Today was one of those days that absolutely takes the wind out of my sails. I am not a day trader, I never wanted to be a day trader, and I don’t want to become a day trader. In a market like this, however, where any downtrend seems forbidden from lasting more than an hour or two. It seems the only people prospering are those jumping in and out of the market (and either side) all day long.

The day had been going great, with my portfolio up about 2%, but the bottom was put in 30 minutes after the opening bell and it spent the rest of the day rocketing higher. By the time all the dust settled, I was down 0.5% on the day. It would have felt a lot less bad if the market had simply zipped higher at the opening bell and just stayed there all day long. I can live with a half-a-percent loss, but it really stinks to have been up four times that amount and see it all vanish based on nothing.

It’s not like I was heavily short into a big Fed meeting or something. The reversal came about because of nothing. Absolutely nothing. And I have troubling taking “nothing” into account when I’m trying to get positioned. The only silver lining for me was that I got out of my big ETF shorts early in the day.

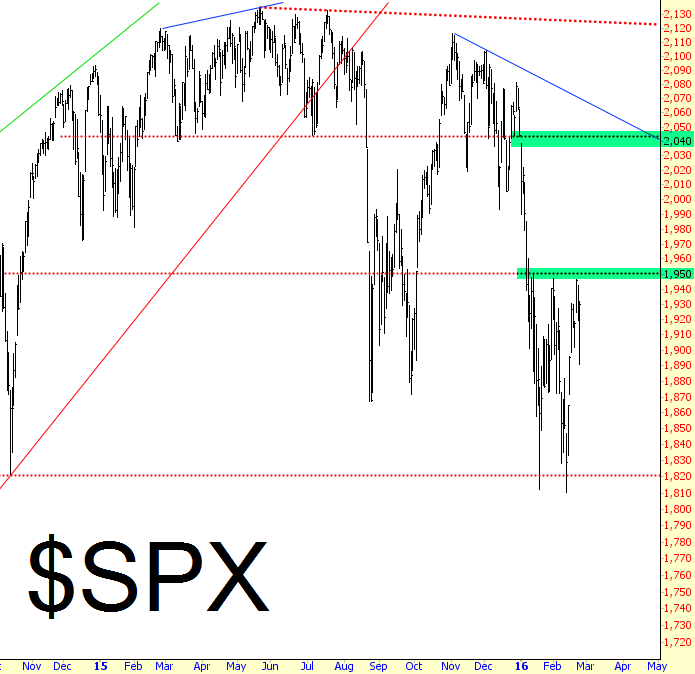

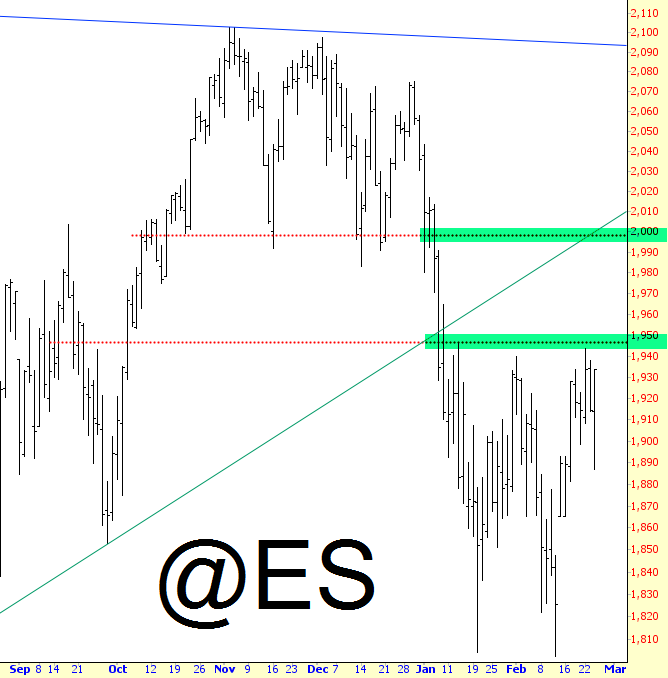

In any case, as I look at the market as a whole, I am seeing something rather consistent: there is a relatively low level of resistance – let’s call it 'Thing One' – and a markedly higher level of much, much stronger resistance – which we can call 'Thing Two'. Between these two things is a demilitarized zone of sorts.

Simply stated, if the bulls can push things above Thing One, I think they’re going to have a fairly easy time getting to Thing Two, because the DMZ offers scant resistance. Such an ascent would tear my heart out, particularly since it seemed like (finally) we were getting some good downside movement. But the last time I checked, the market didn’t really care much about my heart. The only silver lining to such an ascent, of course, would be the prices it would provide bears from which to short, but honestly I’d rather just avoid the whole thing altogether.

That said, here are some charts I’d like to show you with these two resistance lines:

Dow Jones Industrial Average

S&P 100

S&P 500

E-Mini S&P 500

The Russell 2000 has a bit of a “tilt” to its Things, but the general notion still holds:

Like I said, as hard as I work on charts and managing all these positions, it’s horribly deflating to have the day end up like this. I have not lost faith in the bear market of 2016, but it’s not easy.