While Asian markets got off to a poor start in the wake of the Fed decision, seemed to have turned round and continued to push into positive territory soon after US futures markets reopened around 1100 AEDT markets. Oil also halted its slide around the same time as well, and seems to be managing to hold above the US$30 level despite little fundamental change to the outlook.

One factor I would point to is the steadily changing interpretation of the Fed statement today. It was clear that the market was initially hoping for more dovish language, which prompted the selloff into the US close. However, as cooler heads prevailed and analysis began to circulate, the statement did actually show a noticeable dovish tilt to it. The Fed dropped the “reasonably confident” belief that inflation would return to 2%, and “monitoring global economic and financial developments” reappeared. Both of these indicate that global risks, and China in particular, are likely to put a bit of a pause on the hiking cycle in March and April. In an ideal world, I think the Fed would like to meet the market’s pricing of one hike this year halfway, and lower their forecast of four hikes to two or three. But uncertainty around China’s ability to halt capital outflows may upset their ideal scenario.

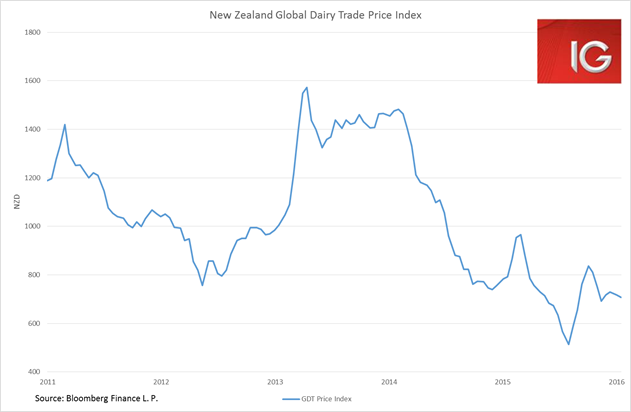

The RBNZ announced a far more cautious view on the global economy, citing a range of concerns, including “the prospects for global growth, particularly around China, global financial market conditions, dairy prices, net immigration, and pressures in the housing market”. And they clearly warned of further cuts to the policy rate this year, stating that “further policy easing may be required over the coming year to ensure that future average inflation settles near the middle of the target range”. Tightened Chinese FX controls and the steady impact of NZ’s LVR controls are likely to see prices ease in Auckland, removing the RBNZ’s financial instability concerns and opening the door to at least 2-3 rate cuts this year. China and the dairy price loom as major headwinds for the NZD, and likely are proximate causes for the NZD to be pushed into the US$0.50 handle by mid-year. Fonterra cut their milk price forecast to a nine-year low of NZD 4.15 from NZD 4.60. The kiwi dollar has lost almost 1% in Asian trade.

The PBOC injected another CNY 340 billion of capital into the money market through open market operations (OMO). While this is the largest weekly capital injection since February 2013, the bigger question is how much will be taken out again after the Chinese New Year holiday. Until then, grand calls that RRR cuts have been abandoned in favour of OMOs and other lending operations may be a bit too early.

Chinese markets had an oddly familiar surge in the late session yesterday to push the Shanghai Composite back above 2700. Yesterday’s move had all the hallmarks of state intervention. Li Yuanchao’s statement at Davos that the government will look after investors may be being backed up with state intervention. But as I said yesterday, state intervention when the market is probably not that far from a natural bottom will only mean more pain for investors. The best move for policymakers is to let the market rebalance itself. Although with the G20 meeting taking place in China in February, concerns about “face” could prompt some state support in Chinese equities as we saw last year around the WWII anniversary.

ASX: The ASX experienced a major bounce with US futures at 1100 AEDT, partly assisted by the strength in commodity prices. Materials and energy stocks significantly outperformed the banks. News of better than output and cost cutting by Fortescue in its output report helped rally stock, and a range of other better than expected production reports helped improve sentiment in the materials space.

ANZ seems to be bouncing after reaching ten-year lows on PE metrics, but banking stocks in general underperformed the market today. This does not bode well for the index. The ASX will struggle to make it back above 5000 and hold that level without the banks starting to catch a buy.