During the stock-market correction and current consolidation, we have received several mixed signals and indicators. The Dow Jones Industrial Average, NASDAQ, Banks and Semis all hit key long-term resistance in early 2018 and pulled back.

This isn’t necessarily bearish, but it signaled that the market was very likely to pull back and/or consolidate for a while. Indicators continue to say investors should “picky” about where they put their money, especially on a sector/stock basis as this correction has given way to a rotation.

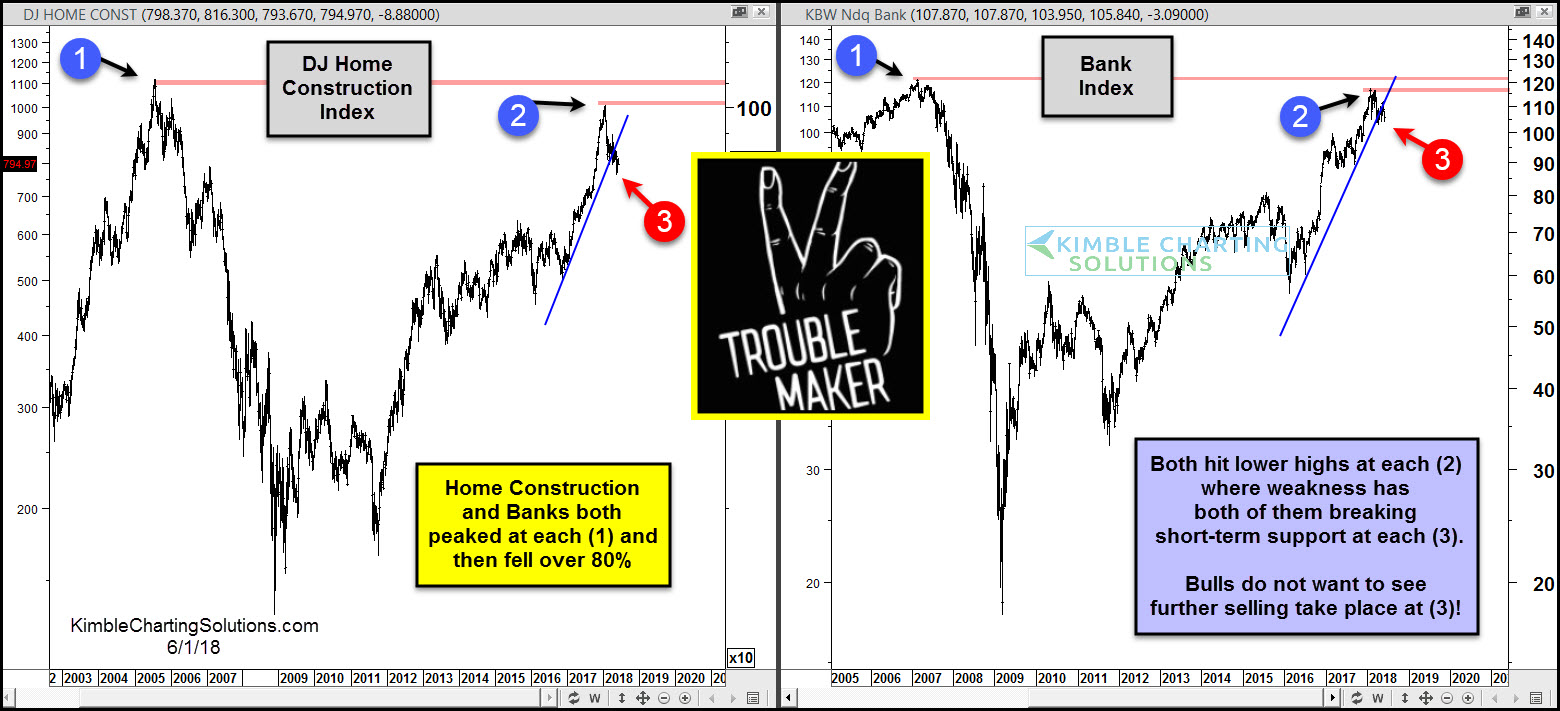

Two sectors that are currently raising investor concerns are Home Construction and Banks. In today’s two-pack of charts, I highlight why investors may want to steer clear of these two troublemakers (and monitor them as they could add to any market weakness).

The Dow Jones Home Construction Index (on the left) tested its 2005/2006 highs earlier this year (see points 1 & 2) and pulled back. The pullback is now breaking down through its steep 22-yearuptrend line (3). This looks like trouble.

The Bank Index (on the right) has a similar look, test of 2007/2008 highs and pullback that appears to be breaking support.Dow Jones Home Construction

The big question now is whether these two troublemakers will see a shallow selloff or a deeper selloff.

The market may be able to hold steady with some weakness but a deep selloff will likely hurt the broader market down as well. Stay tuned!