Post-Brexit rebound sentiment continued on Friday, with the markets pricing for aggressive Central Bank easing.

Spurred on by comments from the Bank of England’s Governor, Mark Carney, who said “The economic outlook has deteriorated, and some monetary policy easing will likely be needed over the summer,” the market is speculating that easing may come as early as July.

Additionally, the ECB mentioned it is considering a departure from the capital key rules that govern its QE Bond purchases, which would open up the doors to buy back more peripheral bonds, significantly increasing Bond Purchase value.

Brexit fallout also has considerably reduced the chances of Fed tightening and simultaneously increased the likelihood of concerted easing policies from the BOE, ECB and the BOJ.

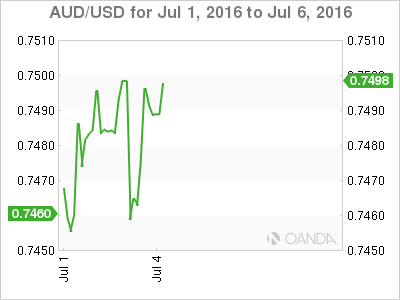

Australian Dollar - Political Jockeying Begins

The AUD is trading well as effervescent equity markets surge, supporting the Australian dollar. While the US dollar was under some end-of-week pressure due to falling US bond yields, the AUD is well supported and may continue to outperform in the short term.

Even weak China PMI data did not derail the Australian dollar bulls last week, and traders remain squarely focused on Central Bank stimuli. Given the AUD’s resilience of late, the currency should continue to be a favored oasis, especially versus the GBP and EUR.

It is likely the AUD was held back last week in anticipation of the weekend elections and the RBA meeting tomorrow. This morning the AUD opened sharply lower, dropping close to half a cent after Saturday’s election pointed to a potential political bottleneck.

Without a clear winner in the Australian elections, an impending minority government weighs heavily on investor sentiment. Minority governments tend to be challenging when it comes to tabling much needed economic or budget policy.

In reality, however, it is unlikely to create near-term credit rating concerns and, as history suggests, election-related currency moves tend to be short-lived, so buying the AUD dip on a minority government outcome will probably pick up steam, in particular against the euro and pound.

Given that risk assets have responded well, the RBA will probably hold off on a rate cut until at least August. With no real urgency to cut at this point, the RBA will probably keep its options open, in spite of the political uncertainty. A rate cut at this juncture will confuse the markets.

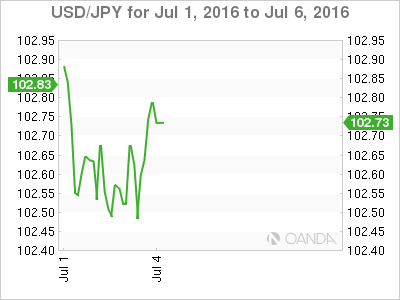

JPY - Show Me the Money

Pressure continues to mount on the Bank of Japan. Last week’s economic data indicated that every metric is working counter to the BoJ’s expectations. The CPI is not responding to recent stimuli, and inflation is running at decade lows, so expectations are high that the BoJ will provide additional stimulus.

The Japanese economy is beyond stagnating and extremely susceptible to any breakdown emanating from Brexit fallout, underscoring market expectations for additional stimulus actions.

In early trade today, the USD/JPY feels tired. Battered back and forth from Brexit fallout to threats of BoJ interventions, barring any unexpected shifts, I expect USD/JPY to consolidate within near-term ranges, as the focus reverts to the US jobs market this week. Speculation is mounting for a recovery in the US jobs data after last month’s NFP fail, which could lend USD support to the JPY.

The Nikkei opened slightly lower this morning, as the BOJ Tankan survey indicated that Japanese companies expect consumer prices only to rise .7 percent this year, lower than the previous survey. This simply magnifies the economic drag on Japan’s economy and just how cautious Japanese companies are.

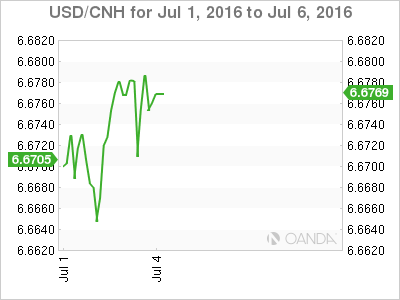

Yuan - More Weakness to Come

Traders are speculating that the Chinese authorities will let the yuan continue to weaken, as a higher level of economic uncertainty kicks in. In the wake of Brexit, the PBOC continues to pass through all of the USD moves.

While the relative calm surrounding the recent RMB depreciation is surprising, I suspect it has more do with larger market musing, distracting attention away from the move. Perhaps too, because the PBOC has actively given greater transparency to its policy objectives, the market is unsurprised.

I expect that China will face additional economic headwinds from the Brexit fallout, so we should expect further yuan weakness throughout 2016. There is also a risk of further EUR weakness, which from a trading perspective, will continue to trigger USD demand.

USD-Asia - Chase for Yield

Investors are flooding back into USD-Asia, reversing pre-Brexit safe havens hedges in favor of underweighted riskier assets.

The ringgit and rupiah are gaining support on the back of risk-on sentiment, which has investors chasing for yield. Malaysian and Indonesian bond yields hit year-to-date lows last week.

Post-Brexit offshore bond flows are indicating upside potential for ringgit and rupiah, plus the Indonesian tax amnesty is boosting investor sentiment, which will probably result in additional revenue flows to cover a widening budget gap.

In the lead up to Brexit, global investors were positioned extremely defensively in Asia EM, and now these underweight positions are moving to overweight, with investors scurrying for yield in the Indonesian and Malaysian capital markets. While Brexit may have delayed Fed tightening, this is viewed as supportive for commodity prices, which are providing a credible floor for USD-Asia markets.

Potentially, massive easing programs from the BoE, ECB and BoJ are in the offing, which could prove supportive for regional asset markets, amidst extremely buoyant investor sentiment.

Naturally, Brexit’s impact is that of a higher level of uncertainty, but from a regional perspective, Malaysia and Indonesia are viewed as very attractive, since their economies, to a greater extent, are less dependent on mature global markets.