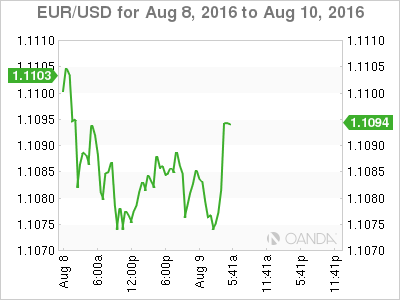

After sharp losses late last week, the euro has looked listless in the past two sessions. On Tuesday, EUR/USD is trading at 1.1070. In economic news, there are major events on the schedule. Germany’s trade surplus narrowed to EUR 21.7 billion, marking a four-month low. In the US, we’ll get a look at additional employment numbers, with the release of Preliminary Unit Labor Costs. The US will also publish Preliminary Nonfarm Productivity, a consumer inflation indicator.

Eurozone manufacturing indicators started the week on a positive note. German Industrial Production posted a gain of 0.8% in June, rebounding after a sharp decline of 1.3% in the previous release. This figure was just shy of the forecast of 0.9%.However, manufacturing numbers were soft on Friday. German Factory Orders, an important indicator, continues to struggle and dropped 0.4% in June, compared to an estimate of +0.5%. The indicator has managed just one gain so far in 2016, pointing to continuing weakness in the manufacturing sector. Italian Industrial Production followed suit with a decline of 0.4%, well short of the estimate of +0.3%. The manufacturing sector has been hit hard by weak global demand, and the economic instability caused by Britain’s decision to leave the EU could take a further toll on the Eurozone economy.

US employment numbers sparkled on Friday, led by Nonfarm Employment Change. The July report surprised the markets with a huge gain of 255 thousand, crushing the estimate of 180 thousand. This release follows the outstanding June reading of 280 thousand. US wage growth has been a soft spot in the robust labor market, but there was positive news as Average Hourly Earnings gained 0.3%, edging above the forecast of 0.2%. As well, Unemployment Claims remained steady at 4.9%. What will the Federal Reserve do with these numbers? Prior to the payrolls release, a September hike was virtually off the table, especially in light of the soft US GDP report in late July. The Fed has made no secret of the fact that any rate move will be data-dependent, and the stellar job numbers will force to Fed to give serious thought to a move in September. Employment and inflation releases in the next few weeks will be critical factors in determining if the Fed makes a move next month, or revisits the rate question in December.

EUR/USD Fundamentals

Tuesday (August 9)

- 6:00 German Trade Balance. Estimate 23.2B. Actual 21.7B

- 6:45 French Government Budget Balance. Estimate -61.8B

- 10:00 US NFIB Small Business Index. Estimate 94.5

- 12:30 US Preliminary Nonfarm Productivity. Estimate 0.5%

- 12:30 US Preliminary Unit Labor Costs. Estimate 1.8%

- 14:00 US IBD/TIPP Economic Optimism. Estimate 46.2

- 14:00 US Wholesale Inventories. Estimate 0.0%

* Key releases are in bold

*All release times are GMT

EUR/USD for Tuesday, August 9, 2016

EUR/USD August 9 at 8:10 GMT

Open: 1.1085 High: 1.1094 Low: 1.1069 Close: 1.1091

EUR/USD Technical

| S1 | S2 | S1 | R1 | R2 | R3 |

| 1.0821 | 1.0925 | 1.1054 | 1.1150 | 1.1278 | 1.1376 |

- EUR/USD has been flat in the Asian and European sessions

- 1.1054 is a weak support line. It could break during the Tuesday session

- There is resistance at 1.1150

Further levels in both directions:

- Below: 1.1054, 1.0925 and 1.0821

- Above: 1.1150, 1.1278, 1.1376 and 1.1467

- Current range: 1.1054 to 1.1150

OANDA’s Open Positions Ratio

EUR/USD ratio is unchanged on Tuesday, consistent with the lack of movement from the pair. Short positions have a strong majority (57%), indicative of trader bias towards EUR/USD breaking out and moving to lower levels.