There was some follow through to Monday's buying, but resistance wasn't breached in newly defined channels and wedges. Will there be a 'sell the news' event later today once the election result is official?

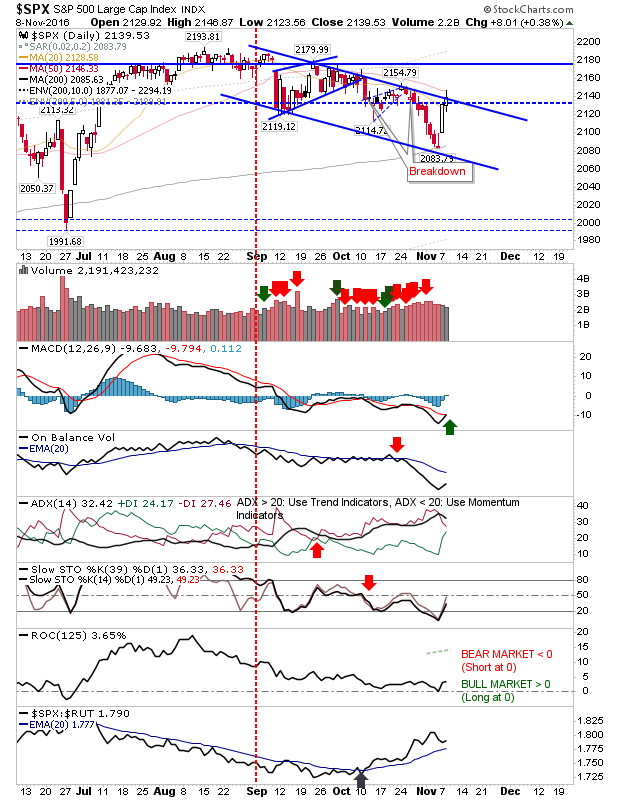

The S&P 500 tagged its 50-day MA before it came back to rest under declining channel. Volume dropped for a second day, but there was a MACD trigger 'buy'.

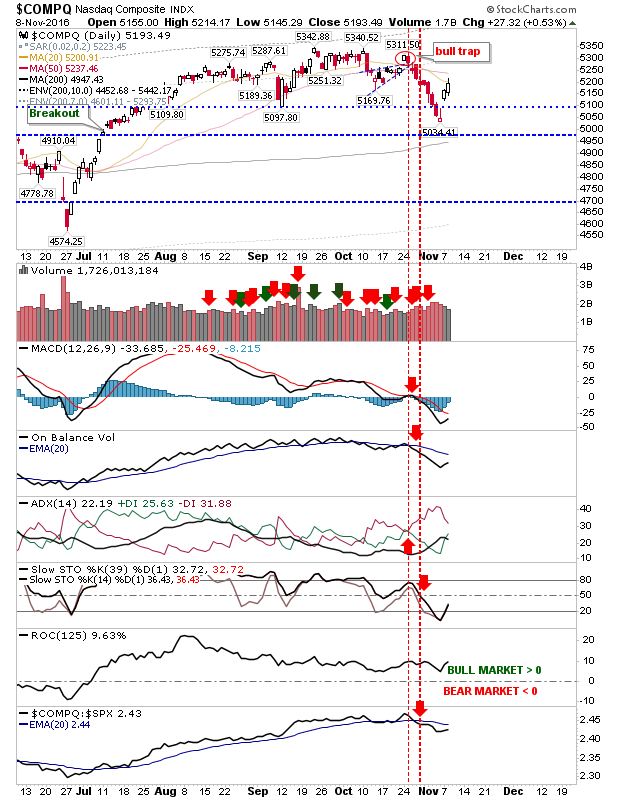

The NASDAQ Composite is back inside prior congestion where things could get tricky for bulls. Watch for a tag of the 50-day MA, this might be the cue for a short position.

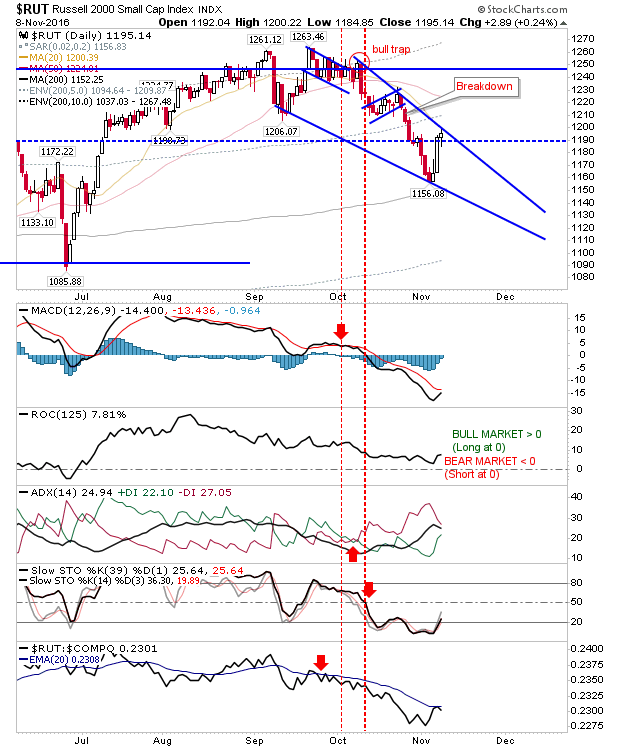

The Russell 2000 also finished at wedge resistance. However, this downward angled wedge is typically bullish, so confirmation of the election result might be enough to deliver an upside breakout.

Obama's election was followed by a sell-off. A Trump election would certainly see a sell off, but even a Clinton victory might see some buyers remorse and a little easing of the gains over the past couple of days. Real upside momentum will only kick in if new 52-week highs can be posted, taking markets beyond the levels traded during the summer doldrums.