Centrist Emmanuel Macron, a pro-EU ex-banker and former economy minister, emerged as the leader of the first round of voting and qualified for a May 7 runoff alongside the second-place finisher, far-right leader Marine Le Pen. The “best” scenario for EURO would be: Macron wins with a comfortable margin. The “worst” scenario would be: Le Pen wins (this could happen).

On the other hand, the dollar is still in clear oversold area. The Federal Reserve is still expected to raise interest rates again this year with the rate hike likely to occur in September rather than June. We know that President Trump is comfortable with a weaker currency, but as a matter of fact, talking about growth, job creation and domestic demand, U.S. economy is the most resilient compared to that of EU and UK.

Fed Chair Janet Yellen said that the Federal Reserve's plans to raise U.S. interest rates gradually are aimed at sustaining full employment and near-2-percent inflation without letting the economy overheat.

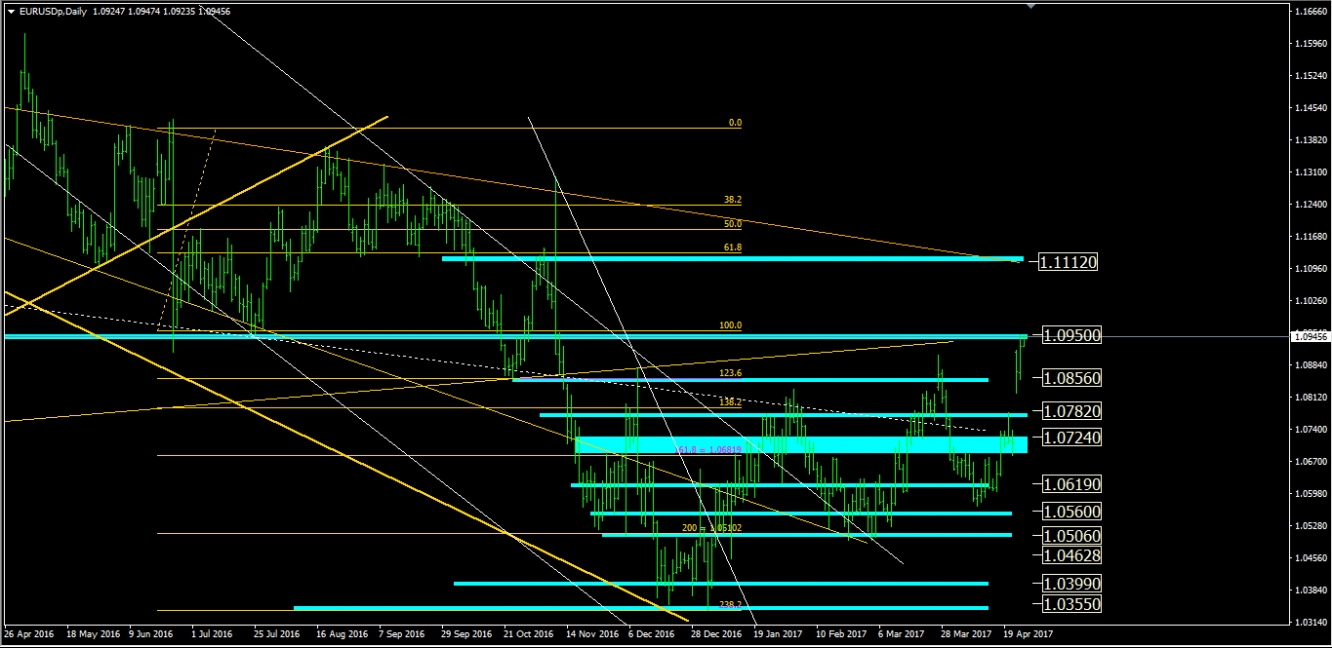

We expect a consolidation around 1.095, with possible retests of 1.085 area.

Our special Fibo Retracement is confirming the following S/R levels against the monthly and weekly trendlines obtained by connecting the relevant highs and lows back to 2012:

Weekly Trend: Overbought

1st Resistance: 1.0950

2nd Resistance: 1.1112

1st Support: 1.0856

2nd Support: 1.0782

EUR

Recent Facts:

14th of February: German GDP (Preliminary release) + German ZEW Economic Sentiment + Eurozone GDP (Preliminary release)

German GDP worse than expected, German ZEW worse than expected, Eurozone GDP worse than expected.

15th of February, Eurozone Trade Balance

Better than expected.

21st of February, German Manufacturing PMI

Better than expected.

23rd of February, German GDP

Worse than expected.

1st of March, German Manufacturing + German Unemployment Change

German Manufacturing worse than expected, German Unemployment Change better than expected.

2nd of March, Eurozone Inflation data

In line with expectations.

3rd of March, German Services PMI + Eurozone Retail Sales

Worse than expected.

7th of March, Germany Factory Orders

Worse than expected.

8th of March, German Industrial Production

Better than expected.

9th of March, ECB Interest Rate decision + ECB Press Conference

Interest Rates unchanged, ECB President Dovish (can be cut again in the future if necessary).

14th of March, German CPI + German ZEW Economic Sentiment

German CPI as expected, German ZEW worse than expected.

24th of March, German Manufacturing PMI

Significantly better than expected.

30th of March, German CPI

Lower than expected.

31st of March, German Unemployment Change + Eurozone CPI

German Unemployment Change better than expected (for the sixth time in a row), Eurozone CPI worse than expected.

3rd of April, German Manufacturing PMI

As expected.

11th of April, German ZEW Economic Sentiment

Better than expected.

21st of April, French Manufacturing PMI + German Manufacturing PMI

Better than expected.

23rd of April, French Elections (first round)

Centrist Emmanuel Macron, a pro-EU ex-banker and former economy minister, emerged as the leader of the first round of voting and qualified for a May 7 runoff alongside the second-place finisher, far-right leader Marine Le Pen.

24th of April, German Ifo Business Climate

Better than expected.

USD

Recent Facts:

2nd of December: Nonfarm Payrolls + Unemployment Rate

Better than expected.

27th of January, GDP + Durable Good Orders

GDP Significantly worse than expected, Durable Good Orders as expected.

1st of February, ADP Nonfarm Unemployment Change + U.S. Institute for Supply Management Manufacturing

Better than expected (ISM Manufacturing at its highest level since November 2014).

3rd of February, Nonfarm Payrolls + Unemployment Rate

Nonfarm Payrolls better than expected, Unemployment Rate worse than expected.

14th of February, Producer Price Index (PPI)

Better than expected.

15th of February, Core CPI (Consumer Price Index) + Retail Sales

Better than expected.

16th of February, Building Permits + Initial Jobless Claims + Philadelphia Fed Manufacturing Index

Better than expected.

21st of February, Manufacturing PMI + Services PMI

Worse than expected.

27th of February, Core Durable Good Orders + Pending Home Sales

Worse than expected.

28th of February, GDP (Preliminary release)

Worse than expected.

3rd of March, ISM Non-manufacturing PMI + Fed Chair Yellen Speech

ISM Non-manufacturing PMI better than expected, Yellen noted that a rate increase at next meeting "would likely be appropriate" insisting on the condition that data on employment and inflation have to move in line with expectations.

8th of March, ADP Nonfarm Employment Change

Better than expected.

10th of March, Nonfarm Payrolls + Unemployment Rate

Better than expected.

14th of March, Producer Price Index

Higher than expected.

15th of March, Core CPI + Retail Sales

As expected.

15th of March, FOMC Economic Projections + FOMC Statement + Fed Interest Rate Decision + FOMC Press Conference

The Federal Reserve increased interest rates by 0.25% to a 0.75-1% range. Dovish speech of Chairwoman Yellen.

16th of March, Building Permits + Philadelphia Fed Manufacturing Index

Building Permits worse than expected, Philadelphia Fed Manufacturing better than expected.

24th of March, Core Durable Goods Orders

Worse than expected.

24th of March, Manufacturing PMI + Services PMI (preliminary release)

Worse than expected (4th time in a row).

28th of March, Conference Board Consumer Confidence

Better than expected (the highest since December 2000).

30th of March, GDP

Better than expected.

5th of April, ADP Nonfarm Employment Change + ISM Non-Manufacturing Employment + ISM Non-Manufacturing PMI

ADP Nonfarm Employment Change better than expected.

ISM Non-Manufacturing Employment + ISM Non-Manufacturing PMI worse than expected.

7th of April, Nonfarm Payrolls + Unemployment Rate

Nonfarm Payrolls worse than expected, Unemployment Rate better than expected.

14th of April, Core CPI + Retail Sales

Core CPI (Inflation) lower than expected.

Retail Sales worse than expected.

20th of April, Philadelphia Fed Manufacturing Index

Worse than expected.

25th of April, New Home Sales + CB Consumer Confidence

New Home Sales better than expected, CB Consumer Confidence worse than expected.

Even though retail sales fell sharply in March, data in general has been relatively healthy, allowing GBP to recover from its lows following the report. That said, the softness in retail sales and trade points to a weaker first-quarter GDP report.

Some unresolved tension with Scotland and Northern Ireland, which voted against leaving the EU. May provided no clear plan about the comprehensive “free-trade” partnership with EU members she wants to achieve.

Sterling jumped as Theresa May called for early general elections on June 8. She said Britain needed a strong and stable leadership going into Brexit talks and beyond.

UK Job Market with stable Unemployment Rate but toughly increasing Job Claimants.

UK Inflation Data on the upbeat while last Manufacturing Production data and Trade Balance were below expectations.

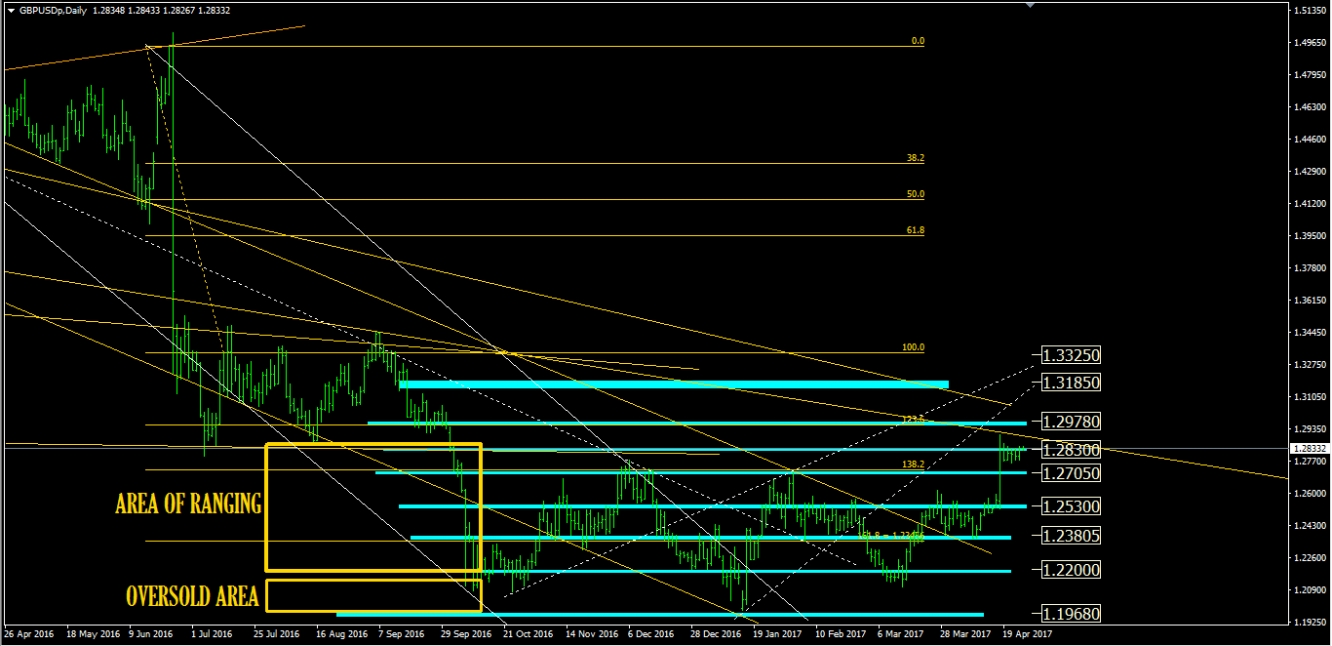

Now market is ranging between 1.253 and 1.283 levels, in general overbought setup waiting for the news and events scheduled next days which we think will push price down to 1.26 back again.

Our special Fibo Retracement is confirming the following S/R levels against the monthly and weekly trendlines obtained by connecting the relevant highs and lows back to 2001:

Weekly Trend: Overbought

1st Resistance: 1.2830

2nd Resistance: 1.2978

1st Support: 1.2530

2nd Support: 1.2380

GBP

Recent Facts:

4th of August, Bank of England Interest Rates decision (expected a cut)

Bank of England lowers Interest Rates as expected (record low of 0.25%) and increases purchase program.

20th of January, Retail Sales

Worse than expected.

26th of January, GDP (Preliminary release)

Better than expected.

1st of February, UK Manufacturing PMI

As expected.

2nd of February, Construction PMI

Worse than expected.

3rd of February, Services PMI

Worse than expected.

10th of February, Manufacturing Production

Better than expected.

14th of February, Consumer Price Index (CPI)

Worse than expected.

15th of February, Job Market

Better than expected.

17th of February, Retail Sales

Worse than expected.

1st of March, Manufacturing PMI

Worse than expected.

2nd of March, Construction PMI

Better than expected.

3rd of March, Services PMI

Worse than expected.

10th of March, Manufacturing Production + Trade Balance

UK Manufacturing Production worse than expected, Trade Balance better than expected.

15th of March, Job Market

Better than expected.

16th of March, Interest Rates Decision + BoE Meeting Minutes

A Bank of England policymaker unexpectedly voted to raise interest rates.

21st of March, CPI

CPI higher than expected.

23rd of March, Retail Sales

Better than expected.

31st of March, GDP YoY

Worse than expected.

3rd of April, Manufacturing PMI

Worse than expected.

5th of April, Services PMI

Better than expected.

7th of April, Manufacturing Production

Worse than expected.

11th of April, UK CPI

Higher than expected.

12th of April, UK Job Market

Worse than expected.

21st of April, UK Retail Sales

Worse than expected.

USD

Recent Facts:

See above.

Australian consumer prices lower than expected.

AUD struggled on the back of dovish RBA minutes and lower copper prices. Because of volatility, the central bank wanted to look past the healthier jobs report.

New Zealand Consumer Price Index revealed a higher than expected inflation. China Industrial Production, far above expectations, drove YoY GDP to +6.9% (better than +6.8% Expectations).

Australia Employment Change growing higher than expected.

Last reading of China Inflation data is lower than expected with Chinese factory activity growing at fastest pace in nearly 5 years.

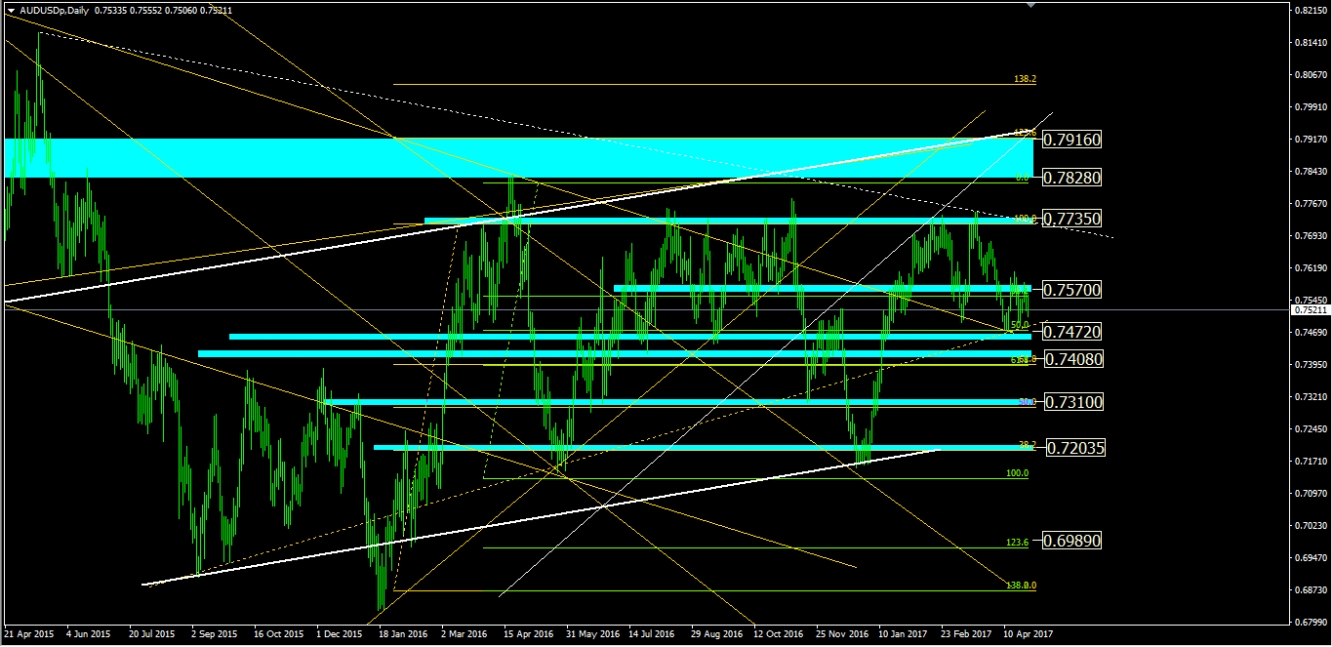

As we wrote in the previous commentaries, 0.757 area is an important resistance. A definitive break of it would lead price up to 0.77 area. Failure to break it would lead price down to 0.746 area.

Our special Fibo Retracements are confirming the following S/R levels against the monthly and weekly trendlines obtained by connecting the relevant highs and lows back to 2012:

Weekly Trend: Neutral

1st Resistance: 0.7570

2nd Resistance: 0.7735

1st Support: 0.7472

2nd Support: 0.7408

AUD

Recent Facts:

1st of November, RBA Interest Rates Statement

RBA’s Governor Lowe signals tolerance for weak inflation and bets seem off for future rate cuts.

3rd of November, RBA Monetary Policy Statement + Retail Sales

RBA said it is focused on the medium-term inflation target.

Retail Sales better than expected.

8th of November, ELECTION OF THE 45th PRESIDENT OF THE UNITED STATES

Donald Trump elected President.

9th of November, Reserve Bank of New Zealand Interest Rate Decision + Monetary Policy Statement

Interest Rates cut to 1.75% from 2.00% as expected.

19th of December, Mid-Year Economic and Fiscal Outlook

Scott Morrison announced lower than an original prediction of A$37.1 billion, investors see it as promising to stave off a downgrade of its AAA (triple A) rating from S&P Global.

9th of January, Retail Sales

Worse than expected.

19th of January, Employment Change

Better than expected.

25th of January, CPI (Consumer Price Index measures the change in the price of goods and services from the perspective of the consumer)

Lower than expected.

1st of February, AIG Manufacturing Index

Worse than expected.

2nd of February, Building Approvals + Trade Balance

Better than expected.

7th of February, RBA Interest Rates Decision + RBA Rate Statement

RBA held steady as expected at a record low 1.50%, while noting better economic conditions with China.

8th of February, New Zealand Interest Rate Decision + RBNZ Monetary Policy Statement

Interest Rates unchanged and RBNZ’s agenda contains no changes for 2017.

16th of February, Employment Change

Better than expected.

28th of February, New Home Sales, Current Account, Private Sector Credit.

1st of March, Australia GDP

Better than expected.

16th of March, Employment Change + Unemployment Rate

Worse than expected.

2nd of April, Retail Sales

Worse than expected.

4th of April, RBA Interest Rate Decision

Interest Rates unchanged, as expected. Dovish tone in Philip Dowe’s Speech.

9th of April, Home Loans

Worse than expected.

13th of April, Australia Employment Change

Better than expected.

18th of April, RBA Meeting Minutes

Dovish.

26th of April, Australia CPI

Lower than expected.

USD

Recent Facts:

See above.