On analysis of the current volatile moves in precious metals and various global equity indices, I find a plethora of queries come up in hope of being quenched; which looks evident enough for traders and investors in global equity markets to compel them to be more skeptical about the fluctuating moves in global equity markets. I find that not only the investors and traders look worried about the growing global slowdown concerns, but the International Monetary Fund also appears ready to combat with any such recessionary situation in near future. The International Monetary Fund laid out a game plan for battling a potential global downturn. The plan would see central banks implement negative interest rates, given their currently low levels.

As fretting over still-unresolved trade tensions, particularly between the U.S. and China, continues, the IMF took preemptive action to enable monetary policymakers to combat an "inevitable" crisis. The organization explained that many central banks reduced policy interest rates to zero during the global financial crisis to boost growth and noted that, ten years later, interest rates remain low in most countries. “While the global economy has been recovering, future downturns are inevitable,” the IMF warned. “Crises have historically required interest rate cuts in the order of three to six percentage points but only three OECD countries - Turkey, Mexico and Iceland - have that kind of room to maneuver today.”

The IMF staff study intends to show how central banks can set up a system that would make deeply negative interest rates a feasible option and comes even as the Federal Reserve is struggling to convince markets that they could move forward from the current range of 2.25% to 2.5% with two more rate increases this year. But markets are skeptical, placing a probability of only about 4% on one increase in December, compared to odds of nearly 12% for a cut by the end of the year, according to fed funds futures.

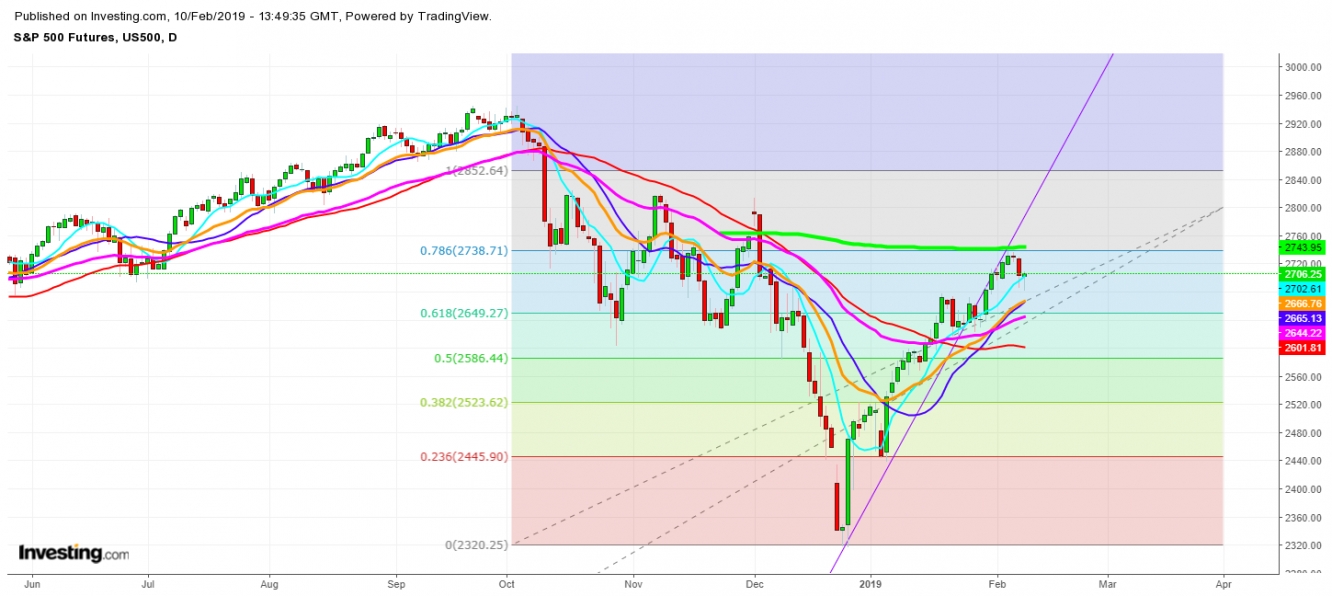

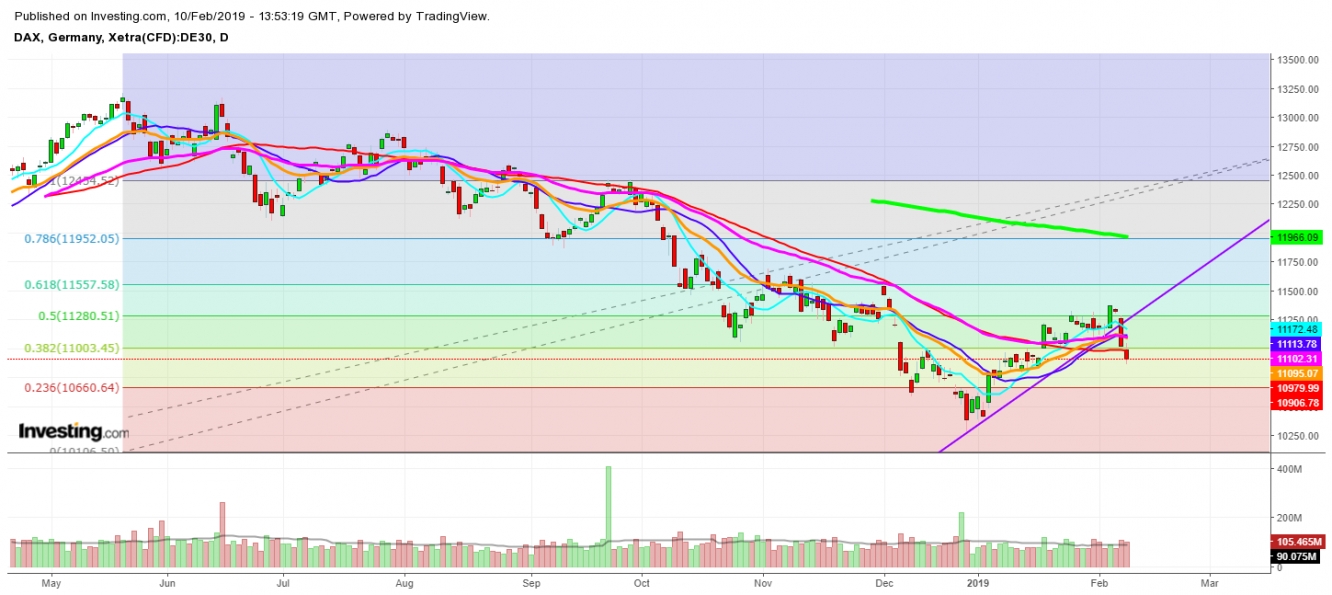

Let’s analyze the movements of Global Equity Indices in different time frames to find out the probabilities of the upcoming market crash in 2019.

Disclaimer

1. This content is for information and educational purposes only and should not be considered as an investment advice or an investment recommendation. Past performance is not an indication of future results. All trading carries risk. Only risk capital be involved which you are prepared to lose.

2. Remember, YOU push the buy button and the sell button. Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from an investment and/or tax professional before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.