For much of the country thawing out from a long winter, we all look forward to April. But April can bring with it highly volatile weather, cold rain, and sleet. This April was no exception in the weather department.

If the weather matched any of the action of the stock and bond market, then this April we got SOAKED!

April has historically been the best month to invest in the market, but this year was the opposite.

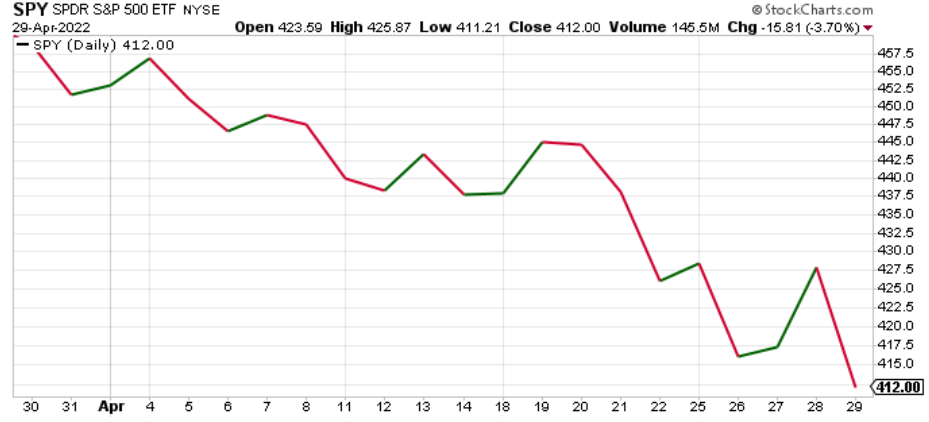

April was brutal (unless you were a short seller, and then you were very happy). The S&P 500 (NYSE:SPY) Index ended down over 8% for the month. As a result, it's currently down -13.3% year-to-date.

The tech-heavy NASDAQ Invesco QQQ Trust (NASDAQ:QQQ) index had its worst month since 2008. It closed the month down over 13%, and down over 20% year-to-date.

Given our indicators and risk gauges forecasting much of this since last Fall, we must say we were not surprised.

If you go back and review our Market Outlooks since last Fall, you will see that we thought the market internals were breaking down even during a positive fourth quarter of 2021.

Again, with…

…interest rates rising at an accelerated pace during 2022,

…bonds selling off at a historic rate, and

…a fierce rally in the dollar, things are upside down.

Other negative factors, including but not limited to high inflation, a contraction in the first quarter GDP (down -1.4%), rising labor costs, a collapse in the Japanese yen and Chinese yuan against the US dollar, geopolitical turmoil (Russian-Ukraine war and Russia threatening all kinds of actions including shutting off oil and gas shipments to Europe) and other domestic issues (supply chains and food production) plaguing prospective economic growth, all weigh heavily on the markets.

Earnings Matter

According to FactSet, 55% of the S&P 500 companies have reported earnings, with 80% beating their earnings estimates and 72% reporting revenues above estimates.

This should help the markets in the near term, and while we don't forecast what the markets may do in the future, our suspicion is that we may see some flowers bloom in May.

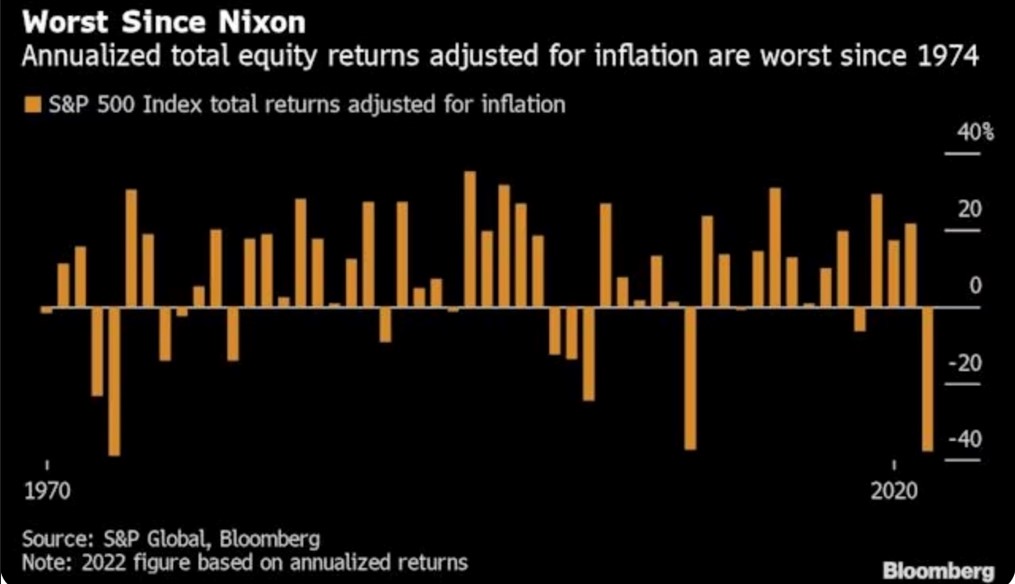

Remember, the markets do not react to what is going on currently as much as they begin to factor in what "could be" in the next year and beyond. Here is a snapshot of how our current market compares to past years using annualized returns (projected for 2022):

Our own Mish has been one of the few, if only, financial commentators on National TV, continuing to emphasize that "I wouldn't buy now as that might be trying to catch a falling knife" and that we remain rangebound. Here is a replay from this past week's appearance on Fox Business with Charles Payne.

Several of MarketGauge's investment strategies are positive on the year. This is largely because their emphasis (including Mish's discretionary service) on commodities, agricultural ETFs, miners, and energy from as early as last Fall. These are the themes that have worked.

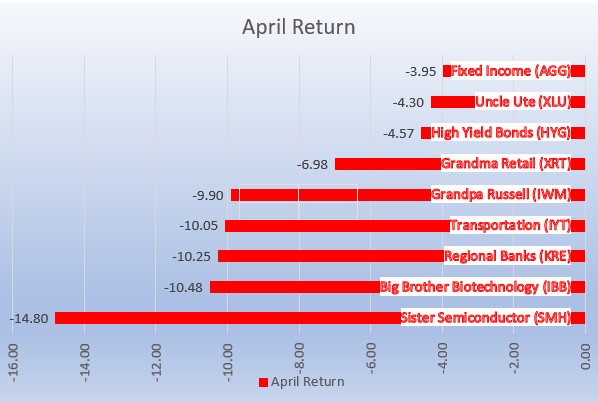

So far this year, there has been nowhere to hide. The typical asset classes offering safe refuge like fixed income, real estate, utilities, consumer staples, and municipal bonds have produced substantial negative returns.

For those of you familiar with Mish's book Plant Your Money Tree and her Modern Economic Family, the family members are used to gauge the health of the economy.

The members (and a few other indicators like Junk Bonds) did not fare well in April. For example, Sister Semiconductor (and technology) had a complete breakdown.

All remain in bearish phases. See below:

What's Next?

We will go into some detail below on some things you can do to position your portfolio to take advantage of the upcoming Spring rally (flowers). We are probably not stuck in an extended bear market (yet), as earnings, the major driver of stock valuations, remain positive and above expectations.

Other factors driving the markets (stock and bond) will continue to depend on interest rates and inflation. It is the uncertainty of these two overriding principles that are currently driving much of the negative expectations being factored into stock price multiples currently.

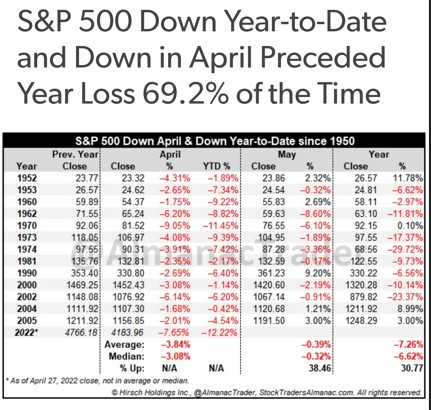

Here is a chart created by Trader's Almanac, which speaks to the problems encountered when we have a negative April (the best investing month historically) and a negative year-to-date return.

It should inspire you to be highly vigilant of market volatility and to do all you can to mitigate risk:

Here are some things you can do to take advantage of any upcoming flowers (rallies)

- Remain active. Don't take a passive role in holding stocks way below water. Cheap stocks can get cheaper.

- Diversify, diversify, and diversify. In several of our investment approaches, we have taken profitable positions in agricultural, commodities, mining and energy stocks and ETFs. It is so important to pivot to areas of strength in markets like these.

- Use cash and don't let anyone talk you into being fully invested. Sometimes this exercise is the best course for the moment and will provide "peace of mind."

- If you are working with a professional, make sure they have your best interest in mind and not their firms.'

- Watch Mish's Modern Economic Family (in Big View or subscribe for free to her updates). The health of these components (as shown above) can determine the near-term behavior of the markets.

- Follow your own instincts and intuition. If you feel fearful, move to the sidelines and take a pause.

Market Insights from our Big View service.

Risk On

- According to the McClelland Oscillator and short-term up/down volume readings, the market hit oversold levels and actually saw a bounce in underlying sentiment to end the week. The cumulative Advance/Decline line also continues to hold at/above lows set in March. (+)

Risk Off

- Of the key market indices, IWM is in the worst shape with the lowest weekly close since late 2020 and down -17% on a rolling 52-week basis. QQQ and SPY aren't fairing much better, each closing at their own lowest weekly levels since Q1 2021. (-)

- Despite the poor performance in the Utility sector (XLU) breaking down hard below its 50-day moving average, it is still outperforming the SPY on a relative basis and has been since the beginning of April…a risk-off reading. (-)

- Every sector that we monitor was down on the week, led by Consumer Discretionary Spending (XLY) which was down -7.4% which is a clear risk-off indication (-)

- Commodities led by corn (CORN +3.5%) and natural gas (UNG +10.1%) managed to buck this week's selloff. (-)

- The NASDAQ Composite tells a different story when you look at its market internals which still remain relatively weak, with the Advance/Decline line hitting new lows. (-)

- Value (VTV) continues to outperform Growth (VUG) on a relative basis, however, VTV still broke down hard below its long-term 200-day moving average showing full risk-off mode across both categories. Scary and most ominous. (-)

- With Regional Banks (KRE) breaking down into a Bear phase this week, every member of Mish's Modern Family is currently Bearish. (-)

- Soft Commodities (DBA) held up well on the week, remaining in a bullish phase and existing as a key component to the global inflationary theme. (-)

- Although the US dollar (UUP) had an incredibly strong run in the month of April, it looks to have possibly put in a blow off top to end this week, after getting significantly overbought on a closing basis led by speculation of an even more aggressive Fed policy. (-)

Neutral

- The two weakest indices according to volume analysis are the NASDAQ 100 and Russell 2000, both showing at least 4 distribution days over the past 2 weeks and only 1 accumulation day each. However, the Diamonds and S&P have more neutral readings on their recent volume patterns (=)

- Despite another tough weak, Risk Gauges remain in a weak neutral phase. (=)

- Sentiment measured by VXX broke out this week to its highest level since March, but failed to make a higher high on a long-term basis. (=)

- The number of stocks above key moving averages are hovering at oversold levels for both the SPY and IWM, but have not completely broken down yet. (=)

- US Treasuries (TLT) bounced early in the week from oversold levels but broke back down in the latter half of the week and are at risk of potentially breaking down further. (=)

- Foreign equities popped this week across the board (both EEM and EFA) outperforming US Equities helped by a strong performance from China (FXI) +4.9% on the week. (=)

- Oil (NYSE:USO) bounced on the week while gold(NYSE:GLD)) sold off hard despite the geopolitical stress, caused by an incredibly strong dollar. (=)