Last week the XIV saw the largest price drop in over a year falling more than 23% from the July 26 High. After bottoming on August 10, the XIV moved back higher stalling out just under the 61.8% retrace level in what counted best as a corrective move higher.

Since topping on August 15, XIV has once again broken back below last week’s low at 72.44. The break of the 72.44 low has given additional confirmation that the high struck on July 26 was indeed a larger degree top. This suggests that the XIV still has some work to do to the downside prior to moving back to new highs once again.

The VIX Index has now closed over the 11 level for 8 consecutive sessions. From a longer-term perspective, this is not news as the VIX is well over the 11 level. This is, however, the longest streak that the VIX has closed over 11 since April of this year. On Friday, August 11 the VIX Index closed at 14.98 again, still very low from a historical perspective.

What is interesting is that we are now beginning to see calls for the VIX to hit 60 by this October. Keep in mind these are levels that have not been seen since the 2008 financial crisis. While I do think it is very likely that we once again see some volatility return to the market into the fall, I do not think the VIX is ready to hit 60 just yet.

Fourth-Wave Move

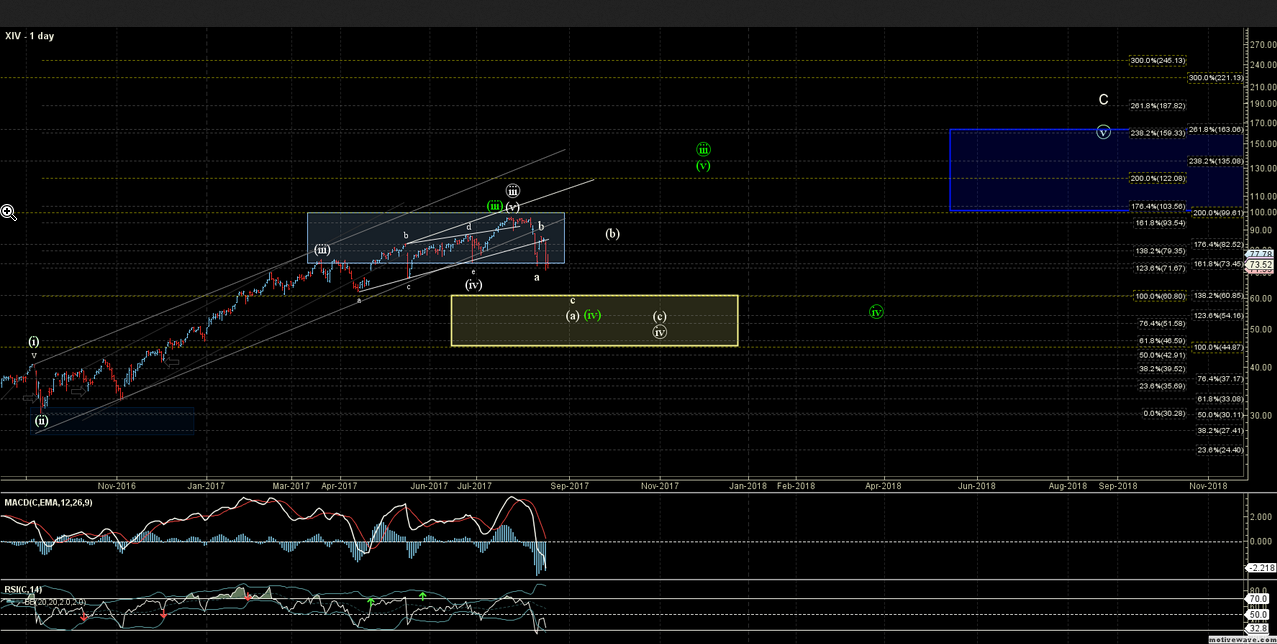

I noted in my last article that the XIV had likely put in a larger degree top near the upper end of my long-term target zone. Now that this top has been struck, I am looking for the XIV to ultimately move toward the 60.85-44.87 support zone into the fall. This move down into that support zone is likely coming in the form of a larger degree fourth wave.

Fourth waves are some of the more difficult patterns to project and typically require traders to be nimble when trading. In this particular fourth wave, there have already been several excellent trade setups since the high that was struck on July 26 at just under the 97 level. These trade setups came from both just under that 97 level into the August 11 lows and then once again off of the August 14 high and into Friday’s low.

Once the XIV begins to show longer-term bottoming signals then the focus will again be on trading XIV to the long side (VXX to the short side). If the XIV can make it down into the larger degree support zone at the 60.85-44.87 zone it still has the potential to more than double in value going into 2018. My long-term upside targets remain in the 99.61-163.06 zone with an outside chance of seeing over 220 before this makes its final long-term top.

With that, I reiterate what I noted on July 7 as it remains true today:

While there will likely be a nice trade for nimble traders upon the next leg down, for those with a bit longer-term outlook the next buying opportunity may just be the easier trade to be had.

For this reason, I will continue to remain nimble as the XIV moves lower into the fall. This will ensure I am not flat footed once XIV is ready to run.

Mike Golembesky is a widely followed Elliott Wave technical analyst, covering U.S. Indices, Volatility Instruments, and Forex on ElliottWaveTrader.net (www.elliottwavetrader.net), a live Trading Room featuring intraday market analysis (including emini S&P 500, metals, oil, USD & VXX), interactive member-analyst forum, and detailed library of Elliott Wave education.