Monday/Tuesday:

Heading into the US Federal Reserve’s interest rate decision, we were watching this key USD/JPY resistance level:

USD/JPY Daily:

With the interest rate hike fully priced in, it was always going to be about the Fed’s expectations for monetary policy heading into 2017. With price at a major resistance level and starting to reject, we were looking to make a play at selling some intra-day weakness.

The hourly chart in Tuesday’s blog above shows the clear risk profile we had set up.

USD/JPY Daily:

As we now know, the Fed raised rates and most importantly, forecast three more hikes in 2017. Much higher than the market had expected and with this misalignment of expectation came the repricing to the upside and blew our setups away.

Wednesday:

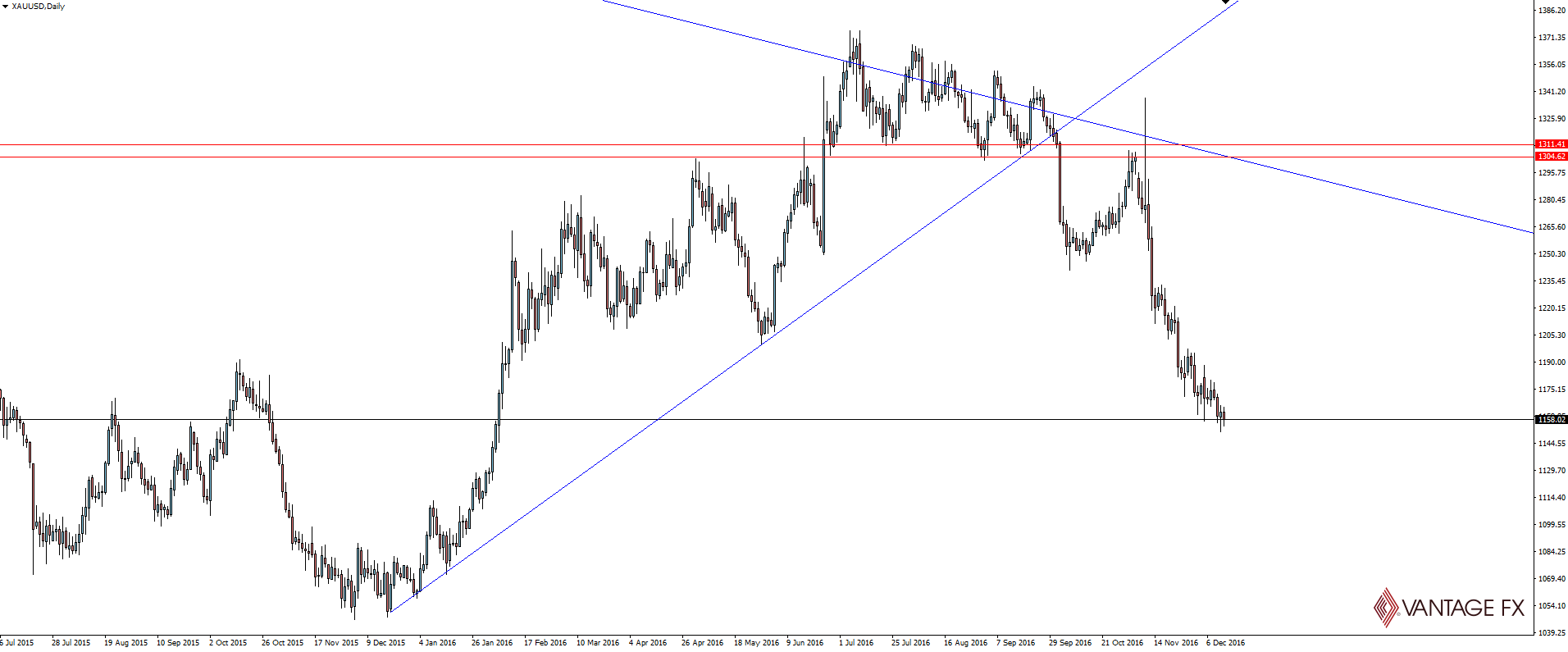

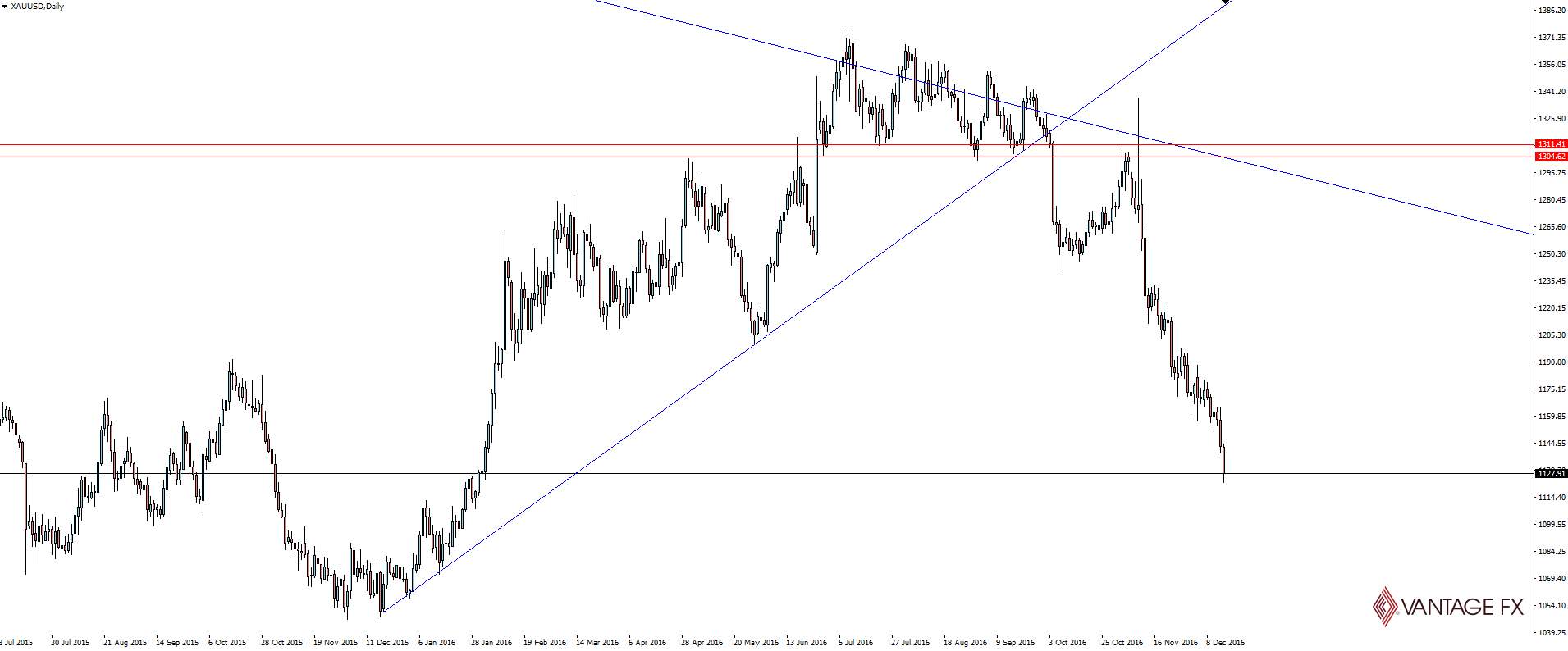

Wednesday’s blog took a bigger picture view at how far gold has fallen over the last few months:

XAU/USD Daily:

This wasn’t a specific trading setup but more of a post to highlight just how decimated gold has been and still how far between major higher time frame levels price still is.

XAU/USD Daily:

Again, same story as above where the Fed shocked the market by giving an expectation for three more hikes in 2017 and gold continued to be smashed as a result.

Still nowhere near those daily swing lows either. Commodities sure do know how to trend!

Thursday:

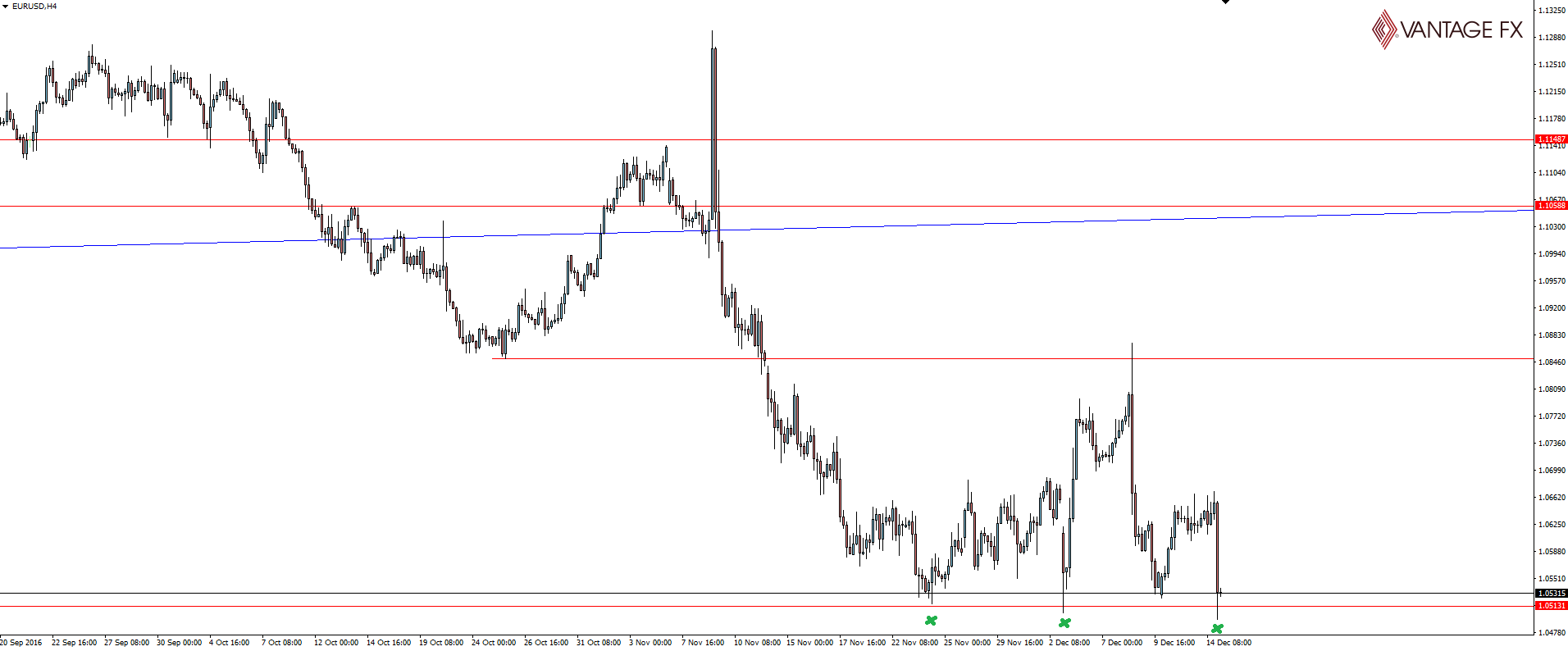

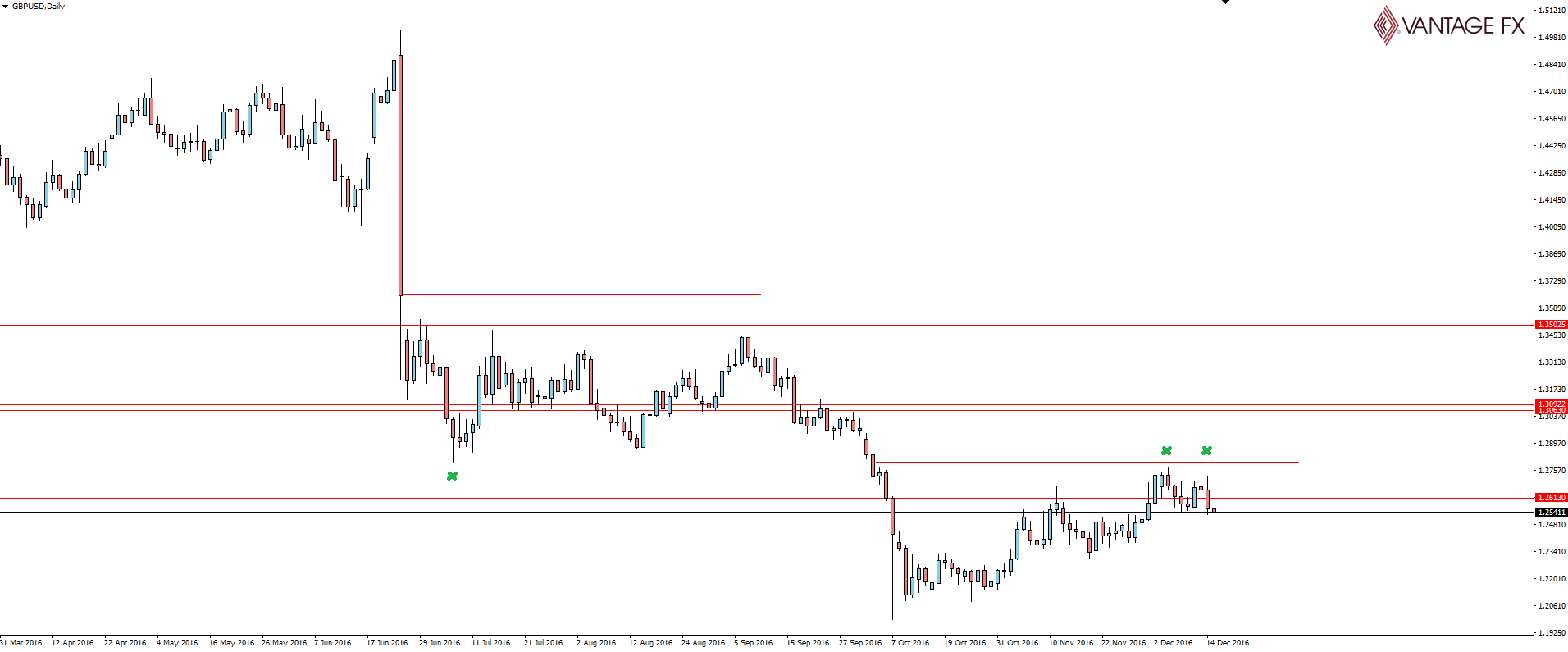

Thursday’s blog was a continutation of last week’s USD recap post that focused on the fallout from the Fed rate hike in the Forex majors.

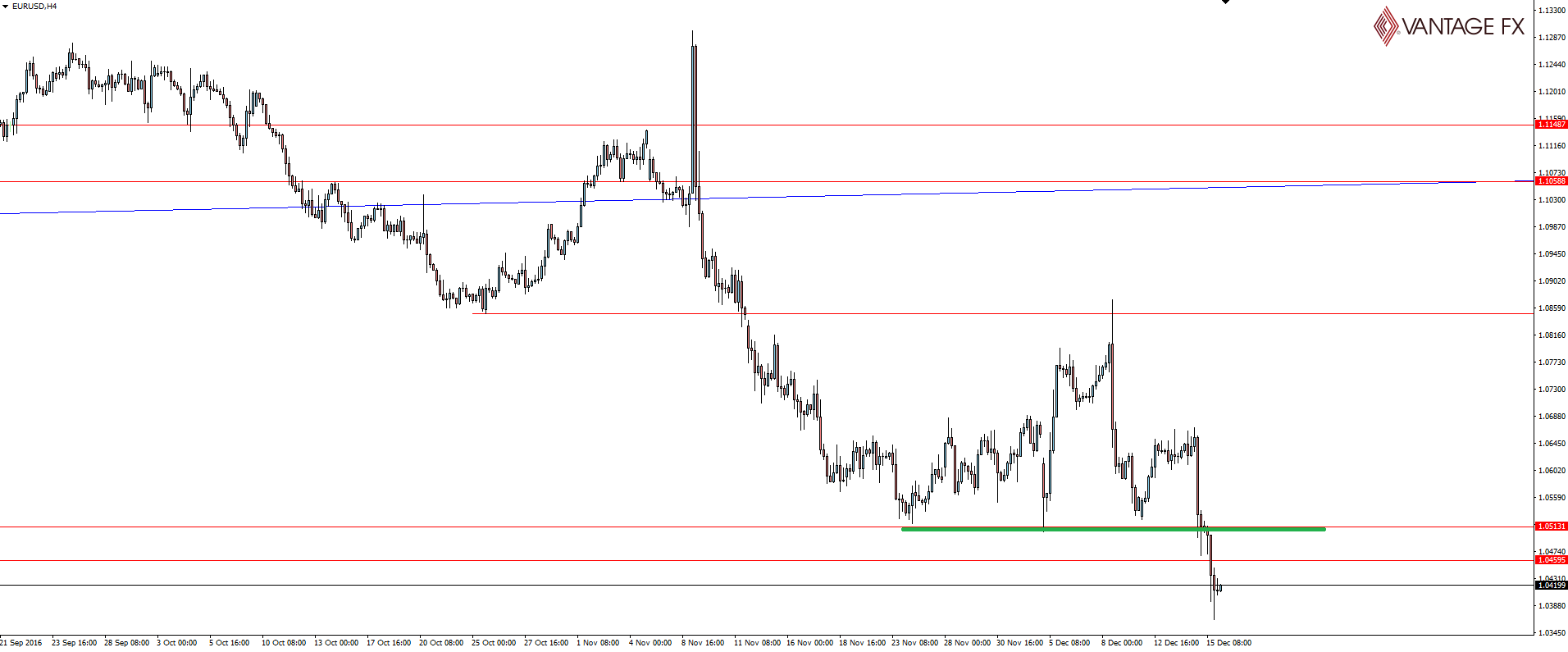

EUR/USD 4 Hour:

GBP/USD Daily:

With the US dollar continuing to rip faces off as it pushes higher, Cable and Fiber of course are getting smashed.

EUR/USD 4 Hourly:

I’ve featured EUR/USD here because that support level had no chance of holding and we’ve seen some nice follow through in the intraday price action throughout yesterday and today.

Risk Disclosure: In addition to the website disclaimer below, the material on this page prepared by Forex broker Vantage FX Pty Ltd does not contain a record of our prices or solicitation to trade. All opinions, forex news, research, tools, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently, any person acting on it does so entirely at their own risk. The expert writers express their personal opinions and will not assume any responsibility whatsoever for the Forex account of the reader. We always aim for maximum accuracy and timeliness, and FX broker Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.