The epidemiological outlook improves, while the U.S. stock market reaches one record high after another. But the key question today for the gold investors is: what will Powell say?

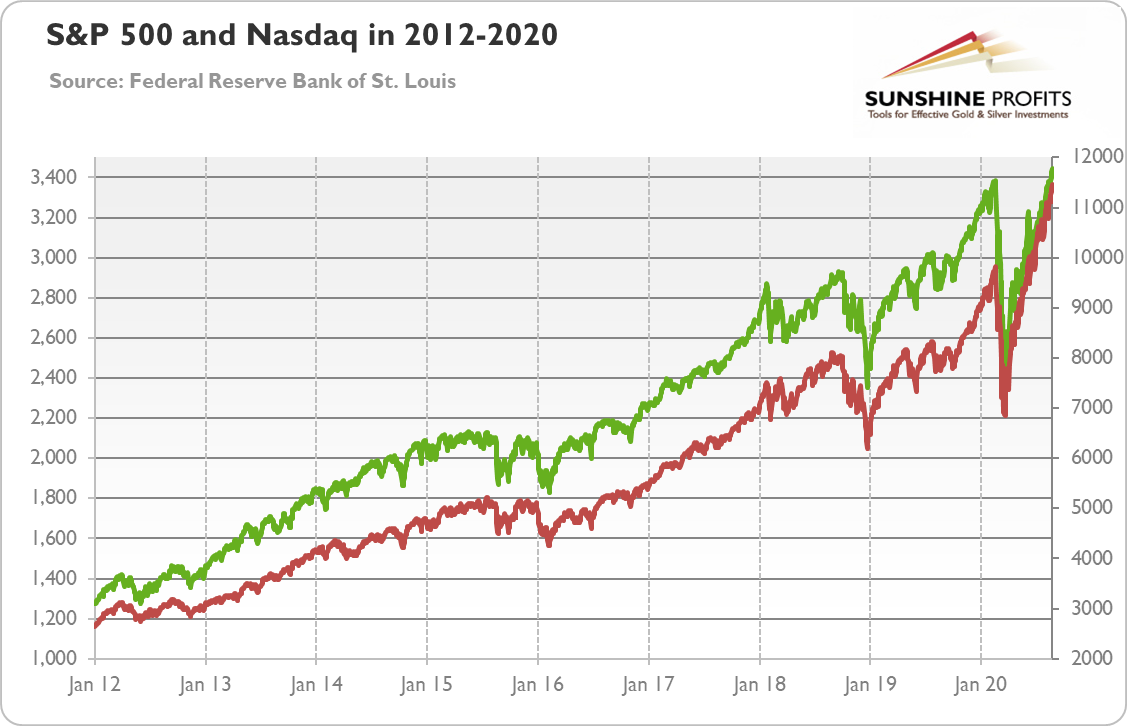

The U.S. stock market is in the bullish mood. Although Dow Jones is still a few percent below its February peak, the S&P 500 has recovered completely from the coronavirus-driven plunge, surpassing even 3,400 this week, as one can see in the chart below. But the real euphoria is on the Nasdaq exchange. As the chart below shows, the Nasdaq Composite has not only recouped all its losses caused by the Covid-19 pandemic, but it actually soared to above 11,450.

What is happening? Well, the progress in a Phase-1 trade deal between the U.S. and China has been cited as a reason behind the positive market sentiment. Another important issue is optimism over progress in developing treatments and vaccines for Covid-19, as the U.S. Food and Drug Administration approved the emergency use of blood plasma from recovered patients.

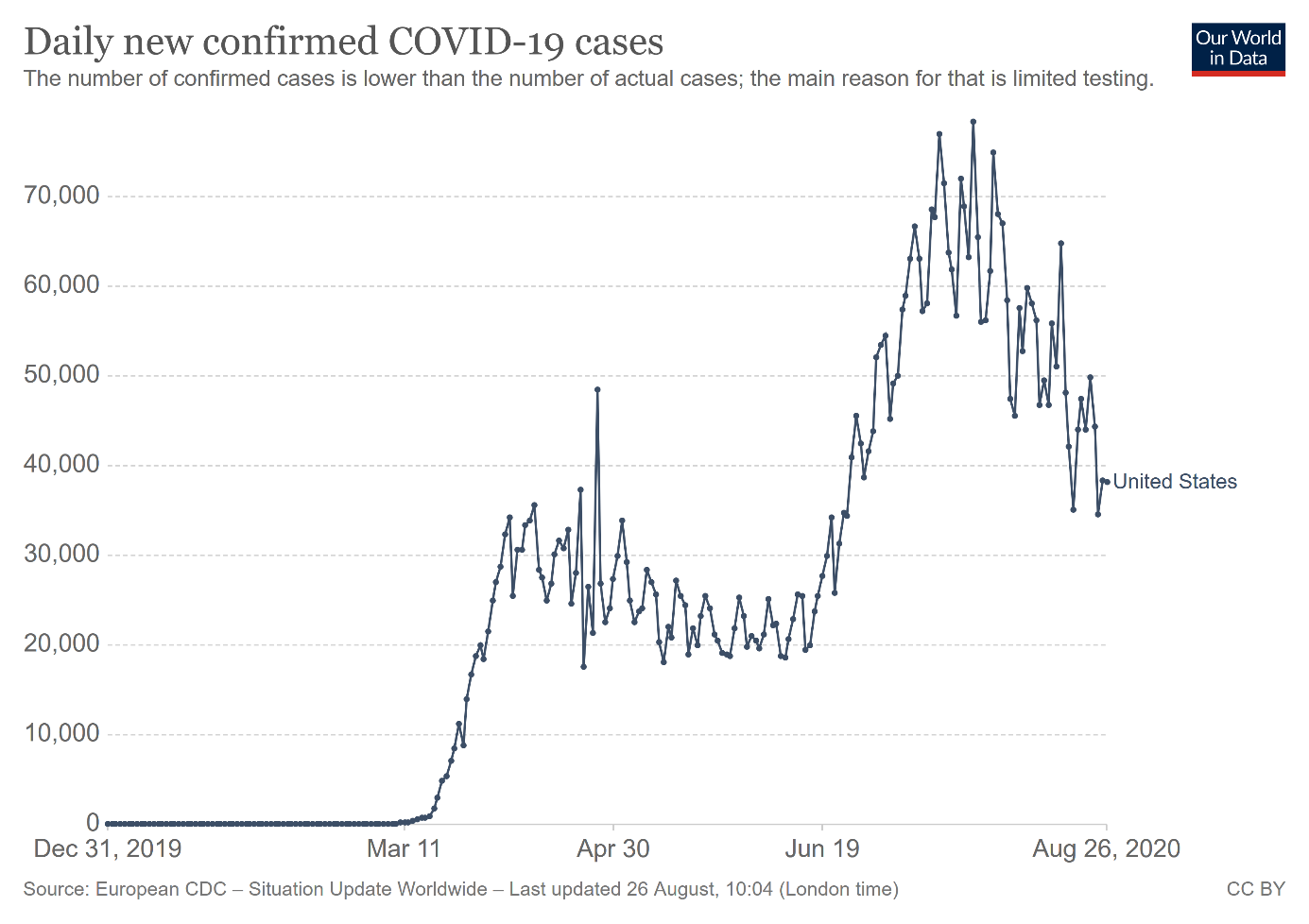

Moreover, the epidemiological situation has improved recently. As the chart below shows, the number of daily new cases of infections peaked at the end of July and has been declining since then. Although the numbers are still above the levels seen in March and April, it seems that the second wave (or the second leg of the first wave) of cases has been brought under control.

The improved epidemiological situation creates hopes for a more vigorous and sustainable economic recovery. So, the recent rally in the stock market prices could be reasonable, after all. Of course, bears could rightly point out that the S&P 500 rise is driven by just five tech stocks and the Fed's massive liquidity injections, but for now the party goes on and the bulls celebrate.

Implications for Gold

What does it all mean for the Gold market? Well, the risk-on sentiment is negative for the safe-haven assets such as gold. However, with stock prices so elevated and still rising, gold could be sought more often as a sensible hedge and portfolio diversifier. Moreover, the yellow metal often goes in tandem with equities - as both asset class benefit from the easy monetary policy and low interest rates.

The improving epidemiological situation and upcoming economic recovery are also headwinds for the gold market. However - and luckily for the gold bulls - gold does not need a global epidemic to shine. And it can also rally during recoveries - after all, in the previous bull market, gold peaked in 2011, two years after the official end of the Great Recession.

What is key for gold's outlook, is the macroeconomic environment, and that is greatly shaped by the Fed's actions. The ultra dovish stance adopted by the Fed in a response to the coronavirus crisis has been very supportive for gold prices, as the U.S. central bank signaled that real interest rates will remain low for long.

However, it might be the case that the Fed has turned so dovish and rates so low, that investors now believe that they could go only higher (although it seems to me that we are not yet there). So, it is possible that gold needs another dovish declaration from the Fed to continue its bullish rally.

Luckily, it may happen as soon as today. The Federal Reserve Chair Jerome Powell will talk at the Kansas City Fed Jackson Hole symposium on the monetary policy framework review that has been recently conducted by the U.S. central bank. His speech is highly anticipated as investors expect that he will accept more inflation in the future. Indeed, the current inflation-targeting regime has been criticized by many Fed officials who would prefer either higher inflation target or a monetary regime looking more as price-level targeting that allows for higher inflation after periods of low inflation. In other words, the Fed could change how it defines and achieves its inflation goal, trying, for example, to achieve its inflation target as an average over a longer time period rather than on an annual basis.

It goes without saying that allowing for higher inflation would be positive for gold prices. However, if Powell disappoints market expectations and deliver more hawkish speech than expected, gold price could enter a deeper correction. Stay tuned!

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts