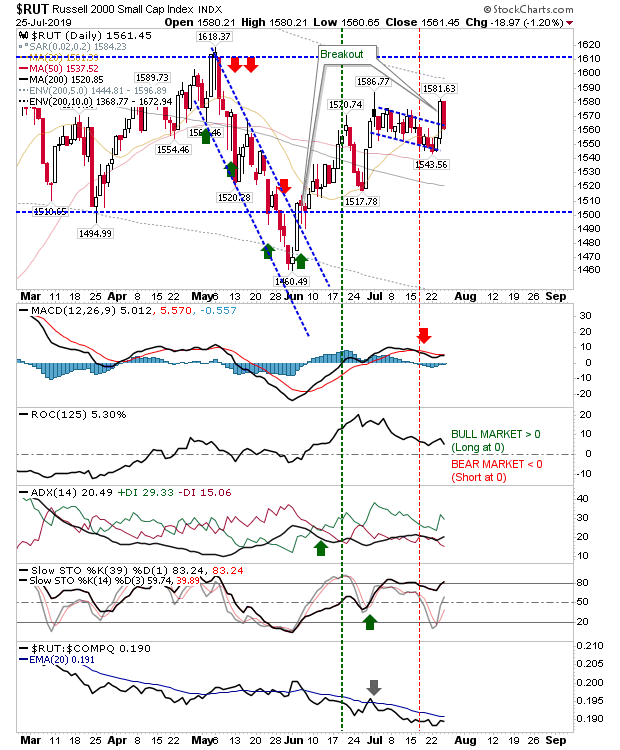

Today's action - paired with yesterday's - has given bulls confidence more gains could be on the way. The losses were not significant and there was a great recovery breakout in the Russell 2000 'bull flag', which was feeling the pressure all through last week. Again, just as any losses were mitigated by the broader trading range, so was yesterday's gain. However, it does suggest there are buyers willing to come in if the water is nice.

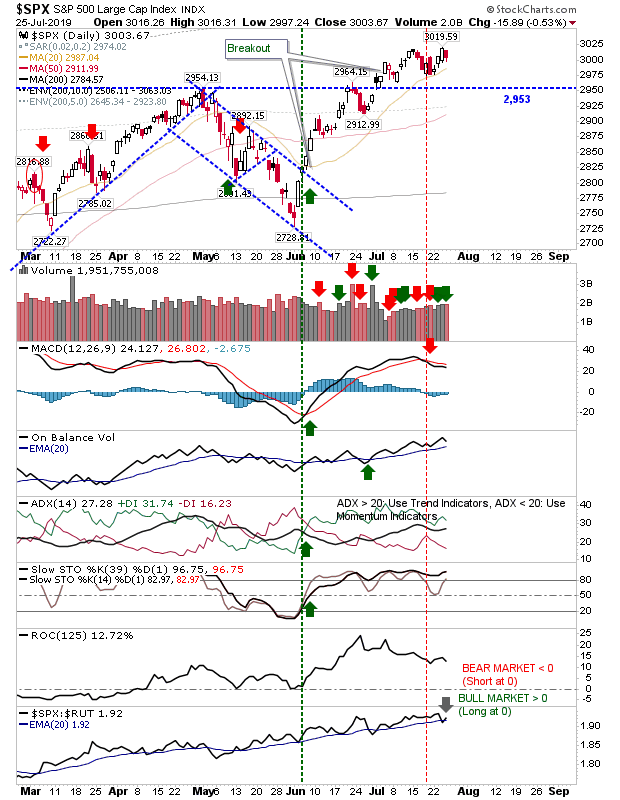

Action in the Russell 2000 was perhaps the most important for the last couple of days. The S&P did manage a new all-time closing high, only to give back a little today. Volume did edge a little above yesterday's in what would be considered distribution, but I'm not really seeing this as problematic. Relative performance ticked up above the trigger line, negating yesterday's reversal.

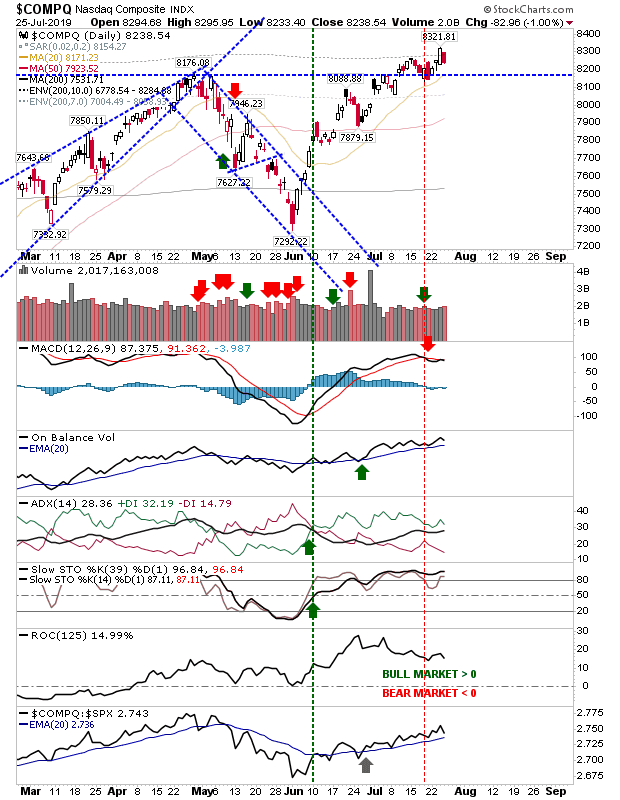

The Nasdaq 100 also experienced a similar reversal, erasing most of Wednesday's gain but holding the relative performance advantage against the S&P 500. Again, the Nasdaq another index to register a new all-time closing high before today's losses.

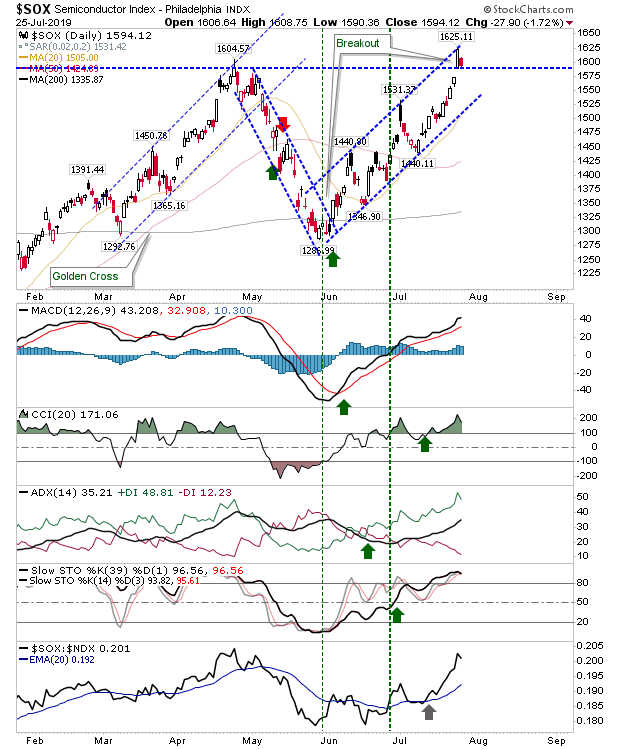

The Semiconductor Index had cleared the April swing high in a breakout yesterday as relative performance accelerated higher. Technicals are in excellent shape and today's losses, while nearly 2%, weren't enough to reverse the breakout.

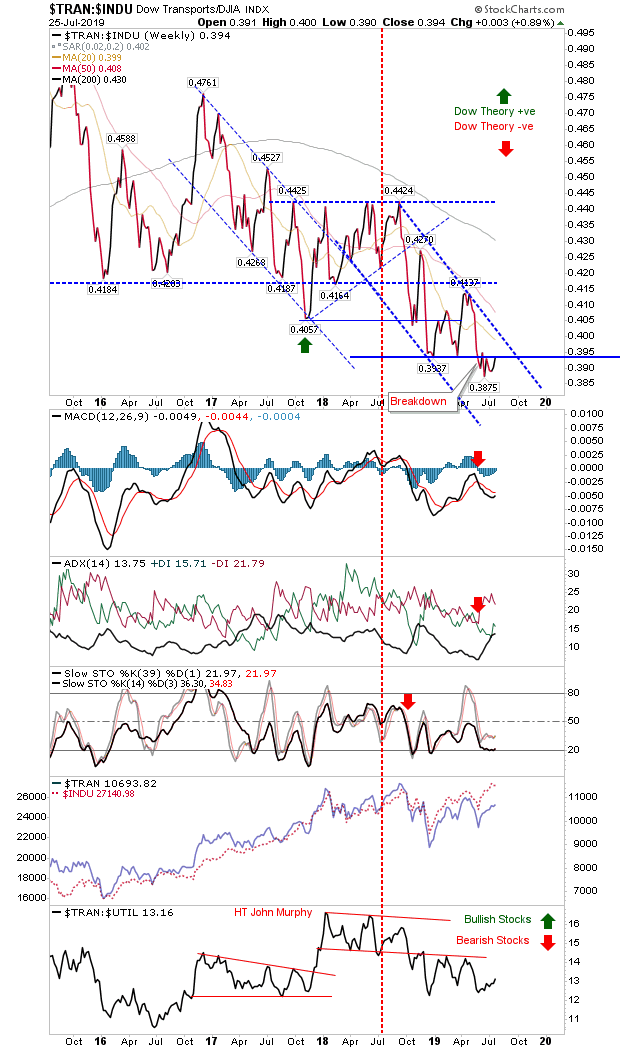

Of breadth metrics, the one I'm watching is the Dow Transports : Industrials ratio. June brought a support breakdown in this relationship (initially bearish), but the failure of it to accelerate lower leaves it set up for a possible 'bear trap'; bullish for Transports and the broader market as a whole.

For tomorrow, watch for the Russell 2000 to build on its 'bull flag' breakout and start to challenge the May high, I'm also looking for a possible major swing low in the Dow Transports:Index ratio - this would be bullish for Transports, and by association, for the broader economy as a whole.