Oh well - the damage was certainly limited. Now we move on to Fed Day on Wednesday. It's my long-standing policy to always call Fed days as "uncertain" just because there's really no telling what the heck they're going to say, and there's also no telling whether Mr. Market will take good news as good news or bad news and vice-versa. So there's no point in doing any detailed analyses of charts tonight. We'll pick up where we left off, Wednesday night after the dust has settled.

The technicals

Market index futures: Tonight, all three futures are barely higher at 12:15AM EDT with ES up a mere 0.02%.

ES daily pivot: Tonight the ES daily pivot falls from 2018/42 to 2013.25. That has the effect of putting ES back above its new pivot so this indicator flips right back to bullish.

Once again we're seeing very little movement in the overnight futures as I expect that most people will be sitting on their hands until they hear what Auntie Janet has to say at 2 PM Wednesday. Then we might see a few good scalping opportunities for the fleet of finger. In the meantime all I can do is call Wednesday uncertain.

YM Futures Trader

No trade tonight..