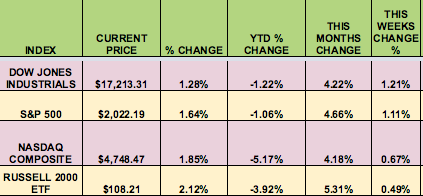

Markets: The market put together a rally this week, (4th in a row for the S&P - 1st time since May ’13), spurred on by more ECB stimulus, and, you guessed it, rising crude oil prices. All 4 indexes rallied, with DOW and S&P 500 large caps leading the way.

Dividend Stocks Update: These high dividend stocks go ex-dividend this coming week: NASDAQ:NEWT, NYSE:LVS, NYSE:RWT, NASDAQ:POPE, NYSE:SFL, NASDAQ:HCAP, NYSE:NMFC, NASDAQ:TCPC, NYSE:GEF, NASDAQ:PNNT, NYSE:VGR, NASDAQ:GAIN, NASDAQ:GLAD, NASDAQ:GOOD, NASDAQ:LAND.

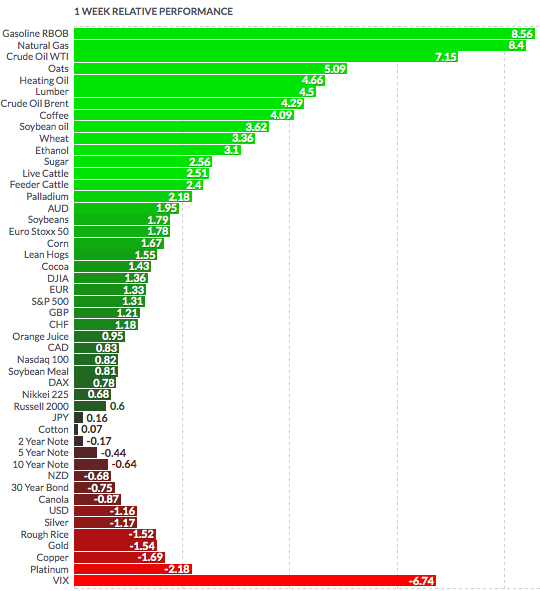

Volatility: The VIX fell 2% this week, finishing at $16.50.

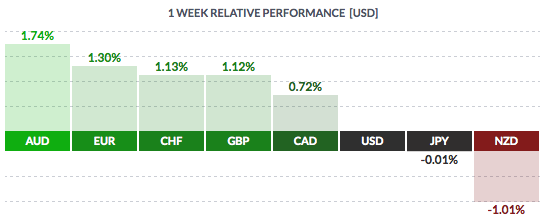

Currency: The US dollar fell this week vs. most major currencies, except the NZ dollar.

Market Breadth: 19 of the DOW 30 stocks rose this week, vs. 23 last week. 71% of the S&P 500 rose this week, vs. 80% last week.

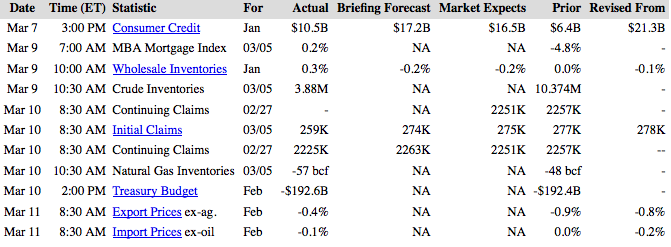

US Economic News: Initial Claims were less than expected this week…the Mortgage Applications Index was up. Import Prices fell again.

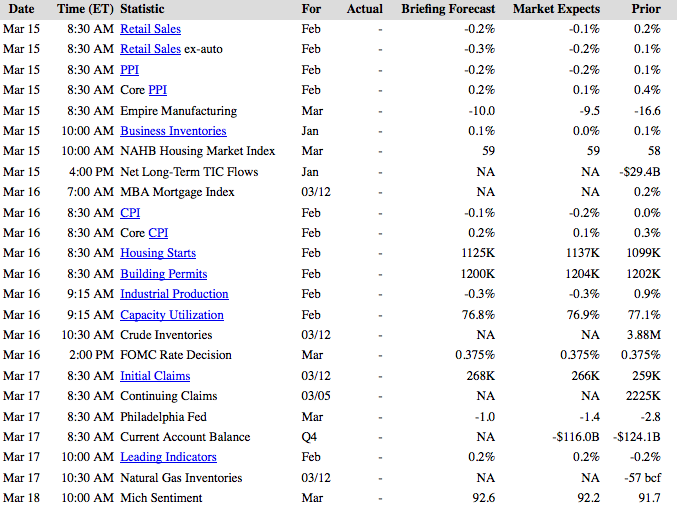

Week Ahead Highlights: All eyes will be on the Fed next Tues.-Wed., as they meet to determine if they’ll raise interest rates. The market currently isn’t expecting a March rate hike. It’ll also be a heavy data week, with many economic reports due out. In addition, Friday is options expiration day for March monthly options.

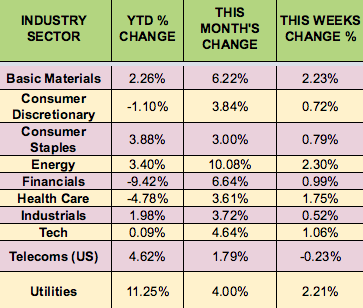

Sectors and Futures:

A mixed group – Energy, Basic Materials, and Utilities led this week, as Telecoms were down slightly.

Gasoline, Natgas and Crude Futures led this week, with Platinum trailing: