Most Asian markets had a bad session, but European indexes surged. The Euro STOXX 50 rose 2.53%. The S&P 500 soared at the open, and the upward trend was reinforced by a dramatic 16.6% month-over-month jump in new home sales announced 30 minutes after the opening bell (more on the housing data here). The index hit its 1.54% intraday high in the final hour and closed with a trimmed gain of 1.37%, biggest best advance since its 1.64% pop 51 sessions ago on March 11th.

The yield on the 10-year note closed at 1.86%, up two basis points from the previous close.

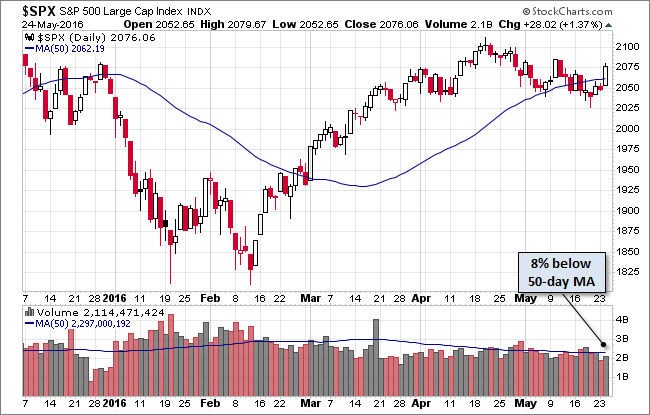

Here is a snapshot of past five sessions in the S&P 500.

Here's a daily chart of the index, which closed above its 50-day moving average. Volume was a bit below trend on today's rally.

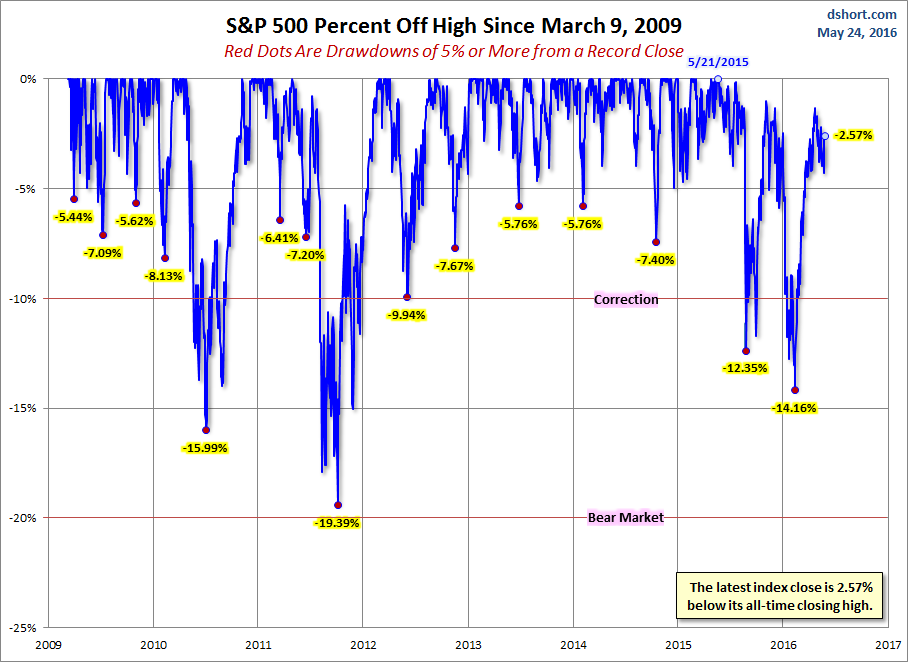

A Perspective on Drawdowns

Here's a snapshot of selloffs since the 2009 trough.

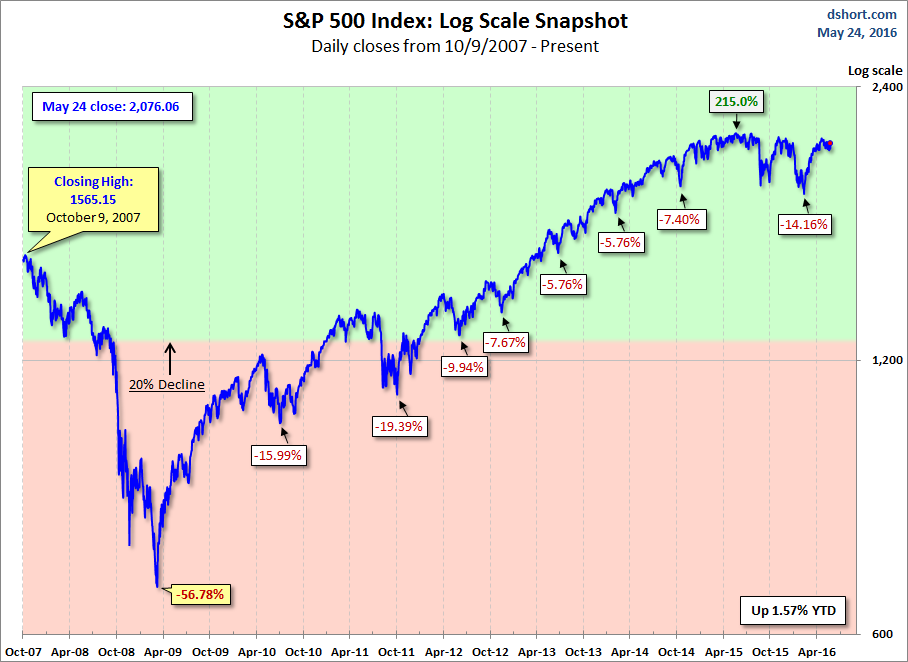

Here is a more conventional log-scale chart with drawdowns highlighted.

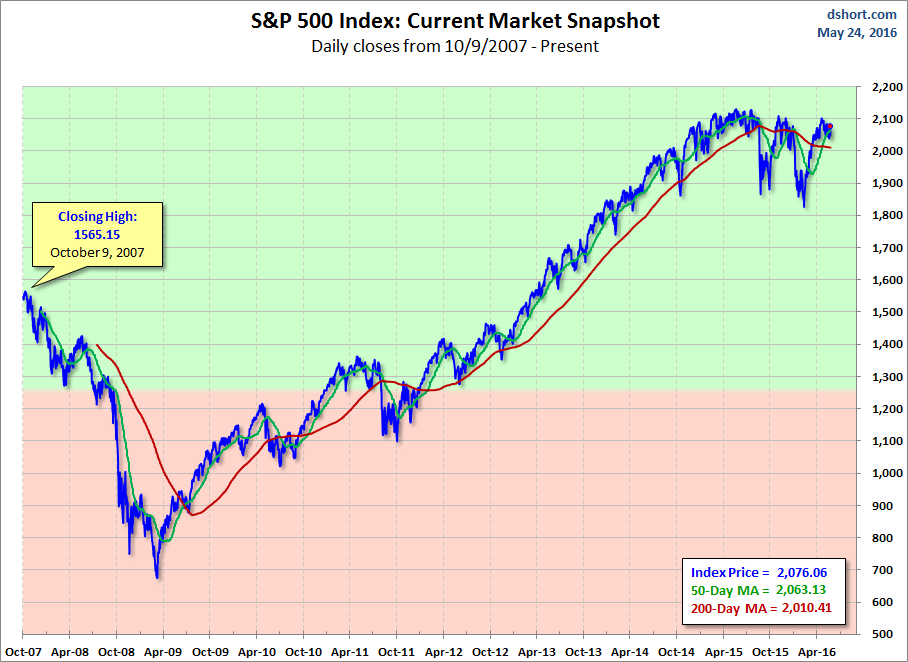

Here is a linear scale version of the same chart with the 50- and 200-day moving averages.

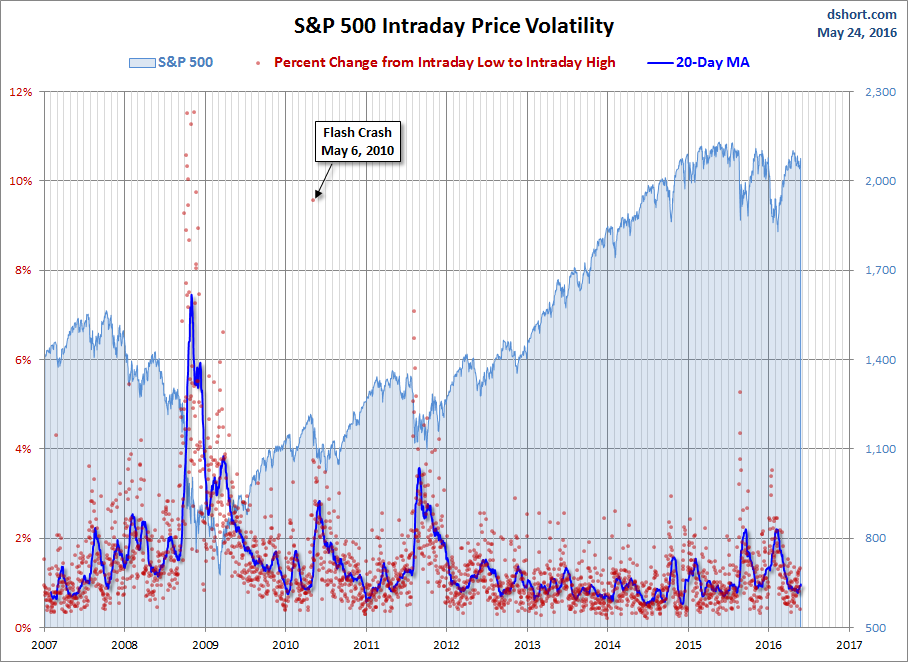

A Perspective on Volatility

For a sense of the correlation between the closing price and intraday volatility, the chart below overlays the S&P 500 since 2007 with the intraday price range. We've also included a 20-day moving average to help identify trends in volatility.