US Trading- S&P 500 Futures +1 point

- 10-Year Yields 2.37%

- VIX 15.31

- Oil $59.02

- Dollar Index 96.98

International Trading

- Japan Nikkei -1.6%

- China Shanghai -0.92%

- Hong Kong HSI +0.16%

- South Korea Kospi -0.82%

- UK FTSE +0.41

- German DAX +0.28%

S&P 500 SPY)

When we look at around the globe, we can find that most markets have just stalled out in recent weeks. The markets globally seem to be lacking in any direction. The S&P 500 is not any different and is pointing to a flat opening today, and the battle zone will seemingly continue with support around 2,785 and resistance around 2,812.

Yields

There is no doubting that yields will sway the direction of stocks. For now, support in the 10-year note is around 2.31%.

Apple (AAPL)

Apple (NASDAQ:AAPL) has performed well in recent trading, and the stock seems like it may just range bound over the next few weeks, which would be welcome news and give the stock a chance to consolidate ahead of quarter results towards the end of April. The range is $182 to $195.

Nvidia (NVDA)

NVIDIA Corporation (NASDAQ:NVDA) is struggling to finish off the last leg of its break out, and until it can help significant rise above $178, we can’t say it has broken out.

AMD (AMD)

Advanced Micro Devices Inc (NASDAQ:AMD) continues to trend higher and is testing the uptrend now $24.75. The uptrend needs to hold, or we will need to consider the direction of this stock.

Micron (MU)

Micron Technology Inc (NASDAQ:MU) is also really struggling, and once again $40.25 will act as stiff resistance. I think the odds of a decline to $36 are pretty high now.

Qualcomm (QCOM

Qualcomm Incorporated (NASDAQ:QCOM) continues to face stiff resistance at $58. I think the stock will struggle to break out until there is more clarity around its multiple suits.

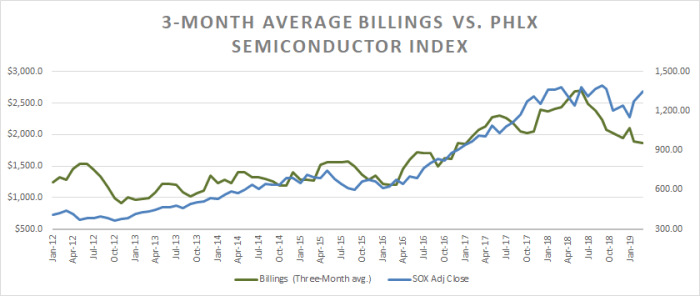

Chips

Morgan Stanely was negative on chip stocks today following Infineon’s negative commentary, calling into to question a second-half recovery. Recent data from the North American equipment billings data that has been weak.