Currencies

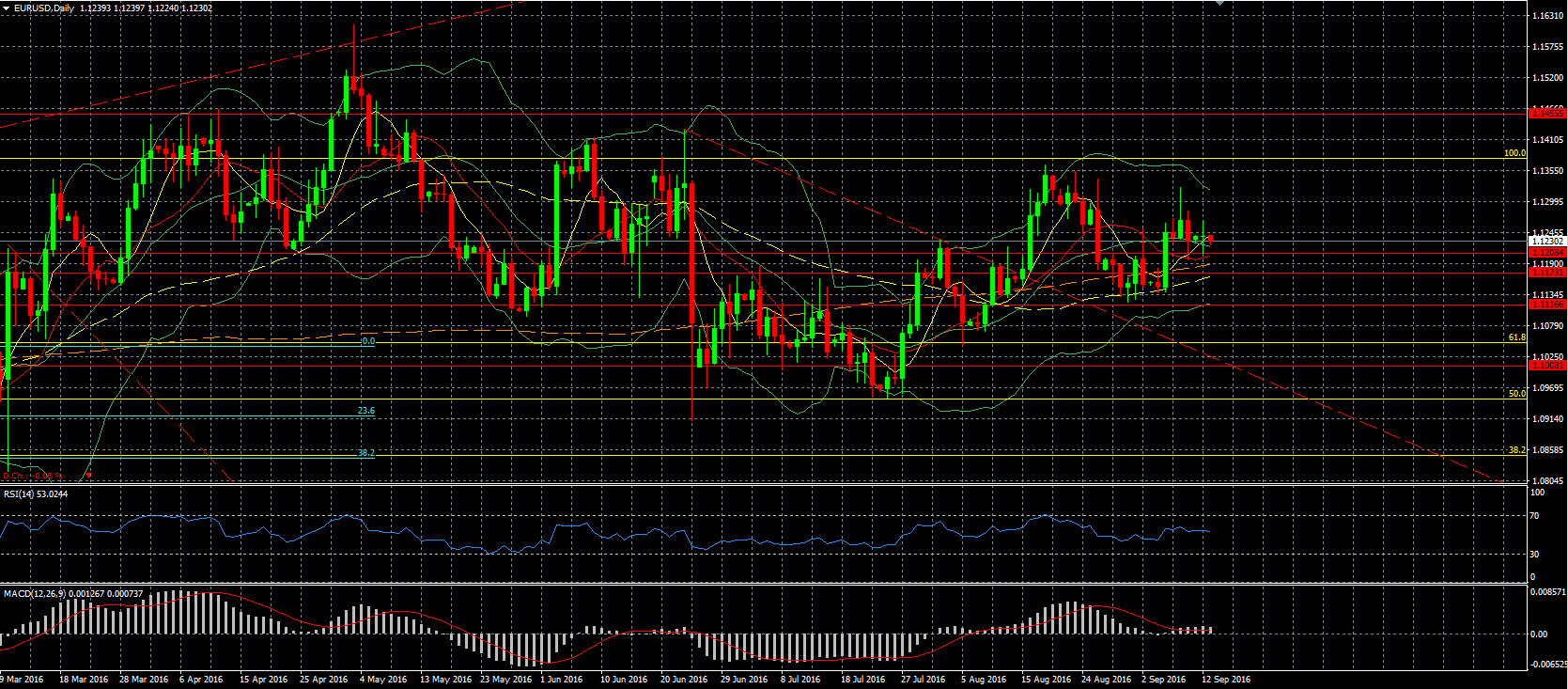

EUR/USD – tested the support around the 1.12 level again which was able to hold on before moving marginally higher. Overall the EUR was one of the few currencies where we didn’t see a large correction during the day, as the comments from the FED members were not too hawkish.

USD/JPY – moved down yesterday, even before the USD started to weaken across the board. The main reason for this is that the market was moving a bit more to safe havens due to the large drop in the equity markets Friday and yesterday morning. While the equity market corrected nicely as the day went by, the USD remained on the back foot against the JPY. This morning we are moving up again after having come close to test the support around the 101.26 level.

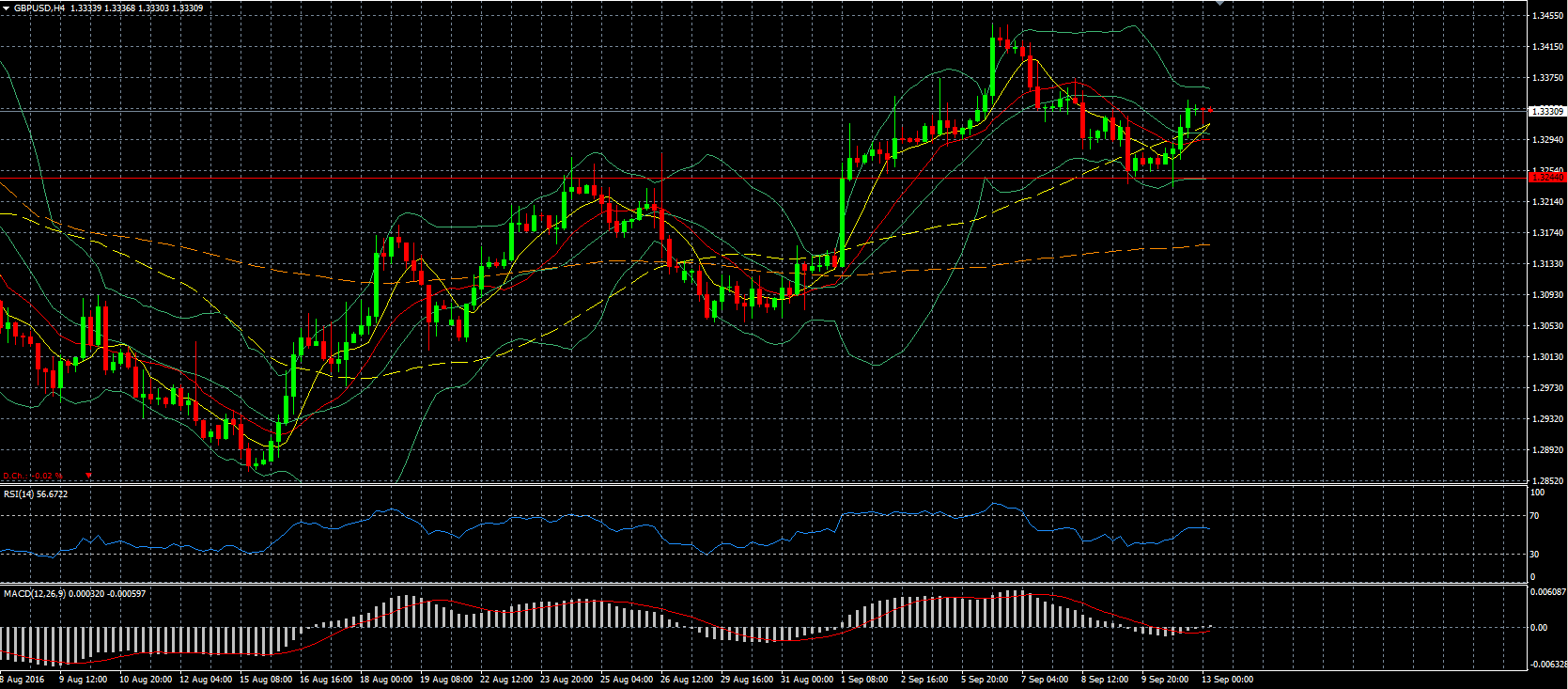

GBP/USD – for those following me on Twitter, we could see that the support around the 1.3224 level was tested a few times during the day but was able to hold firm and we subsequently moved up, especially after the comments from the FED members, which made a September move less likely.

AUD/USD – indeed dropped to the 0.75 level and while it dropped below this level for a while, if was able to bounce back, benefitting from some general weakness in the USD.

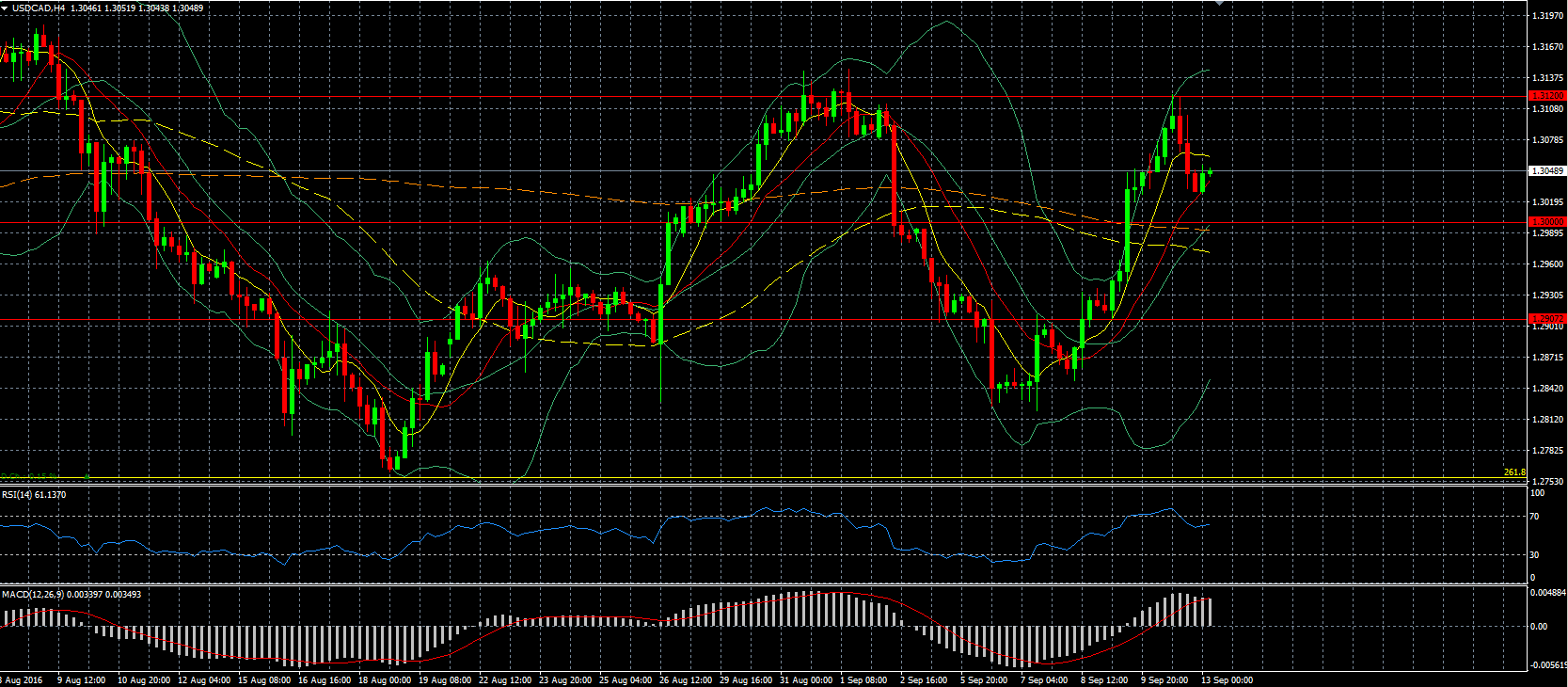

USD/CAD – reached the resistance at the 1.312 level and that is where it stopped for now. Also here, USD weakness played a part, as well as rising oil prices, even though that is a combination that happens a lot.

Indices

DAX 30 – opened lower as was expected, but was able to benefit from a change in sentiment. This morning we are expected to open lower again though, and we still have the downwards trend line to deal with obviously.

S&P 500 – was indeed able to find support around the 2100 level, and traded on this level for quite a while, but when the FED members sounded a bit less hawkish than some deem necessary for the FED to raise the interest rate this month, we saw the S&P move firmly higher and corrected a large part of the drop of Friday.

Commodities

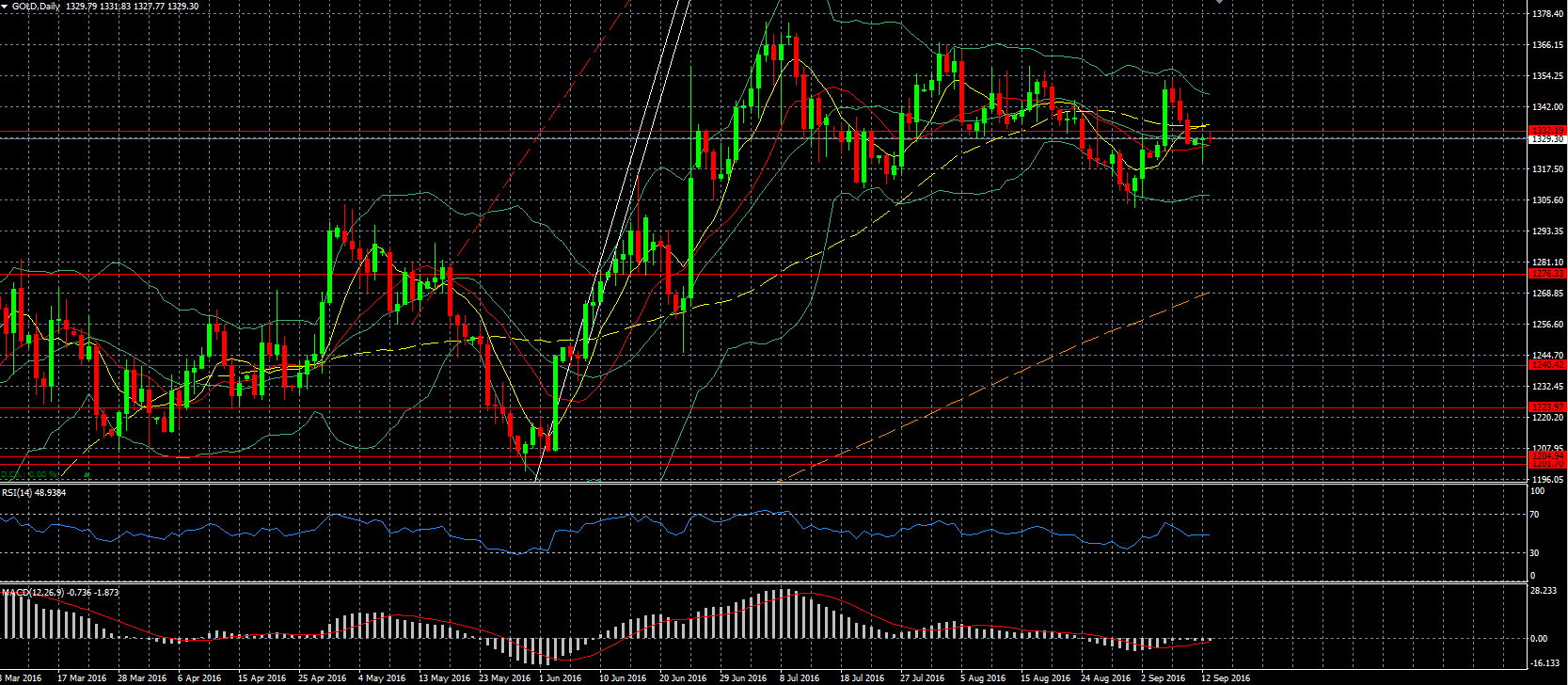

Gold – as the drop Friday was relatively muted, also yesterday the reaction was not too aggressive and we remained trading below the resistance around the 1332 level. The chance the FED will rate the interest rate next week have dropped back to 15% after the comments from the different FED members who spoke yesterday. We will not be hearing anything until the actual decision as they have now entered their blackout period ahead of the FOMC meeting.

Oil – moved down for the better part of the morning and started to move higher as the USD started to weaken more and more. In addition there are still issues in Libya where production is stalled by ongoing unrest. On the other hand, OPEC foresees also that in 2017 there will be an oversupply of the market as production from nom-OPEC countries is expected to increase.

Stocks

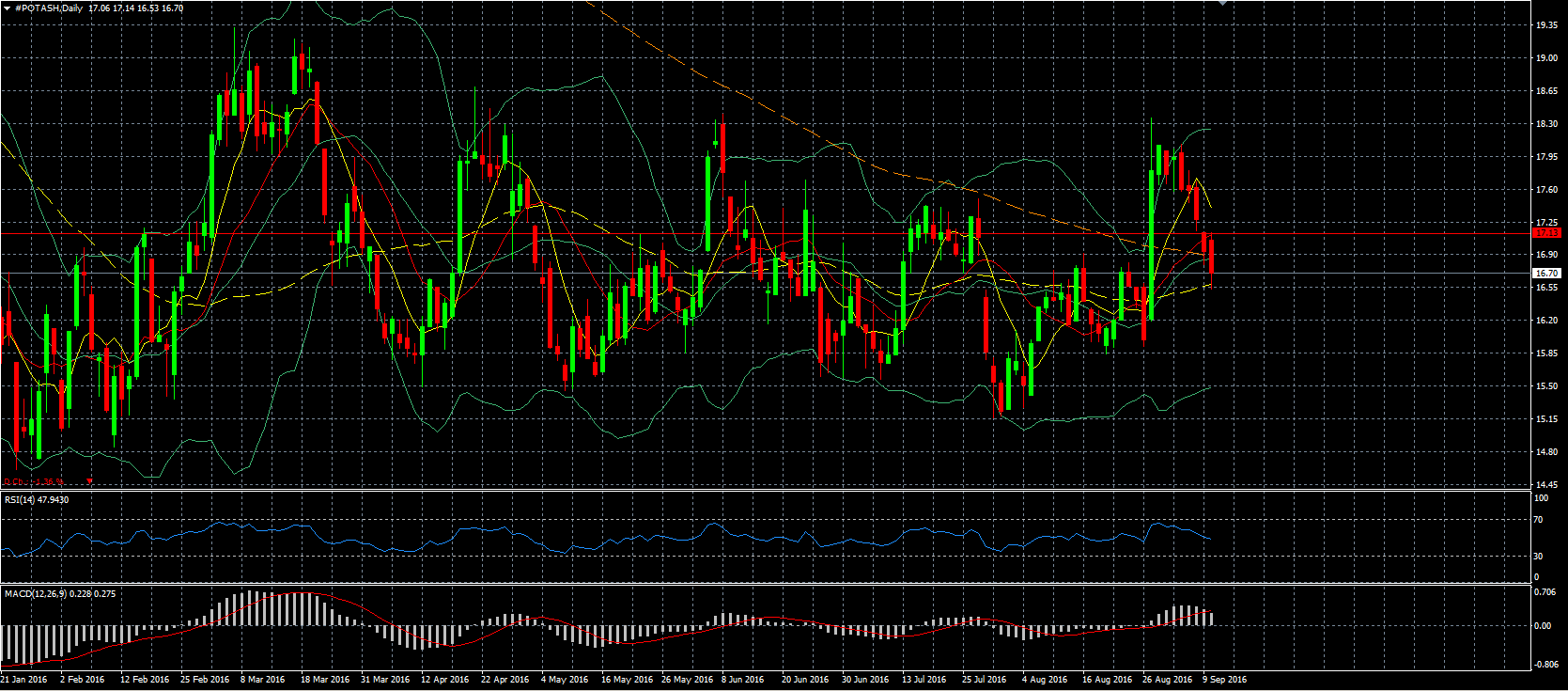

Potash – announced that the merger with Algrium is a done deal. When the possibility was first announced Potash moved up sharply, but yesterday we dropped, even as the equity market moved higher.