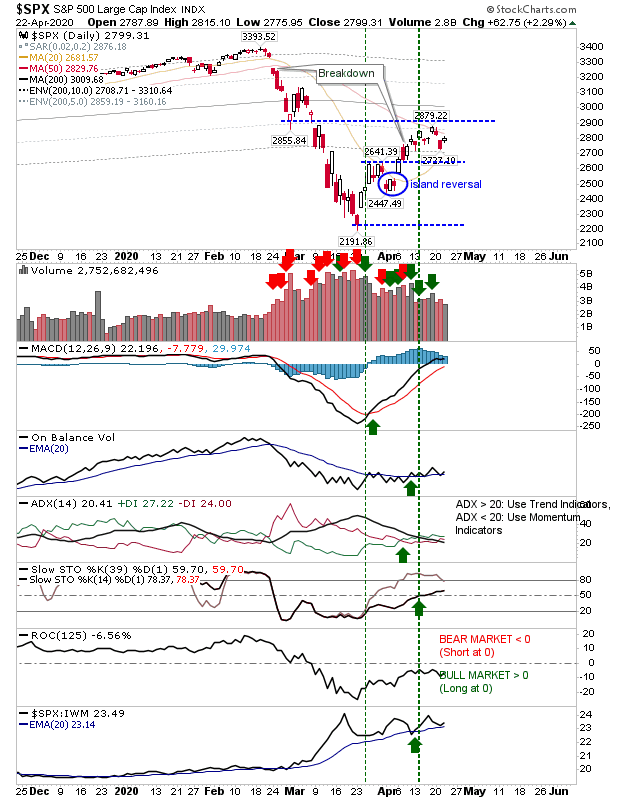

Bulls tried to reverse Tuesday's losses but weren't able to close the breakdown gaps. The topping patterns still look valid despite Wednesday's gains. To add to this, buying volume was well down on Tuesday's selling.

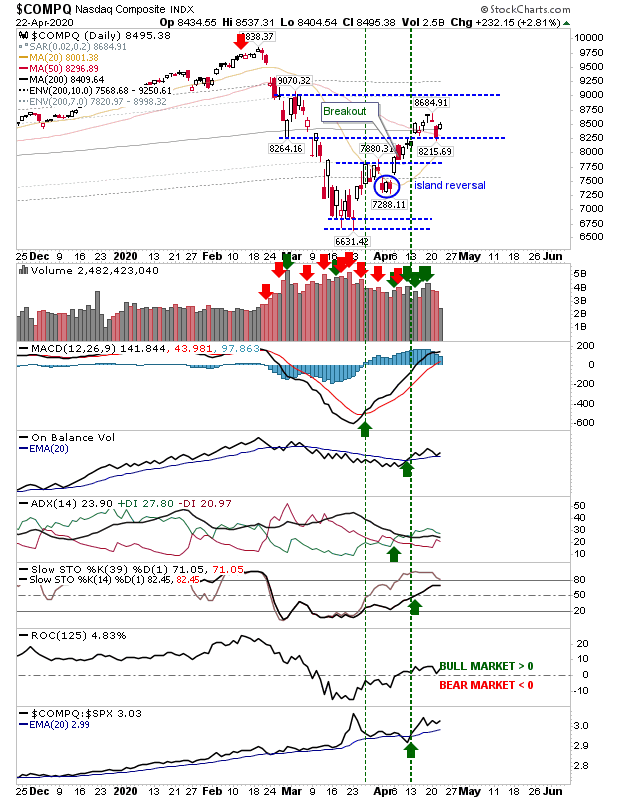

Lead indices, the NASDAQ and S&P 500, remain technically net positive. However, it's hard to be a buyer here.

It's the same for the NASDAQ, although it has managed to hold on to what was resistance (now support) of the February swing low.

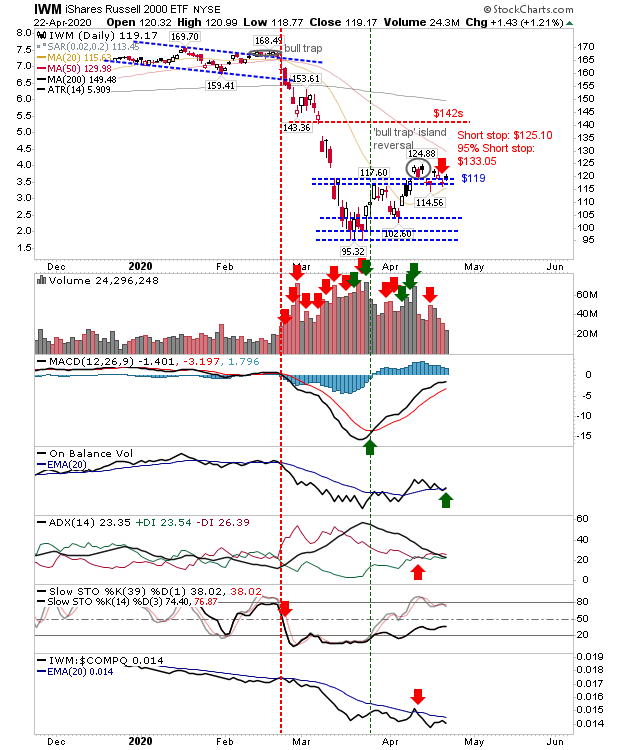

The Russell 2000 made only a minor gain and is holding to the 'bull trap'.

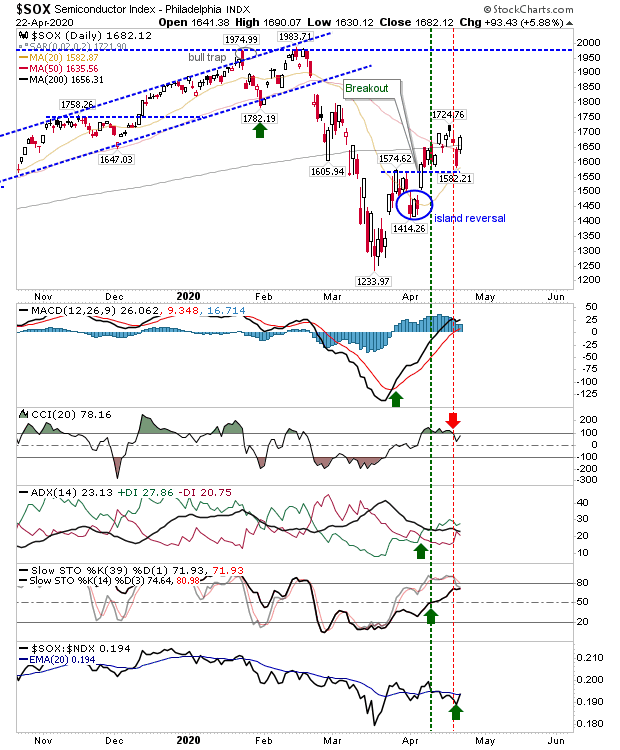

The Semiconductor Index posted a sizable gain, returning above the 200-day MA, but the gain still has to challenge the topping bearish black candlestick from last week.

While it's hard to see how you would want to be a buyer here, those that do may be looking for a repeat of the early April 'bull island' reversal; for those buyers, any loss will make them very flighty. I'm not sure we have a March 2009 low scenario when nobody believed a major swing low was in place and buyers just kept on pushing the market higher - but until there is a return to the decisive selling of February and March, then these small(er) gains will continue; holding Tuesday's low is critical in this regard.