The US dollar ripped sharply higher today following the Federal Reserve’s decision to raise interest rates.

While the hike wasn’t a surprise to markets, it was the forecast of THREE more rate hikes throughout 2017 that put a rocket under the buck.

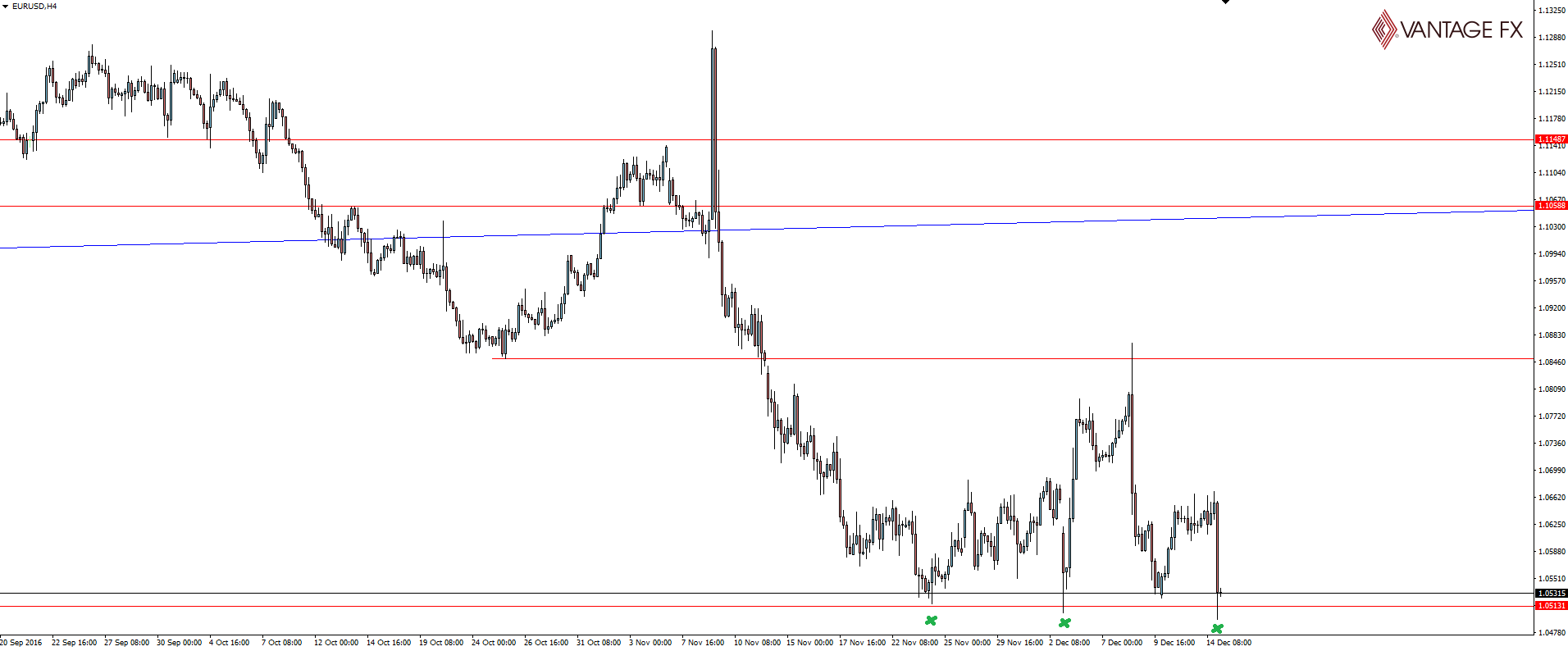

Last week we spoke about EUR/USD reversing out of support and approaching its first point of significant resistance.

Price rejected the level hard and already we’re back to the lows.

EUR/USD 4 Hourly:

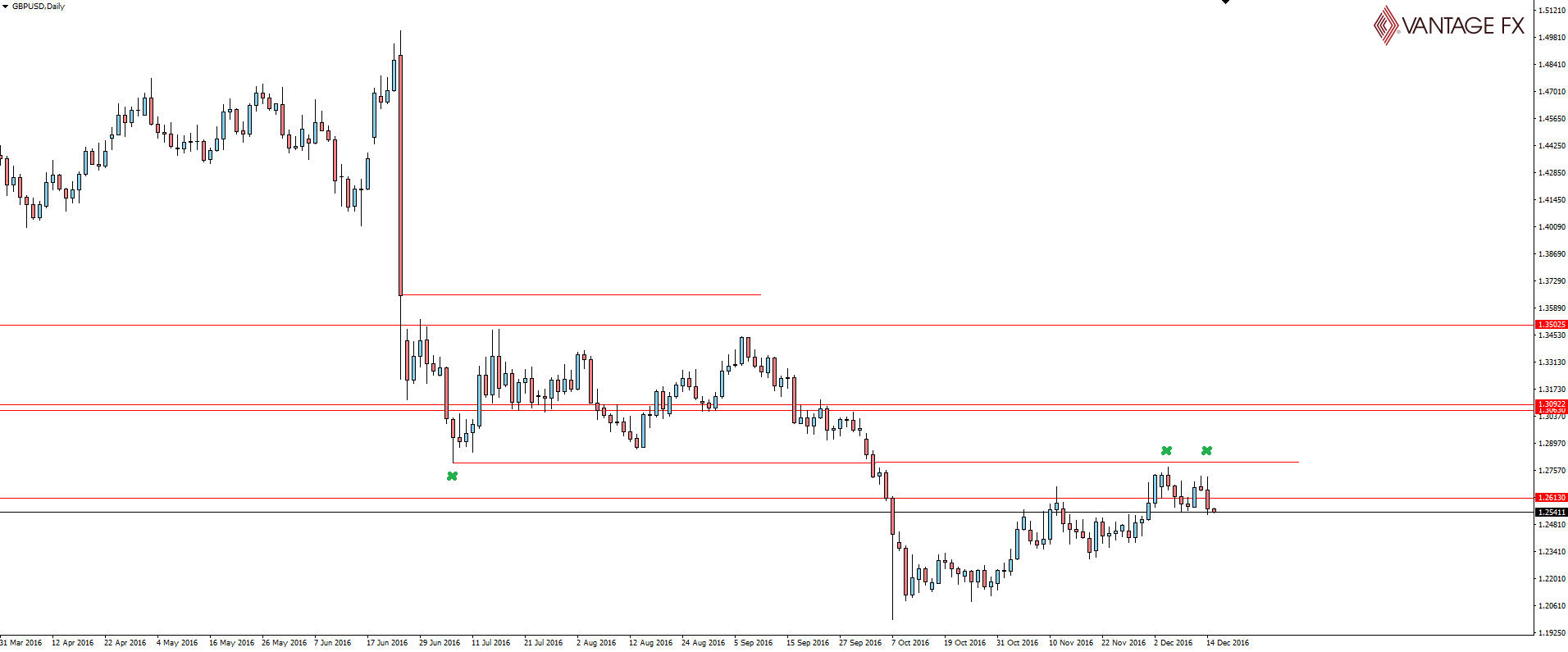

At the same time, we had GBP/USD also at resistance.

But after a second push up into the supply zone we identified, it was once again goodnight to the bulls as price couldn’t make any significant higher high.

GBP/USD Daily:

With the US dollar trading sharply higher following today’s Fed interest rate hike and 2017 projections, these levels these two pairs are very much in play.

GBP/USD’s risk is more clearly defined, having just rejected out of the resistance zone, but EUR/USD could easily see stops start to be triggered if it breaks that low.

Risk Disclosure: In addition to the website disclaimer below, the material on this page prepared by Forex broker Vantage FX Pty Ltd does not contain a record of our prices or solicitation to trade. All opinions, forex news, research, tools, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently, any person acting on it does so entirely at their own risk. The expert writers express their personal opinions and will not assume any responsibility whatsoever for the Forex account of the reader. We always aim for maximum accuracy and timeliness, and FX broker Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.