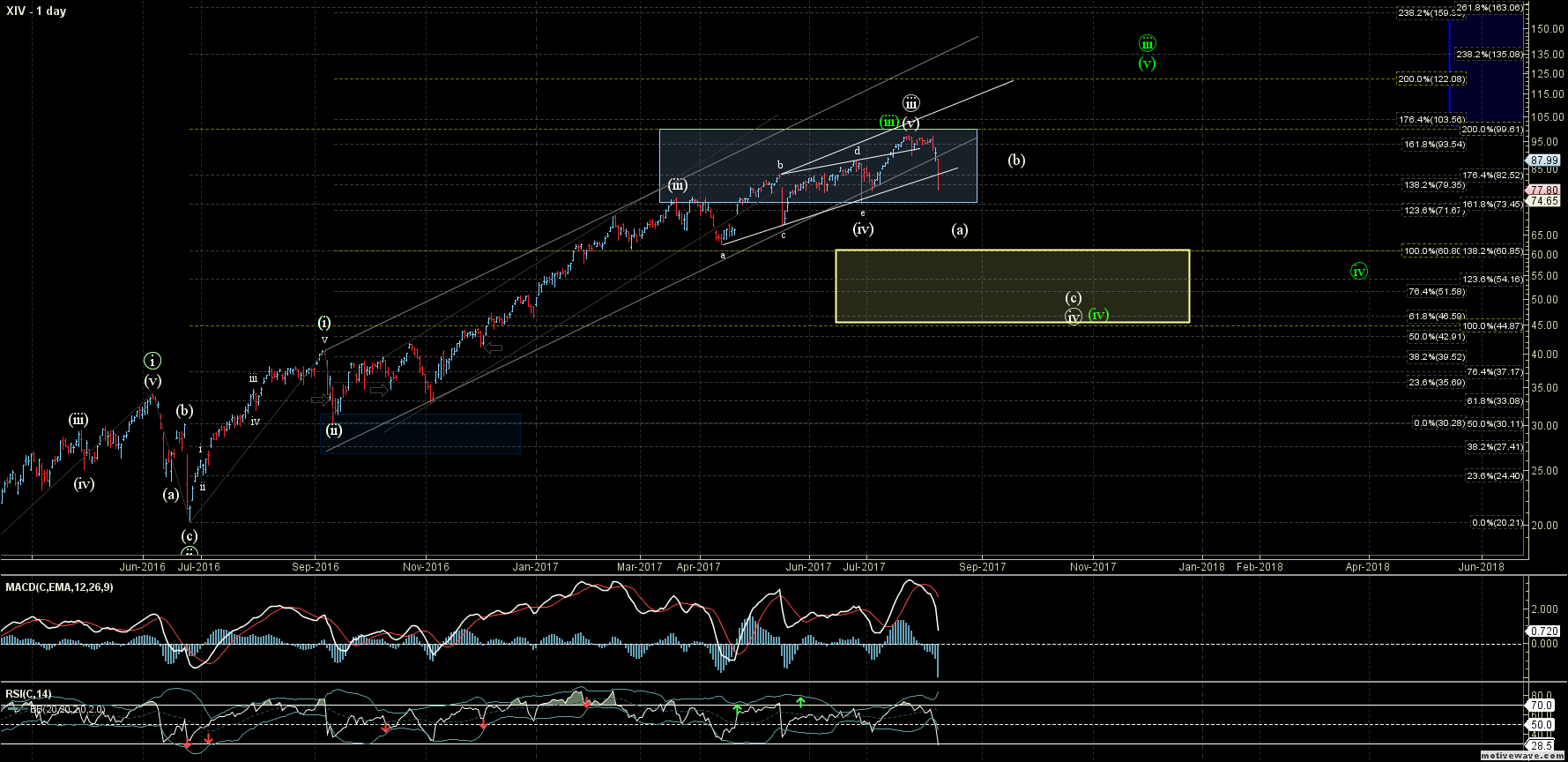

The VelocityShares Daily Inverse VIX Short Term linked To SP 500 VIX Short Fut Exp 4 Dec 2030 (NASDAQ:XIV) fell over 13% on Thursday, August 10th and is now down over 23% from the high that was struck on July 26th. Additionally, the XIV has firmly broken through all of shorter term price support levels that I have been mentioning now for several weeks. The break of these support levels is, therefore, making it highly probable that a larger degree top has been struck in the XIV.

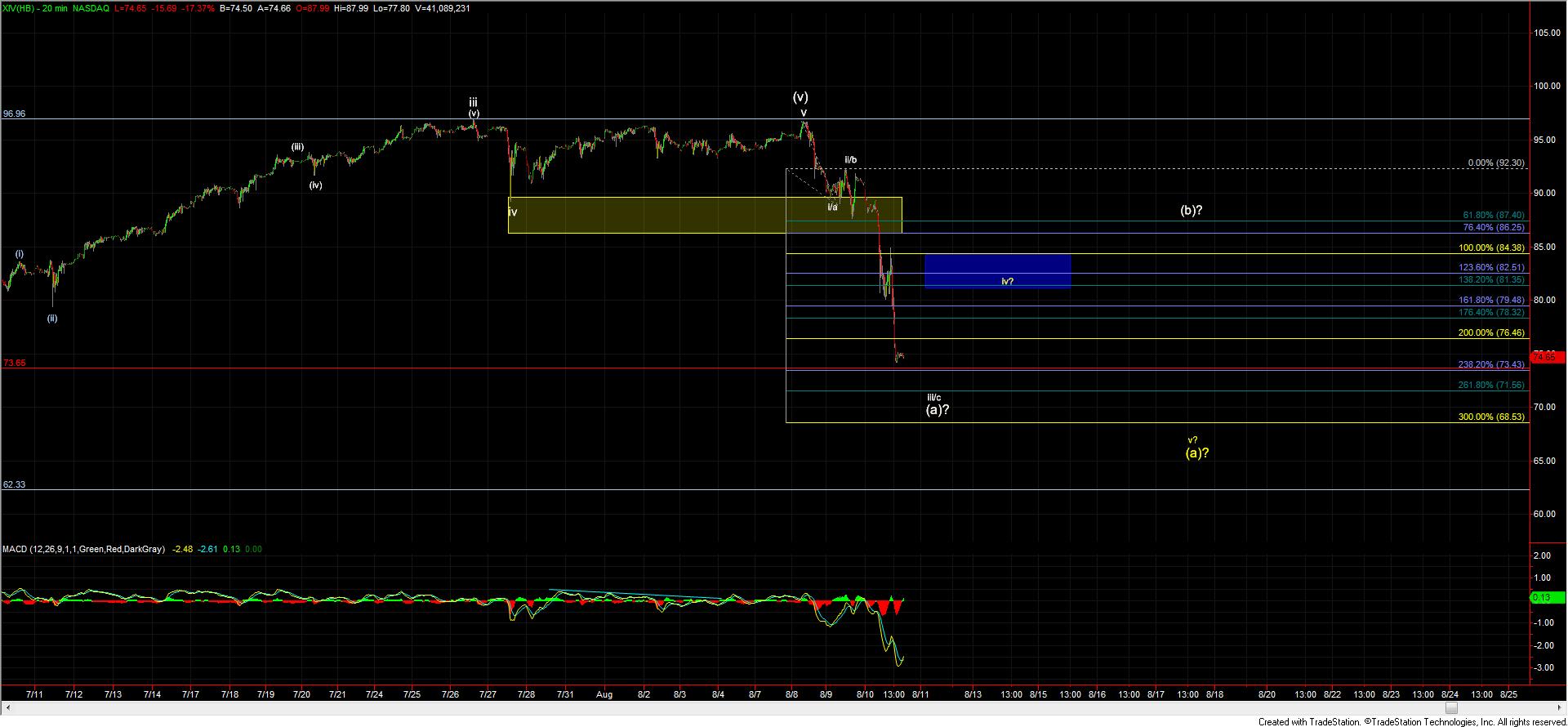

The shorter term move down off of the 8/8 high and into the 8/10 low was very clear and followed all of our Fibonacci Pinball targets almost perfectly. This adherence to our Fibonacci Pinball targets allowed for some excellent trading over the last several sessions. We are now at a fairly important inflection point on the XIV. The price action over the next several trading sessions should give us a better idea if the path down to lower levels will also be clear and predictable or if it will involve a more complex pattern that involves more twists and turns.

As I have been writing about for several weeks now the CBOE Volatility Index has been at historically low levels for several months. I noted last week that the VIX had closed under the 11 level for a record 18 consecutive trading sessions. This streak was extended into this week as the VIX closed under 11 for the 21st consecutive trading session on Tuesday, August 8th.

On Wednesday, August 9th the iPath S&P 500 VIX Short-Term Futures Exp 30 Jan 2019 (NYSE:VXX) finally began to show some signs of life and finally closed over the 11 level with a close of 11.11. The real fireworks, however, did not occur until Thursday, August 10th as the VIX closed at 16.04, 44% higher than the previous days close. This massive move in the spot VIX index, in turn, caused the VIX futures to see very large moves to the upside thus driving the price of the XIV down along with them.

Last week I wrote that the XIV was hanging on by a thread and it may not take much more to push it over the edge. That push came this week as the XIV broke down very strongly taking out all of the shorter term support levels along with it. The break of these shorter term support levels now leaves the XIV with a pattern that is highly suggestive that a top is indeed in place.

As I noted above the XIV has so far followed our Fibonacci Pinball targets almost perfectly off of the August 8th high and into today’s low. This is allowing us to place shorter term resistance levels on the XIV at the 79.48-84.38 zone. This is a very key resistance zone and will likely tell us if the XIV is going to provide us with a larger degree five wave pattern to the downside or a corrective pattern down off of the 8/8 high.

If the XIV can hold this resistance zone and then make another low it would give us a full five wave move to the downside off of that August 8th high.

Alternatively, if this 79.48-84.38 zone does not hold then we are left with what is likely a corrective 3 wave move to the downside.

In either of these two scenarios on the bigger picture, I still would expect to see lower levels down towards the 60.85-44.87 zone. The latter, corrective scenario, would, however, make tracking the action down towards those lows a bit more difficult. Whereas the former, five wave move, would then allow us to more accurately project retracement targets as well as the targets that should follow to the downside.

I am always on the lookout for tradable setups in the Volatility space. I do however plan to be very selective in any trades that I may attempt in the near term. When the XIV does provide us with a clear and actionable trade setup I will once again be ready to pounce. Until that occurs my guns are back in their holsters and I am left with plenty of powder that is dry.