- The overall numbers for the US macro trend point to growth, albeit moderately so

- Chicago Fed Index will likely confirm US recession risk was still low last month

- The shortfall of supply is likely to give home building a boost in the US

- US housing market demand is firmer, but existing home sales may get pinched

- Europe’s equity markets hint at an improvement for Eurozone consumer sentiment

Two updates on the US economy will attract close attention today, starting with the February data for the Chicago Fed National Activity Index. We’ll also see last month’sprofile for existing home sales. Later, the European Commission publishes flash March data for its Consumer Confidence Indicator for the euro area.

Consumer confidence in the Eurozone is expected to bounce this month.

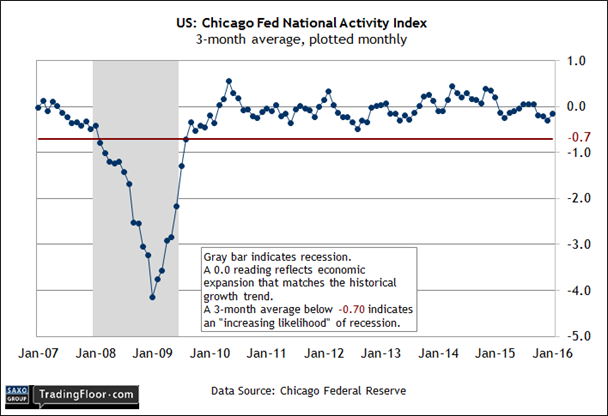

US: Chicago Fed National Activity Index (1230 GMT) The year so far has been a roller coaster for economic expectations, but the outlook has been stabilising lately as the crowd becomes increasingly confident that recession risk remains a low-probability event for the near-term future.

The broad trend doesn’t look especially strong at the moment, but there’s still enough forward momentum to argue that last month’s anxiety attack about the economic outlook was excessive. Granted, the Federal Reserve last week decided that macro risk in the US and around the world was still too high to warrant raising interest rates. But maintaining an overly cautious monetary stance doesn’t change the fact that the numbers overall still point to growth, albeit moderately so.

Consider the Atlanta Fed’s current estimate for first-quarter GDP growth. The 1.9% forecast (as of March 16) is modest bordering on weak, but it’s still a step up from the 1.0% in last year’s fourth quarter. The improvement suggests that the odds are low that a recession has started in 2016.

A reality check arrives via today’s February update of the Chicago Fed National Activity, a broad measure based on dozens of indicators. My econometric modelling suggests that the three-month average for this business cycle index will remain just below zero. The reading equates with slow growth that’s below the historical trend rate but strong enough to convince the crowd that a new downturn isn’t on the immediate horizon.

The previous update for January posted a negative 0.15 level for the three-month average – far above the negative 0.70 that’s considered a tipping point that marks the start of a new recession. Today’s update for February will probably dispense a similar message: slow but steady growth.

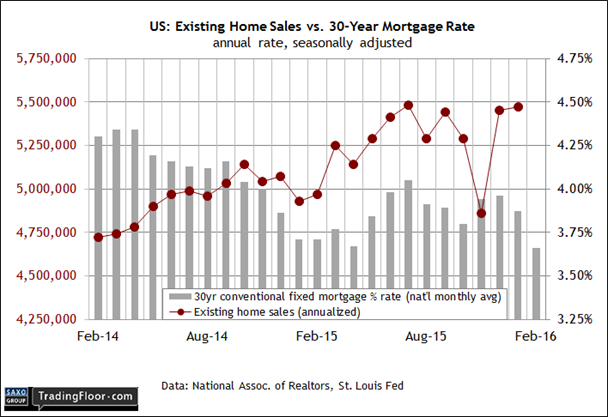

US: Existing Home Sales (1400 GMT) Last week’s numbers on new residential construction suggest that the housing market has a moderate tailwind going into the traditionally busy spring-buying season. Indeed, housing starts overall inched higher in February, sticking close to an average level for the last 12 months. Meanwhile, the single-family component of new housing starts last month increased to the highest level of late 2007.

“The most important fundamental in the housing market is a shortfall of supply relative to demand and there is only one way to fix that problem: more building,” the chief economist at Amherst Pierpont Securities wrote last week. “Industry sources suggest that this is finally beginning to happen.”

Not surprisingly, the outlook from the vantage point of the home building industry is encouraging. “February’s single-family gains indicate that this sector is strengthening in line with our forecast,” said the chief economist at the National Association of Home Builders, a trade group. “As the US economy firms, job creation continues and mortgage interest rates remain low, we should see further growth in housing production moving forward,” he predicted last week.

Today’s numbers on sales of existing homes will update another perspective. Economists expect a modest dip to 5.305 million units (seasonally adjusted annual rate), according to Econoday.com’s consensus forecast. But that’s still close to a nine-year high.

The biggest risk factor at the moment for sales: demand exceeds supply. “The spring buying season is right around the corner and current supply levels aren't even close to what's needed to accommodate the subsequent growth in housing demand,” said the chief economist at the National Association of Realtors, the group that publishes the sales data.

In other words, even if today’s update shows a pullback from January, the slide will be a reflection of limited inventory rather than stumbling demand.

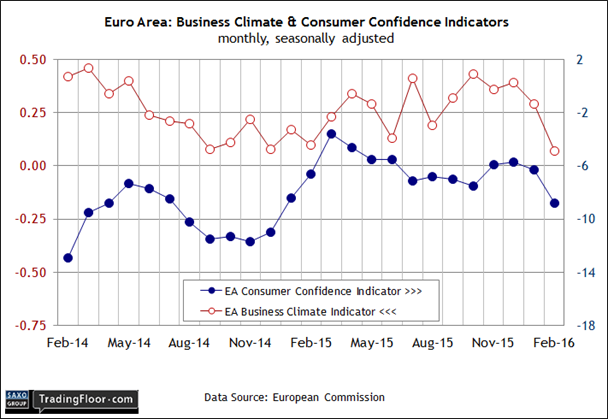

Eurozone: Consumer Confidence Indicator (1500 GMT) Consumer sentiment in Europe fell sharply last month, but a round of recovery looks like a reasonable guesstimate for March, based on Friday’s upwardly revised estimate for first-quarter GDP.

Now-casting.com last week raised its outlook for Eurozone growth in 2016's first three months to 0.43% (quarter-over-quarter rate). For the second week in a row, the consultancy’s estimate posted a solid improvement over the previous Q1 nowcast.

As it stands now, the macro trend for the euro area is on track to accelerate a bit from the 0.3% rise in last year's Q4. If the projection is accurate, GDP’s quarterly pace will register improvement over the previous quarter for the first time in a year.

Europe’s main stock markets appear to be on board with revising expectations higher relative to last month’s gloomy view. Germany’s DAX and France’s CAC-40 have rallied sharply from February’s low. That’s a clue for thinking that today’s March report for the Eurozone Consumer Confidence Indicator will bounce a bit relative to February’s tumble, which left the index at a 14-month low.

Disclosure: Originally published at Saxo Bank TradingFloor.com